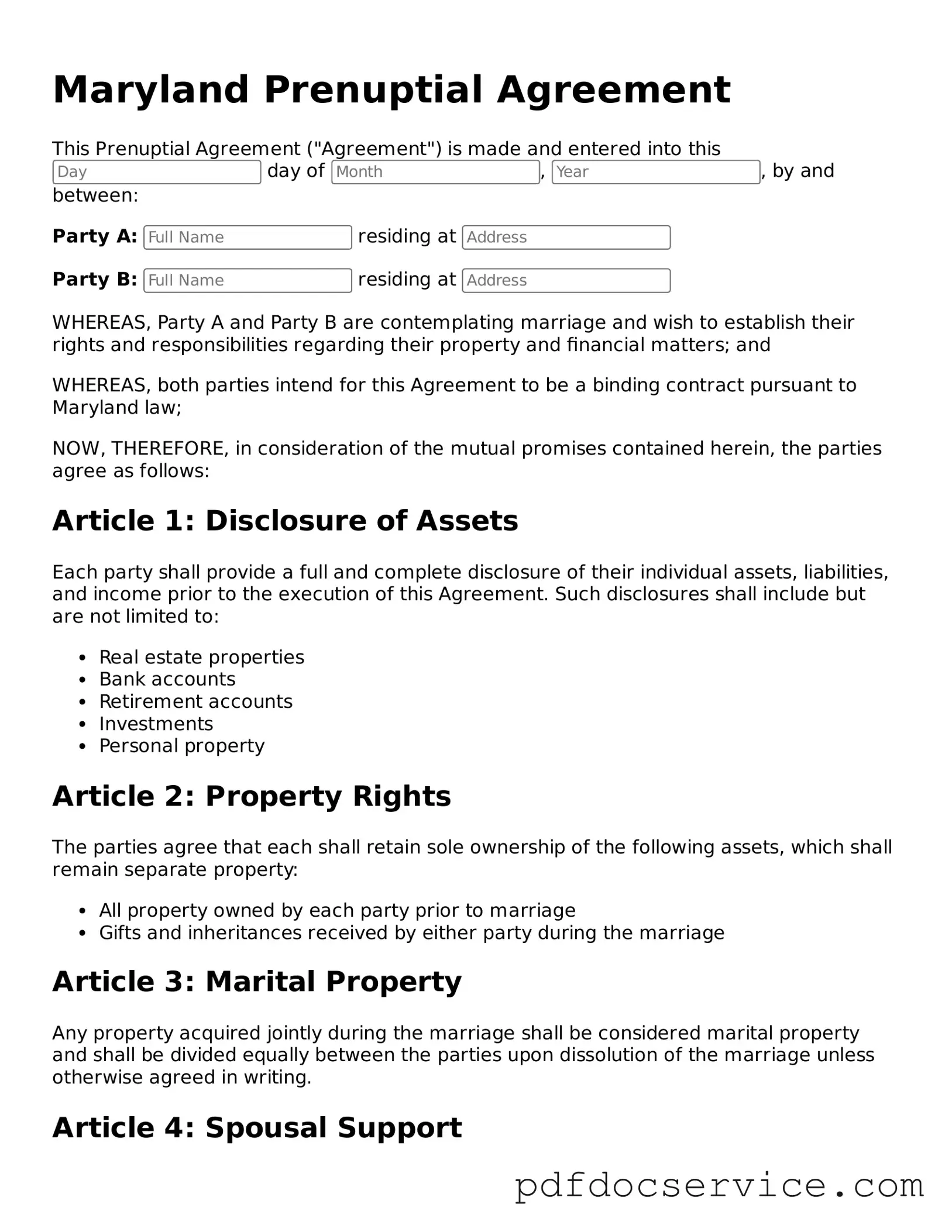

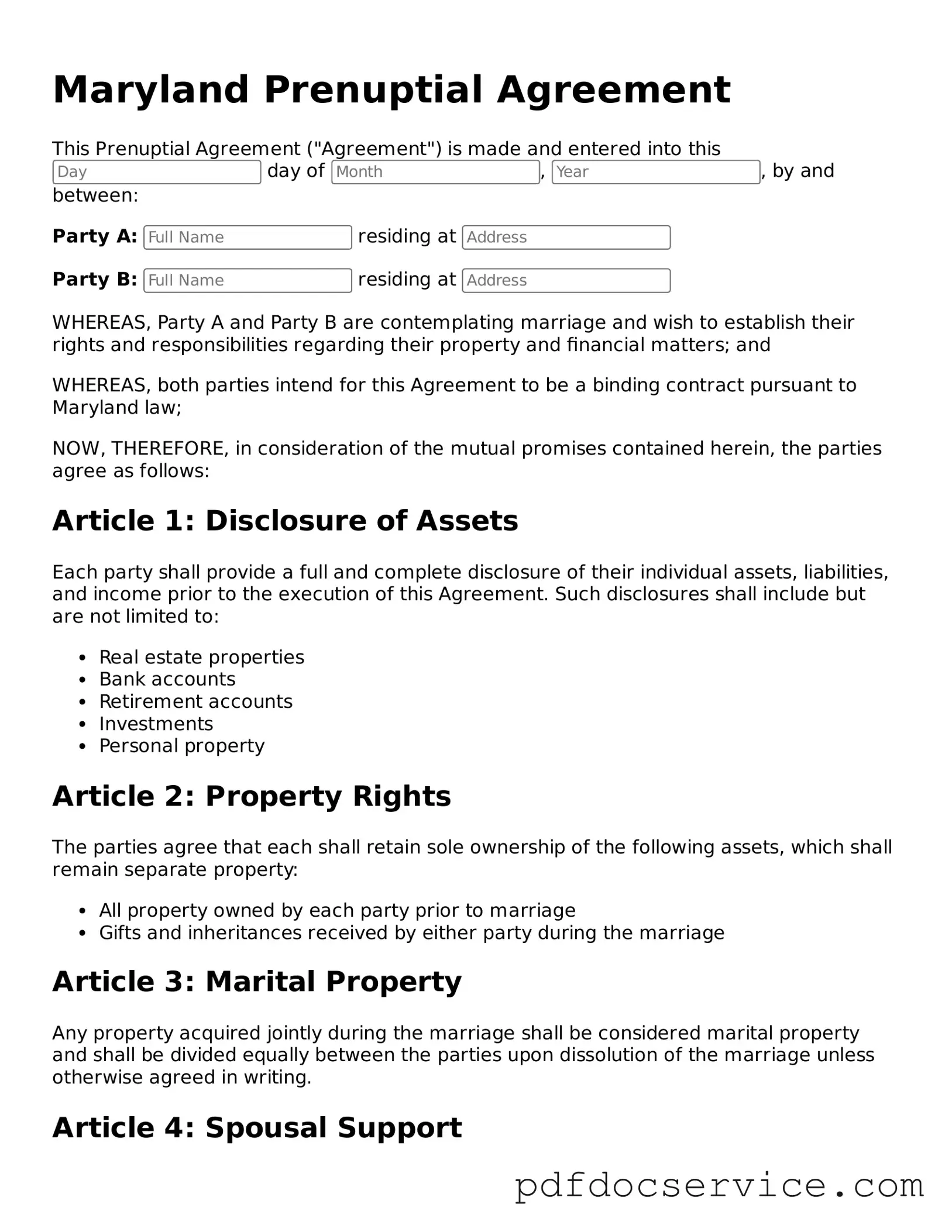

Printable Prenuptial Agreement Template for Maryland

A Maryland Prenuptial Agreement form is a legal document that outlines how assets and debts will be divided in the event of a divorce or separation. This agreement is designed to protect both parties and ensure clarity regarding financial matters before entering into marriage. Understanding the importance and implications of this form can help couples make informed decisions about their future.

Open Prenuptial Agreement Editor

Printable Prenuptial Agreement Template for Maryland

Open Prenuptial Agreement Editor

Open Prenuptial Agreement Editor

or

Get Prenuptial Agreement PDF

Finish the form now and be done

Finish Prenuptial Agreement online using simple edit, save, and download steps.