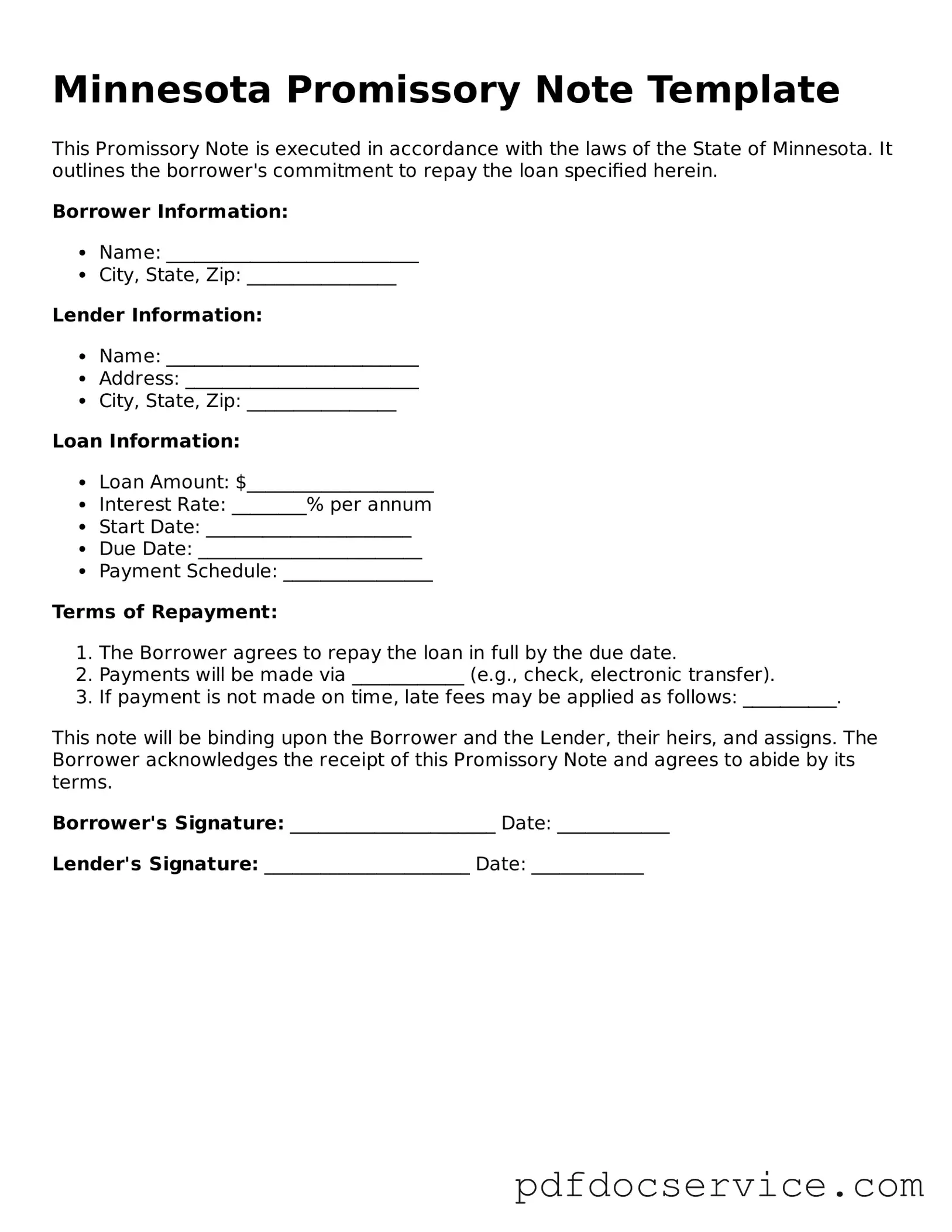

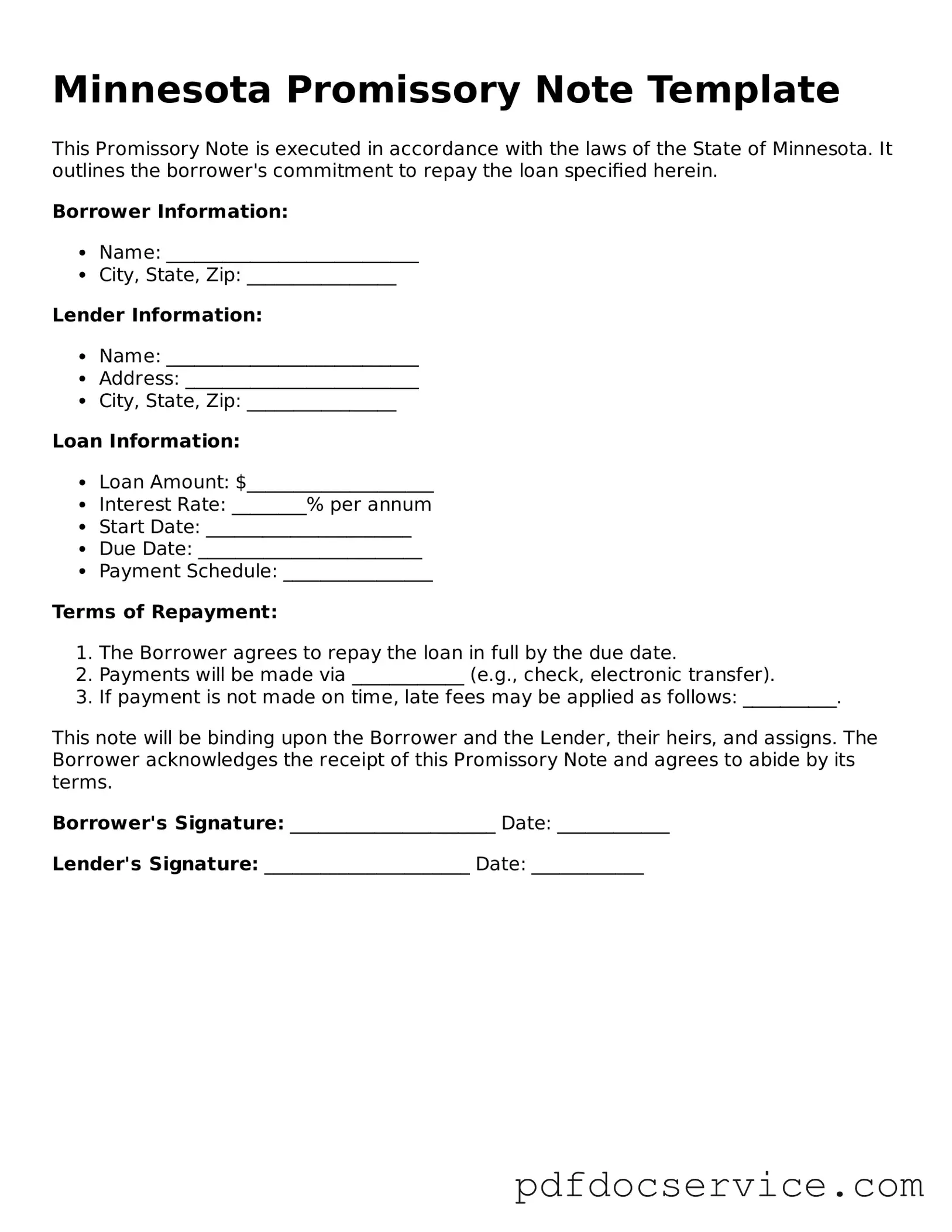

Printable Promissory Note Template for Minnesota

A Minnesota Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a future date or on demand. This legal document outlines the terms of the loan, including interest rates and repayment schedules, ensuring both parties understand their obligations. By using this form, borrowers and lenders can protect their interests and establish clear expectations.

Open Promissory Note Editor

Printable Promissory Note Template for Minnesota

Open Promissory Note Editor

Open Promissory Note Editor

or

Get Promissory Note PDF

Finish the form now and be done

Finish Promissory Note online using simple edit, save, and download steps.