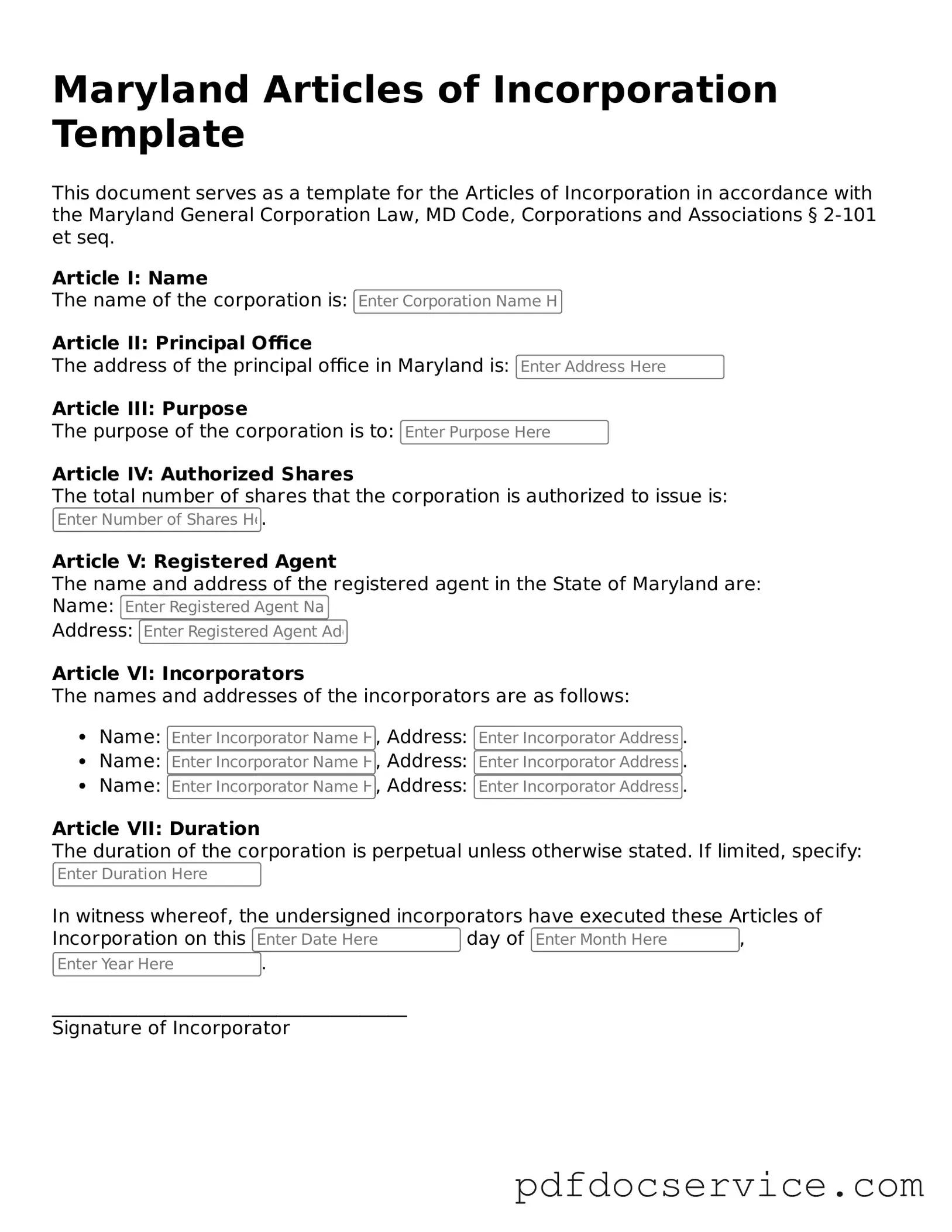

What is the purpose of the Articles of Incorporation in Maryland?

The Articles of Incorporation serve as the foundational document for establishing a corporation in Maryland. This document outlines essential information about the corporation, such as its name, purpose, and the number of shares it is authorized to issue. Filing these articles with the Maryland State Department of Assessments and Taxation is necessary to legally form the corporation.

What information is required to complete the Articles of Incorporation?

To complete the Articles of Incorporation, you must provide several key pieces of information:

-

The name of the corporation, which must be unique and not already in use.

-

The purpose of the corporation, detailing what business activities it will engage in.

-

The address of the corporation's principal office.

-

The name and address of the registered agent, who will receive legal documents on behalf of the corporation.

-

The number of shares the corporation is authorized to issue.

How do I file the Articles of Incorporation in Maryland?

Filing the Articles of Incorporation can be done online or via mail. For online filing, visit the Maryland State Department of Assessments and Taxation website, where you can complete the form and pay the required filing fee. If you prefer to file by mail, download and print the form, complete it, and send it along with the payment to the appropriate address provided on the form.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Maryland varies based on the type of corporation being formed. Generally, the fee ranges from $100 to $300. It is important to check the Maryland State Department of Assessments and Taxation website for the most current fee schedule and any additional fees that may apply.

How long does it take to process the Articles of Incorporation?

The processing time for Articles of Incorporation can vary. Typically, online submissions are processed more quickly, often within a few business days. Mail submissions may take longer, sometimes up to several weeks. For expedited processing, you can request priority service for an additional fee.

Can I amend the Articles of Incorporation after filing?

Yes, amendments to the Articles of Incorporation can be made after the initial filing. If changes are necessary, such as altering the corporation's name or purpose, you must file an amendment form with the Maryland State Department of Assessments and Taxation. This process also requires a filing fee.

Is it necessary to have an attorney to file the Articles of Incorporation?

While it is not legally required to have an attorney to file the Articles of Incorporation, consulting with one can be beneficial. An attorney can provide guidance on compliance with state laws, help ensure that the corporation is set up correctly, and assist with any specific legal requirements related to your business type.