What is a prenuptial agreement in Minnesota?

A prenuptial agreement, often called a prenup, is a legal document that couples create before getting married. It outlines how assets and debts will be handled in the event of a divorce or separation. In Minnesota, this agreement helps ensure that both parties are clear about their financial rights and responsibilities, promoting transparency and reducing potential conflicts later on.

Why should I consider a prenuptial agreement?

There are several reasons to consider a prenup:

-

Protection of individual assets: If you own property or have significant savings, a prenup can help protect those assets.

-

Debt management: It can clarify how debts will be handled, ensuring that one partner isn’t responsible for the other’s debts.

-

Clear expectations: A prenup can set clear expectations about financial responsibilities during the marriage.

-

Peace of mind: Knowing that you have a plan in place can reduce anxiety about the future.

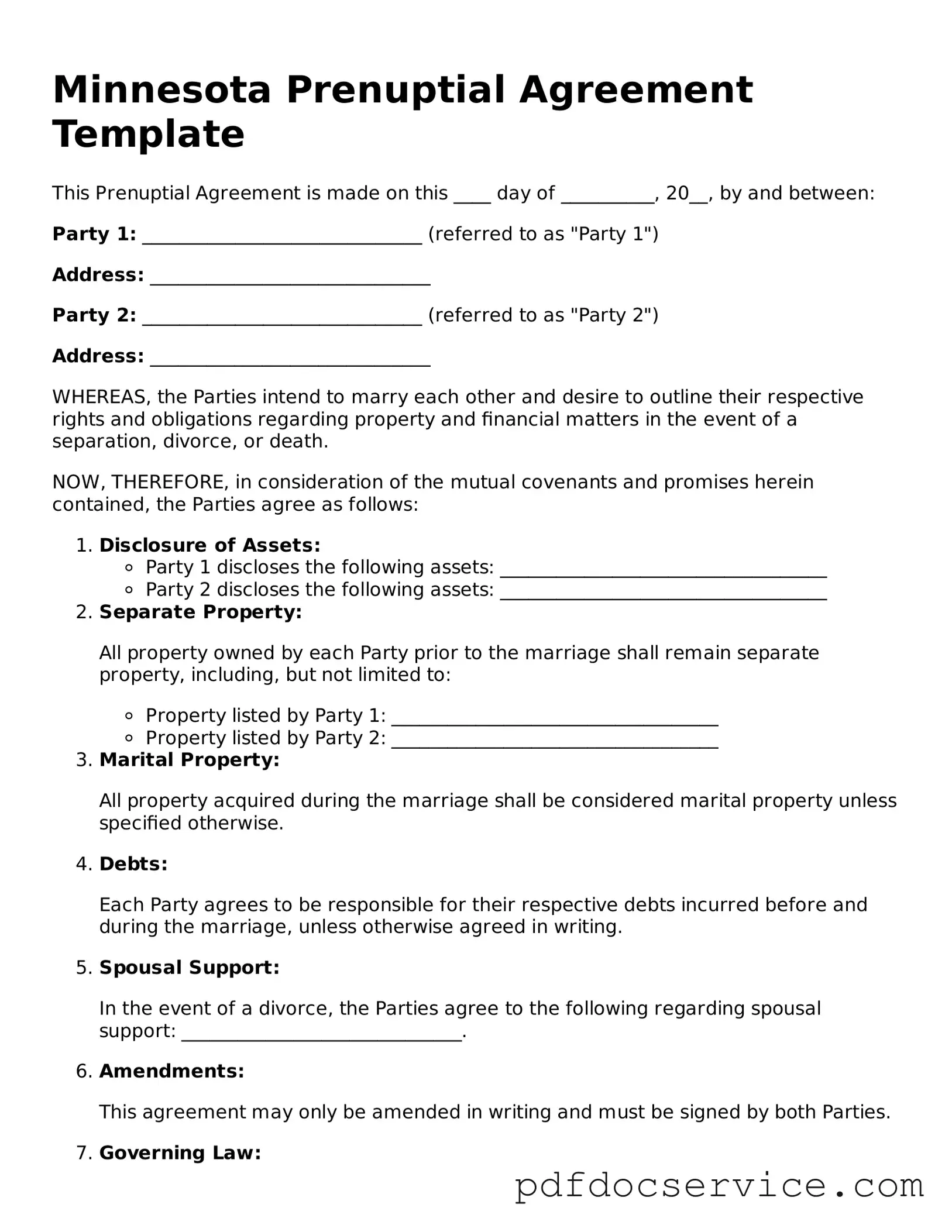

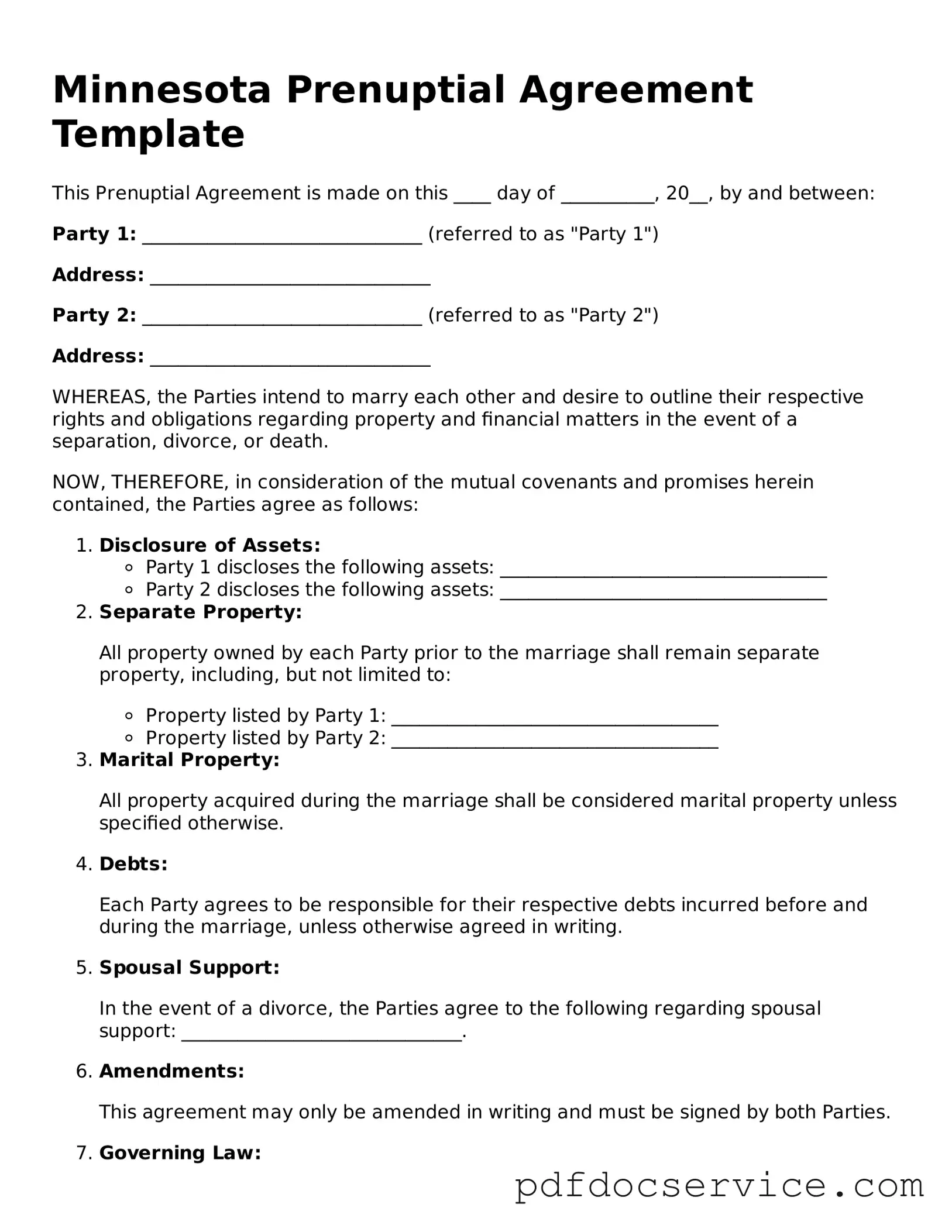

What should be included in a Minnesota prenuptial agreement?

A well-drafted prenup should include:

-

Identification of each party’s assets and debts.

-

How property will be divided in case of divorce.

-

Spousal support or alimony agreements.

-

Any provisions for future income or inheritance.

-

Specific responsibilities during the marriage, if desired.

How do I create a prenuptial agreement in Minnesota?

To create a prenuptial agreement in Minnesota, follow these steps:

-

Discuss your intentions and desires with your partner.

-

