A Minnesota Deed form is a legal document used to transfer ownership of real property from one party to another within the state of Minnesota. This form is essential for recording the change of ownership in public records, ensuring that the new owner has clear title to the property. Different types of deeds exist, such as warranty deeds and quitclaim deeds, each serving specific purposes in property transactions.

What types of deeds are available in Minnesota?

In Minnesota, several types of deeds can be used, including:

-

Warranty Deed:

This type guarantees that the seller holds clear title to the property and has the right to sell it. It provides the highest level of protection for the buyer.

-

Quitclaim Deed:

This deed transfers whatever interest the seller has in the property without any guarantees. It is often used between family members or in divorce settlements.

-

Grant Deed:

Similar to a warranty deed, it offers some assurances about the title but is less comprehensive.

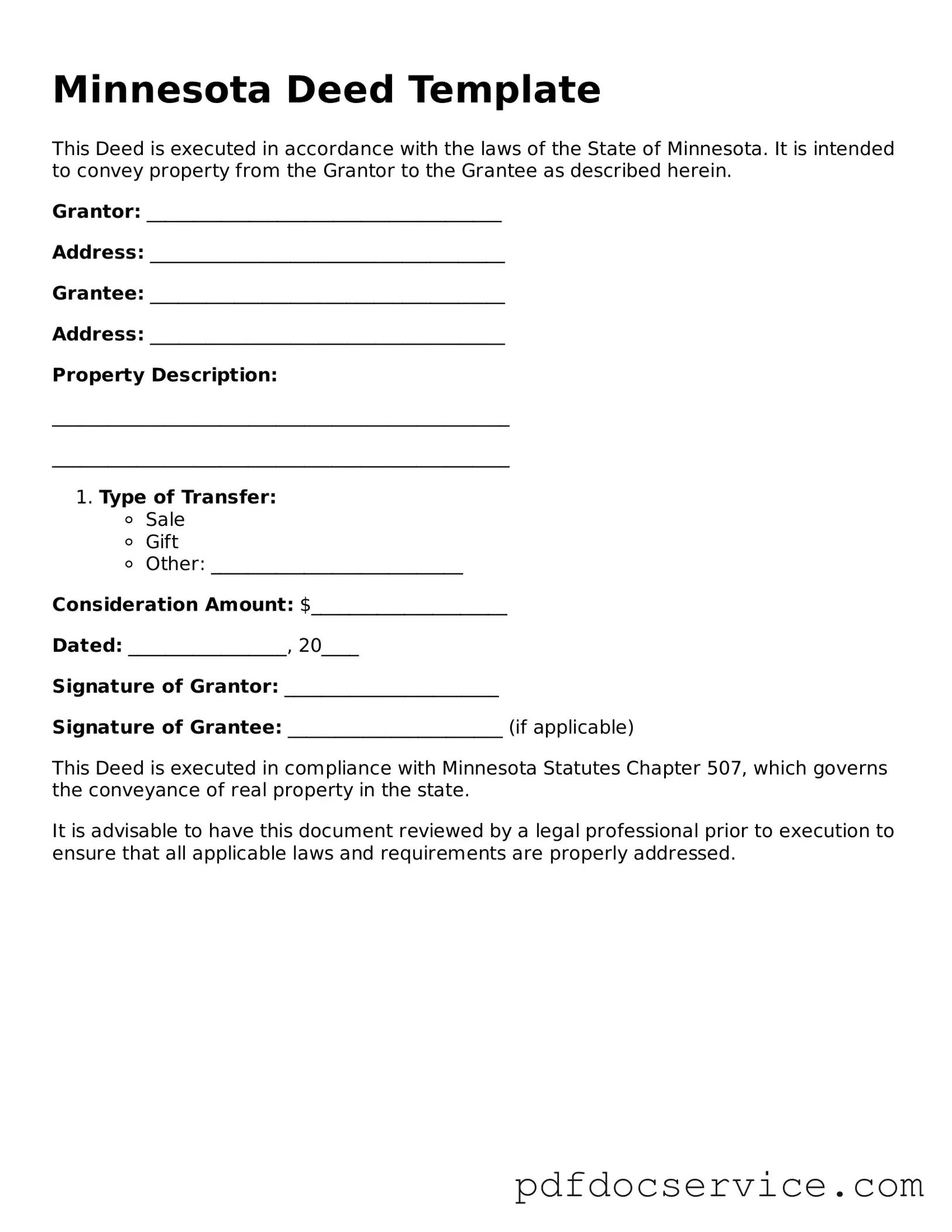

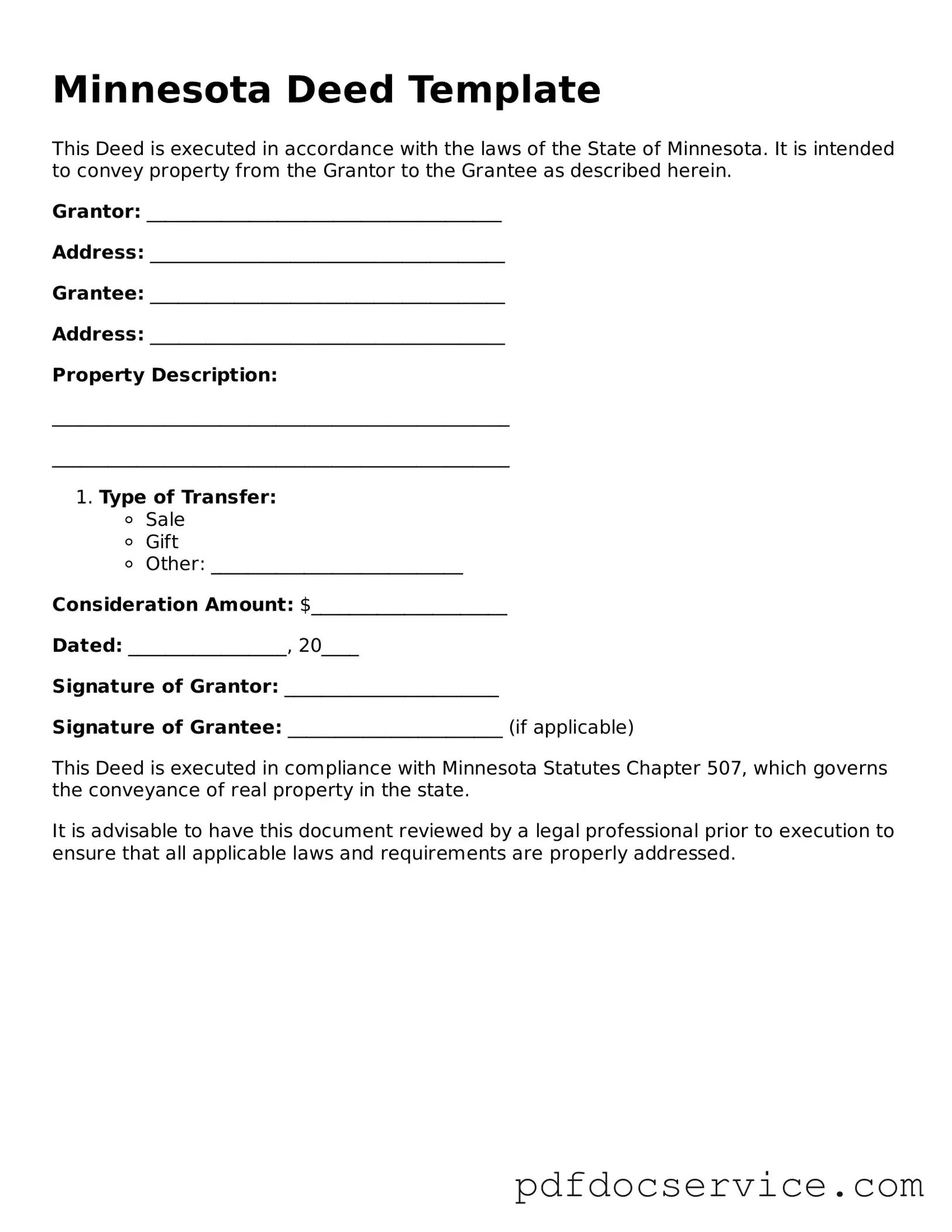

Typically, the deed must be signed by the seller, also known as the grantor. In some cases, the buyer (grantee) may also need to sign, especially if the deed includes specific terms that require acknowledgment by both parties. Additionally, the signatures must be notarized to ensure the document's validity.

To file a Minnesota Deed form, the completed document must be submitted to the county recorder's office in the county where the property is located. This process usually involves:

-

Paying a filing fee, which varies by county.

-

Providing any required additional documentation, such as proof of identity or tax information.

-

Ensuring the deed is properly executed and notarized.

Are there any taxes associated with transferring property in Minnesota?

Yes, when property is transferred in Minnesota, a deed tax is typically assessed. This tax is calculated based on the sale price of the property. Additionally, there may be other taxes or fees, such as recording fees, that must be paid at the time of filing the deed. It is advisable to check with the local county office for specific rates and regulations.

While it is possible to create your own Minnesota Deed form, it is essential to ensure that it meets all legal requirements. Any errors or omissions could lead to complications in the transfer process. For this reason, many individuals choose to work with a real estate attorney or a qualified professional who can help draft the deed correctly.

Once the Minnesota Deed form is filed with the county recorder's office, it becomes a matter of public record. This means that anyone can access the information regarding the property transfer. The new owner should receive a copy of the recorded deed, which serves as proof of ownership. It is important for the new owner to keep this document safe, as it may be required for future transactions or legal matters.

How can I obtain a copy of a Minnesota Deed?

To obtain a copy of a Minnesota Deed, you can visit the county recorder's office where the deed was filed. Many counties also offer online access to property records, allowing you to search and request copies digitally. There may be a small fee for obtaining copies, and it's helpful to have relevant information on hand, such as the property address or the names of the parties involved in the transaction.