What is a Power of Attorney in Minnesota?

A Power of Attorney (POA) in Minnesota is a legal document that allows one person, known as the principal, to authorize another person, known as the agent or attorney-in-fact, to act on their behalf. This can include making financial decisions, handling property transactions, or managing healthcare decisions, depending on the type of POA created.

What types of Power of Attorney are available in Minnesota?

There are several types of Power of Attorney in Minnesota:

-

General Power of Attorney:

Grants broad powers to the agent to manage the principal's affairs.

-

Limited Power of Attorney:

Provides specific powers for particular tasks or a limited time frame.

-

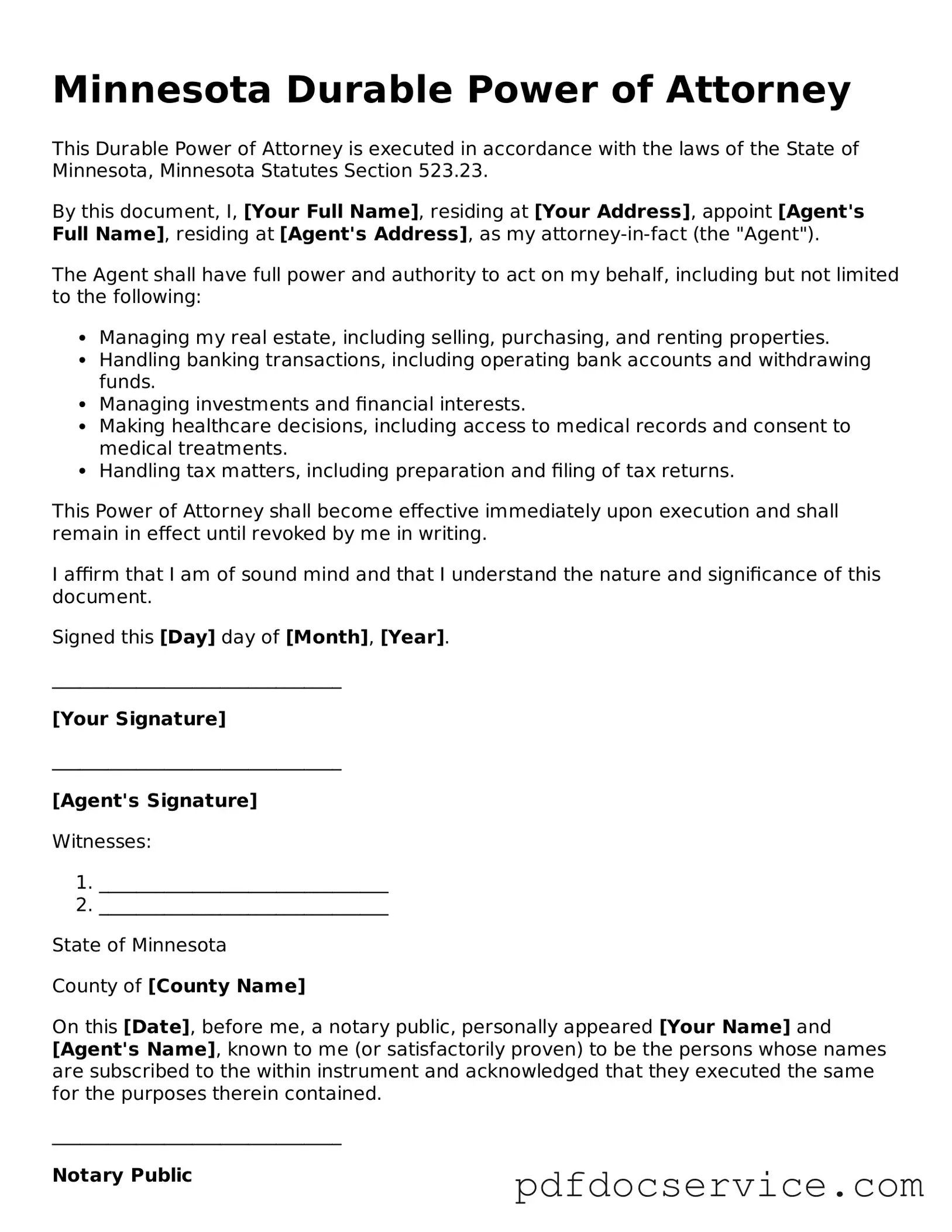

Durable Power of Attorney:

Remains effective even if the principal becomes incapacitated.

-

Healthcare Power of Attorney:

Allows the agent to make medical decisions for the principal if they are unable to do so.

How do I create a Power of Attorney in Minnesota?

To create a Power of Attorney in Minnesota, follow these steps:

-

Choose your agent carefully. This person should be trustworthy and capable of handling your affairs.

-

Complete the Minnesota Power of Attorney form. You can find templates online or consult a lawyer for assistance.

-

Sign the document in the presence of a notary public. This step is crucial for the POA to be valid.

-

Provide copies of the signed document to your agent and any institutions that may need it, such as banks or healthcare providers.

Does a Power of Attorney need to be notarized in Minnesota?

Yes, in Minnesota, a Power of Attorney must be signed in front of a notary public to be valid. This notarization helps confirm the identity of the principal and ensures that the document is executed properly.

Can I revoke a Power of Attorney in Minnesota?

Yes, you can revoke a Power of Attorney at any time as long as you are mentally competent. To revoke it, you should create a written revocation document and notify your agent and any relevant third parties, such as banks or healthcare providers, that the previous POA is no longer valid.

What happens if I become incapacitated and have a Power of Attorney?

If you become incapacitated and have a Durable Power of Attorney in place, your agent can step in and make decisions on your behalf. This includes managing your finances, paying bills, and making healthcare decisions if you have designated them as your healthcare agent.

Can I limit the powers granted in a Power of Attorney?

Yes, you can limit the powers granted to your agent in a Limited Power of Attorney. Specify the exact powers you wish to grant and any conditions or time limits. This ensures that your agent only acts within the scope you define.

A Power of Attorney can be effective immediately or upon a specific event, such as your incapacitation. If you want it to take effect right away, you can indicate this in the document. Otherwise, it will become effective only when you are unable to make decisions for yourself.

Do I need a lawyer to create a Power of Attorney in Minnesota?

While you do not need a lawyer to create a Power of Attorney in Minnesota, consulting one is advisable. A lawyer can help ensure that the document meets all legal requirements and accurately reflects your wishes, providing peace of mind.