What is a Letter of Intent to Purchase Business?

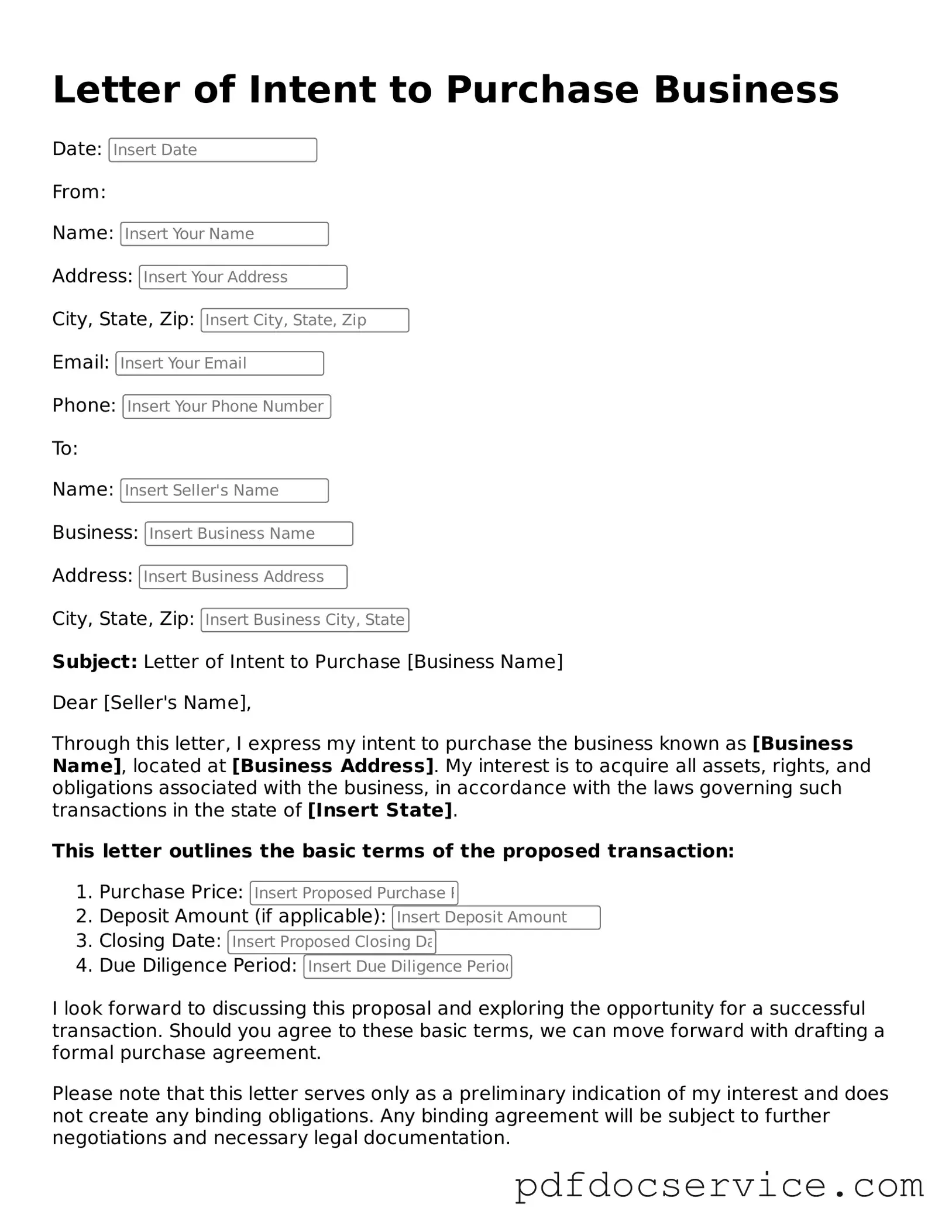

A Letter of Intent (LOI) to purchase a business is a preliminary document that outlines the intentions of a buyer to acquire a business. It serves as a starting point for negotiations and can help clarify the terms and conditions under which the buyer is willing to proceed. While it is not a legally binding contract, it often includes important details that both parties agree to in principle.

Why is a Letter of Intent important?

The LOI is important for several reasons. First, it helps establish a mutual understanding between the buyer and the seller regarding the basic terms of the sale. This can include the purchase price, payment structure, and timeline. Additionally, it can provide a framework for due diligence, ensuring that both parties are on the same page before committing to a formal purchase agreement.

What should be included in a Letter of Intent?

Typically, an LOI should include the following elements:

-

Purchase Price:

A clear statement of the proposed purchase price or the method for determining it.

-

Terms of Payment:

Details on how the payment will be structured, such as cash, financing, or installment payments.

-

Due Diligence Period:

A timeframe during which the buyer can conduct a thorough examination of the business.

-

Confidentiality Agreement:

Provisions to protect sensitive information shared during negotiations.

-

Exclusivity Clause:

An agreement that prevents the seller from negotiating with other potential buyers for a specified period.

Is a Letter of Intent legally binding?

Generally, a Letter of Intent is not legally binding, meaning that it does not create a legal obligation for either party to complete the transaction. However, certain provisions within the LOI, such as confidentiality agreements or exclusivity clauses, can be binding. It is crucial for both parties to understand which parts of the LOI are enforceable and which are not.

How does a Letter of Intent differ from a purchase agreement?

A Letter of Intent is a preliminary document that outlines the basic terms of a potential sale, while a purchase agreement is a formal, legally binding contract that finalizes the terms of the transaction. The purchase agreement will include more detailed provisions, including representations, warranties, and conditions that must be met before the sale can be completed.

When should a Letter of Intent be used?

An LOI is typically used early in the negotiation process, after initial discussions have taken place but before a formal purchase agreement is drafted. It is particularly useful when both parties want to ensure that they are aligned on key terms before investing time and resources into due diligence and contract drafting.

Can a Letter of Intent be modified after it is signed?

Yes, a Letter of Intent can be modified after it is signed, provided that both parties agree to the changes. It is advisable to document any modifications in writing to avoid misunderstandings later in the process. Clear communication is essential to ensure that all parties are aware of and agree to the changes made.

What are the risks of using a Letter of Intent?

Some risks associated with using a Letter of Intent include:

-

Misunderstandings:

If the LOI is not clear, it may lead to differing interpretations of the terms.

-

Time Constraints:

An LOI may create a false sense of urgency, pressuring parties to finalize a deal without adequate due diligence.

-

Loss of Leverage:

Signing an LOI may limit a buyer's negotiating power, especially if it includes an exclusivity clause.

How can one ensure a Letter of Intent is effective?

To ensure that a Letter of Intent is effective, consider the following best practices:

-

Be Clear and Concise:

Clearly outline all key terms and conditions to avoid ambiguity.

-

Consult Legal Counsel:

Engage a lawyer to review the LOI to ensure that it meets legal standards and adequately protects your interests.

-

Communicate Openly:

Maintain open lines of communication with the other party to address any concerns or questions that arise during negotiations.