What is a Maryland Promissory Note?

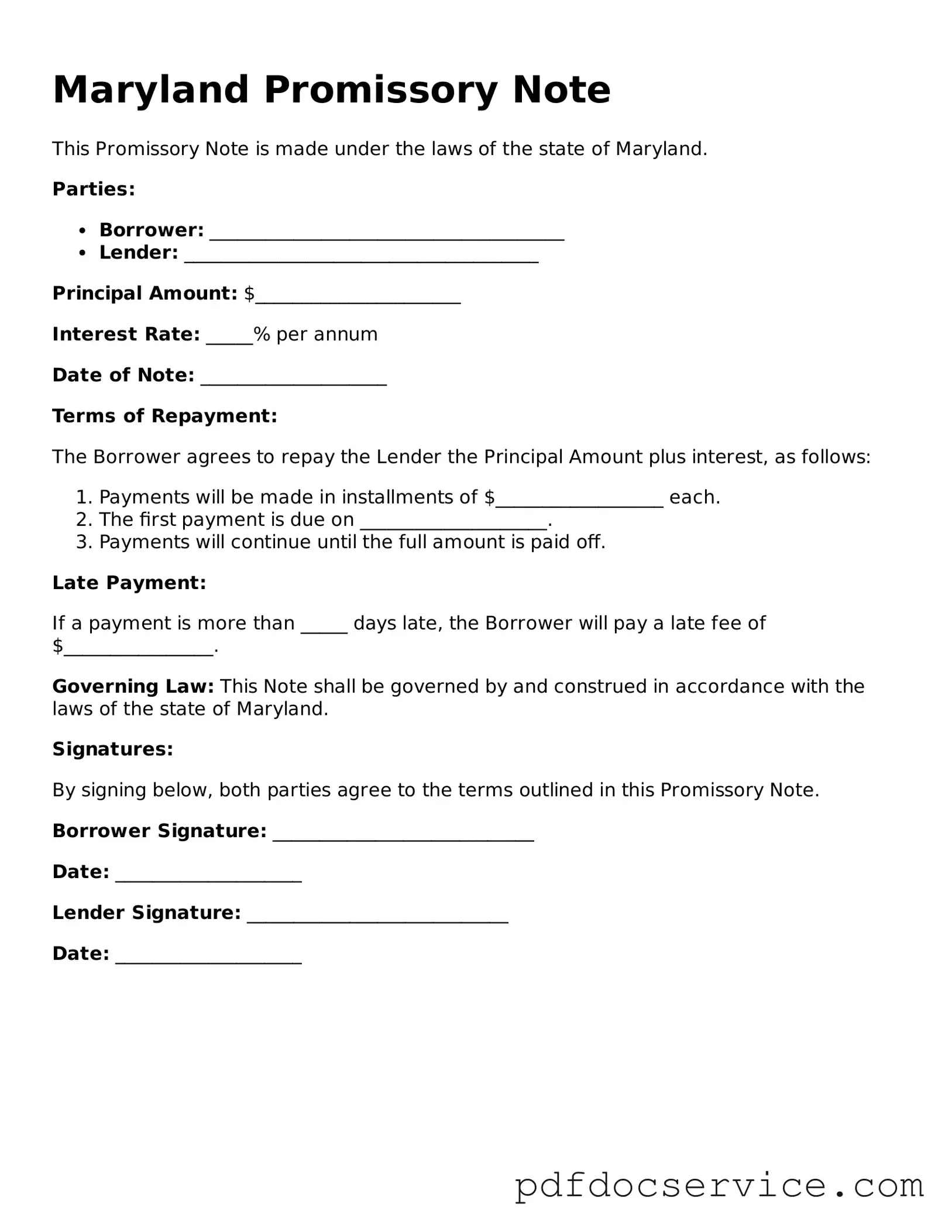

A Maryland Promissory Note is a legal document in which one party (the borrower) agrees to pay a specific amount of money to another party (the lender) under agreed-upon terms. This note outlines the amount borrowed, the interest rate, payment schedule, and any other conditions related to the loan.

Who can use a Promissory Note in Maryland?

Anyone can use a Promissory Note in Maryland, including individuals, businesses, and organizations. Whether you are lending money to a friend, family member, or a business, a Promissory Note helps protect both parties by clearly stating the terms of the loan.

A well-drafted Promissory Note should include the following information:

-

The names and addresses of both the borrower and the lender.

-

The principal amount of the loan.

-

The interest rate (if applicable).

-

The repayment schedule, including due dates.

-

Any late fees or penalties for missed payments.

-

Conditions for default and remedies available to the lender.

-

Signatures of both parties, along with the date of signing.

Is a Promissory Note legally binding in Maryland?

Yes, a Promissory Note is legally binding in Maryland as long as it meets certain requirements. Both parties must agree to the terms, and the note must be signed by the borrower. If the borrower fails to repay the loan, the lender can take legal action to recover the amount owed.

Do I need a lawyer to create a Promissory Note?

While it is not required to have a lawyer draft a Promissory Note, it is often a good idea, especially for larger loans or complex agreements. A lawyer can help ensure that the note complies with Maryland laws and adequately protects your interests.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is best to document any modifications in writing and have both parties sign the revised terms to avoid misunderstandings in the future.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has several options, including:

-

Negotiating a new payment plan with the borrower.

-

Charging late fees as specified in the note.

-

Taking legal action to recover the amount owed, which may include filing a lawsuit.

It is important for lenders to follow the terms outlined in the Promissory Note when addressing defaults to ensure their rights are protected.