The Louisiana Act of Donation Form is a legal document that allows an individual to donate property or assets to another person while they are still alive. This form is essential for ensuring that the transfer of ownership is clear and legally binding, helping to avoid potential disputes in the future.

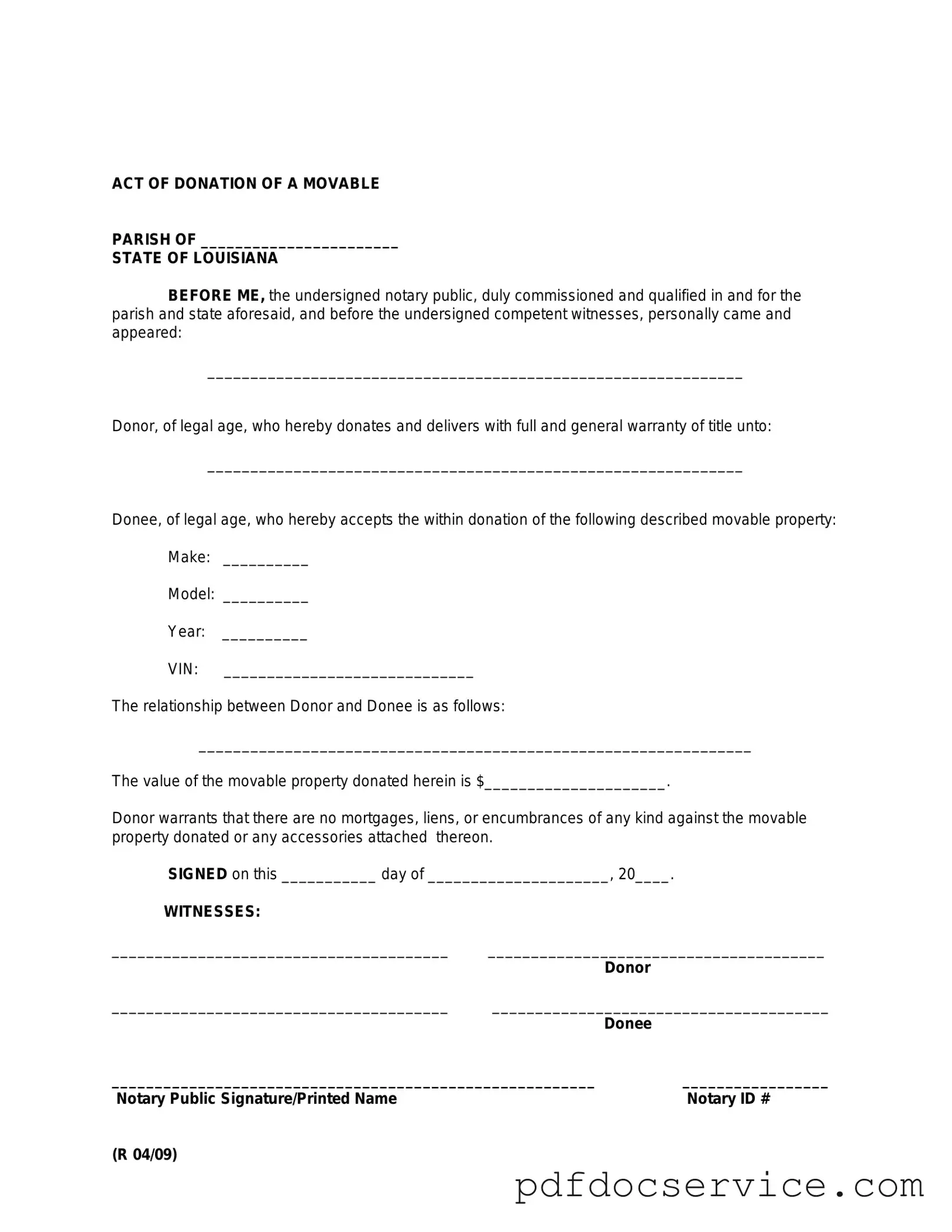

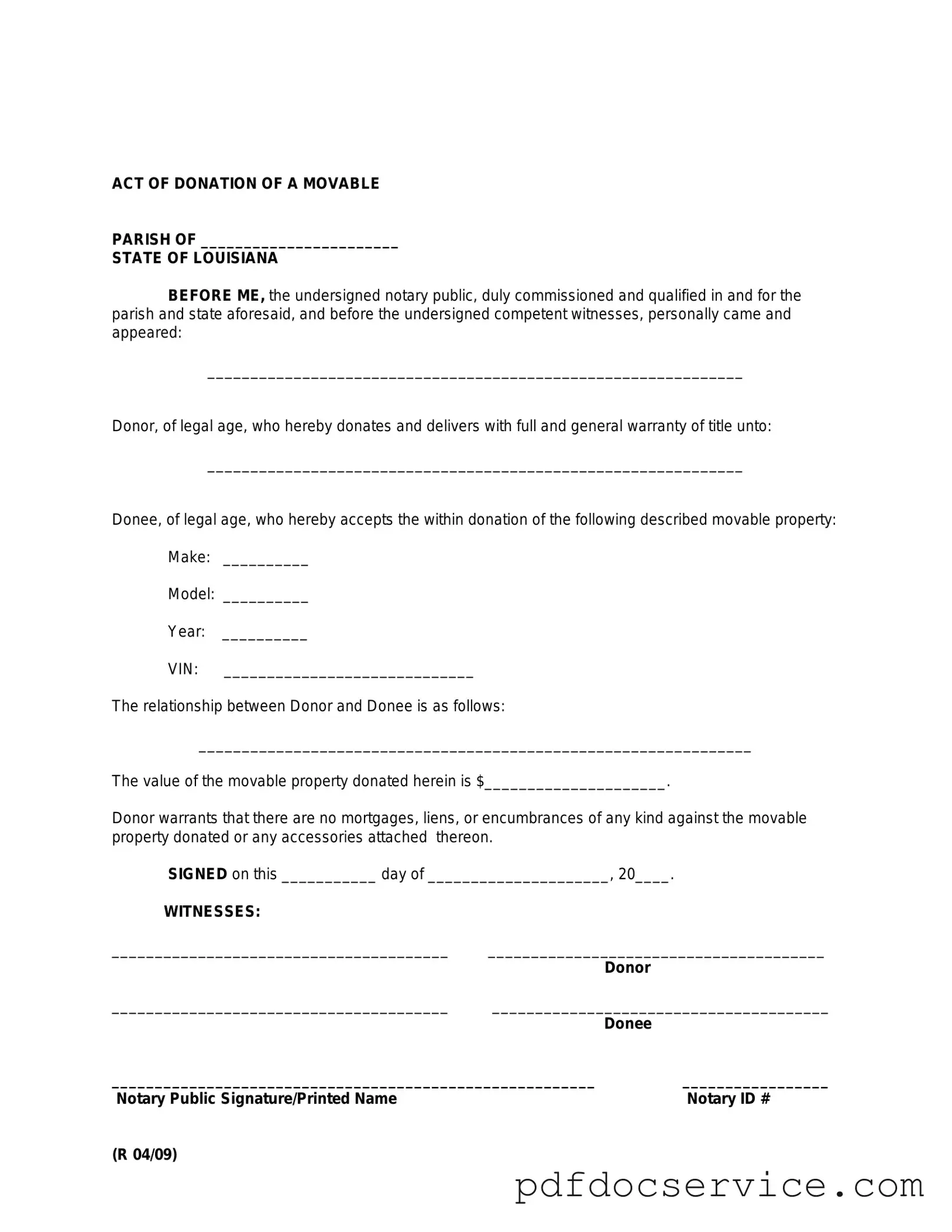

Any adult who wishes to donate property, such as real estate, personal belongings, or financial assets, can use the Act of Donation Form. The donor must have the legal capacity to make the donation, meaning they should be of sound mind and at least 18 years old. The recipient, or donee, can be any individual or entity capable of receiving the donation.

What types of property can be donated?

Various types of property can be donated using this form, including:

-

Real estate, such as land or buildings

-

Personal property, like vehicles, jewelry, or artwork

-

Financial assets, including bank accounts or stocks

It is important to note that certain types of property may require additional documentation or processes for the transfer to be valid.

Yes, the Act of Donation Form must be notarized to be legally effective. Notarization helps to verify the identities of the parties involved and confirms that the donor is making the donation willingly and without coercion. It is advisable to have the document signed in the presence of a notary public to ensure its validity.

Are there any tax implications associated with making a donation?

Donations can have tax implications for both the donor and the recipient. In Louisiana, a donor may be subject to gift tax if the value of the donated property exceeds a certain threshold. However, many donors fall below this threshold and may not owe any taxes. Recipients should also be aware that they may need to report the value of the donation on their tax returns. Consulting with a tax professional can provide clarity on specific situations.

Can the donation be revoked after it is made?

Once the Act of Donation is executed and properly notarized, it generally cannot be revoked unilaterally. However, there are certain circumstances under which a donation can be contested or annulled, such as if the donor was not of sound mind at the time of the donation or if there was fraud involved. It is crucial to understand the implications of making a donation before proceeding.

The Act of Donation Form can be obtained from various sources, including:

-

Local courthouse or clerk of court offices

-

Legal aid organizations

-

Online legal document services

It is important to ensure that the form used complies with Louisiana state laws. Consulting with a legal professional can also help ensure that the form is filled out correctly and meets all necessary requirements.