Consult with a legal professional who specializes in family law.

-

Draft the agreement, ensuring both parties have input.

-

Review the document carefully before signing.

-

Both parties should sign the agreement in front of a notary public.

Can I modify a prenuptial agreement after it is signed?

Yes, you can modify a prenuptial agreement after it is signed. Both parties must agree to the changes, and the modifications should be documented in writing. It’s advisable to consult with a legal professional to ensure that the new terms are enforceable.

Is a prenuptial agreement enforceable in Minnesota?

Generally, a prenuptial agreement is enforceable in Minnesota if it meets certain criteria. It must be in writing, signed by both parties, and entered into voluntarily. Additionally, both parties should have had the opportunity to seek independent legal advice. If these conditions are met, the agreement is likely to be upheld in court.

What happens if we don’t have a prenuptial agreement?

If you don’t have a prenuptial agreement, Minnesota law will dictate how assets and debts are divided in the event of a divorce. This could lead to outcomes that neither party finds favorable. It’s often more beneficial to have a prenup to ensure that both parties are on the same page regarding financial matters.

When should I start discussing a prenuptial agreement with my partner?

It’s best to start discussing a prenuptial agreement early in the engagement process. This allows both partners to express their thoughts and concerns openly. Having these discussions well before the wedding can help avoid stress and misunderstandings as the big day approaches.