A Maryland Deed form is a legal document used to transfer ownership of real property in the state of Maryland. This form outlines the details of the transaction, including the names of the parties involved, the description of the property, and any conditions of the transfer. It is essential for ensuring that the transfer of property is recognized legally.

Anyone who is buying or selling real estate in Maryland needs to use a Maryland Deed form. This includes individuals, businesses, or organizations that are transferring property ownership. It is important for both the grantor (the seller) and the grantee (the buyer) to have this document completed to protect their rights and interests in the property.

What types of deeds are available in Maryland?

Maryland recognizes several types of deeds, including:

-

Warranty Deed:

Guarantees that the grantor holds clear title to the property and has the right to sell it.

-

Quitclaim Deed:

Transfers whatever interest the grantor has in the property without any guarantees.

-

Special Warranty Deed:

Similar to a warranty deed but only covers the time the grantor owned the property.

Choosing the right type of deed is crucial based on the nature of the transaction and the level of protection desired.

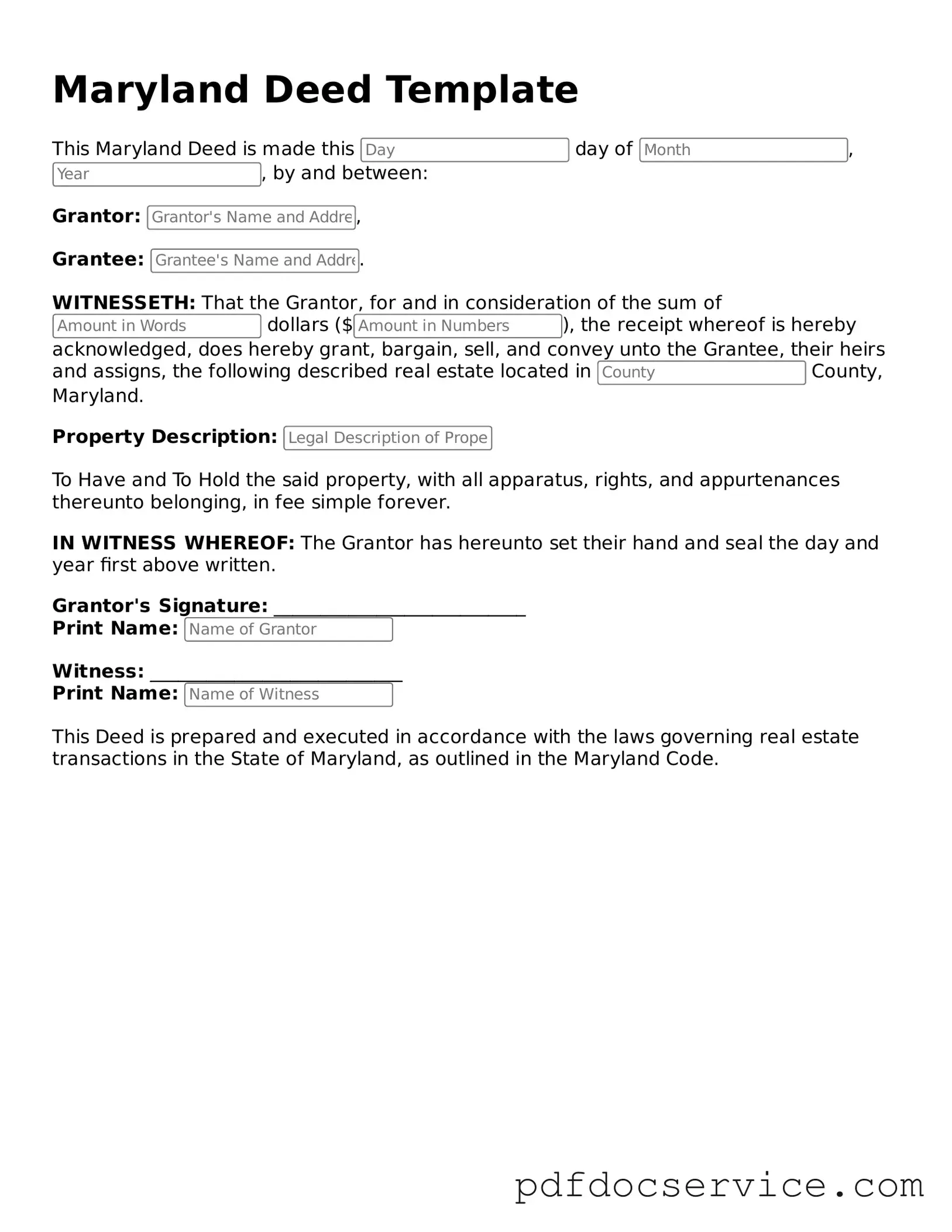

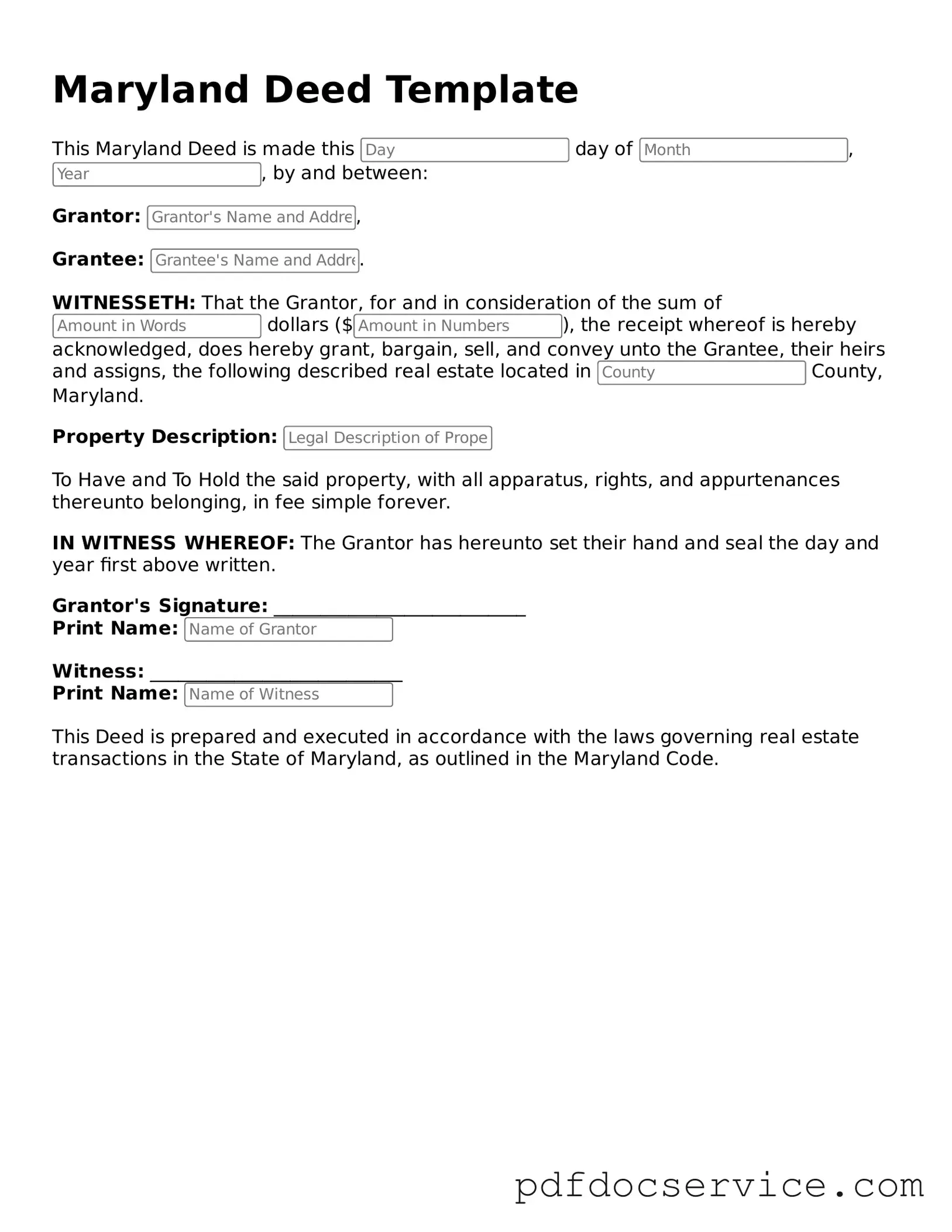

The Maryland Deed form requires several key pieces of information, including:

-

The full names and addresses of the grantor and grantee.

-

A legal description of the property being transferred.

-

The date of the transaction.

-

Any consideration (payment) involved in the transfer.

Ensuring that all information is accurate and complete is vital for the validity of the deed.

Do I need to have the deed notarized?

Yes, a Maryland Deed form must be notarized to be legally valid. The grantor must sign the deed in the presence of a notary public, who will then affix their seal to the document. This step helps prevent fraud and ensures that the identity of the parties involved is verified.

How do I record a Maryland Deed?

To record a Maryland Deed, you must submit the completed and notarized deed to the local land records office in the county where the property is located. There may be a recording fee, and it is advisable to check with the specific office for their requirements. Recording the deed makes the transfer public and protects the rights of the new owner.

Are there any taxes associated with transferring property in Maryland?

Yes, Maryland imposes a transfer tax on the sale of real estate. The tax rate can vary based on the county and the sale price of the property. Both the buyer and seller may be responsible for paying this tax, depending on the terms negotiated in the sale agreement. It is important to consult with a tax professional or real estate attorney to understand the specific obligations.

What happens if I don’t record the deed?

If you do not record the deed, the transfer of ownership may not be recognized by third parties. This could lead to complications in the future, such as disputes over ownership or issues with selling the property later. Recording the deed is essential for protecting your legal rights and ensuring that your ownership is documented in public records.