What is a Quitclaim Deed in Minnesota?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. In Minnesota, this type of deed allows the seller, or grantor, to transfer any interest they may have in the property without making any guarantees about the title. This means the buyer, or grantee, receives whatever interest the grantor has, if any, but does not receive any warranties regarding the property’s title.

When should I use a Quitclaim Deed?

Quitclaim Deeds are often used in specific situations, including:

-

Transferring property between family members.

-

Divorce settlements where one spouse relinquishes their interest in the property.

-

Transferring property into a trust.

-

Clearing up title issues when the owner wants to clarify their interest.

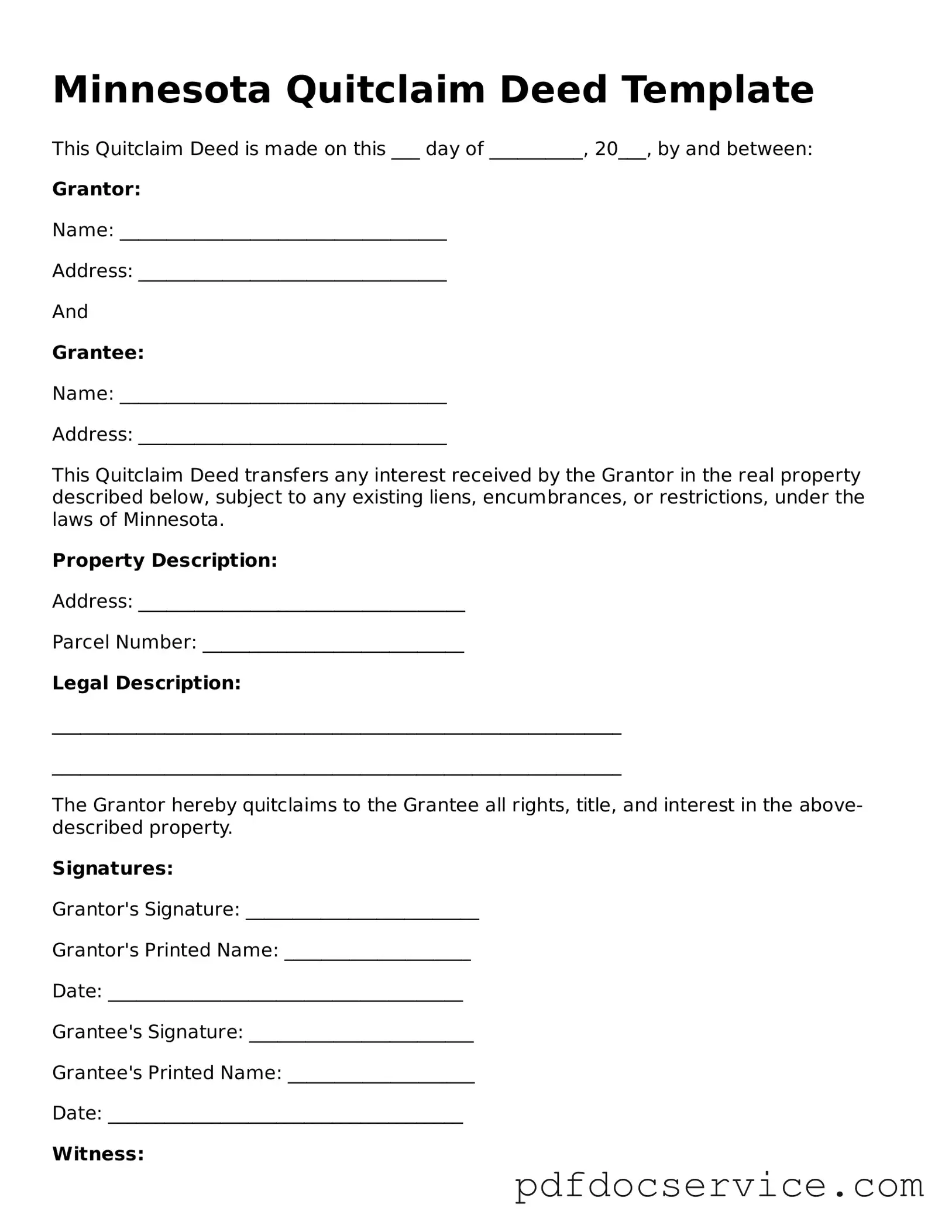

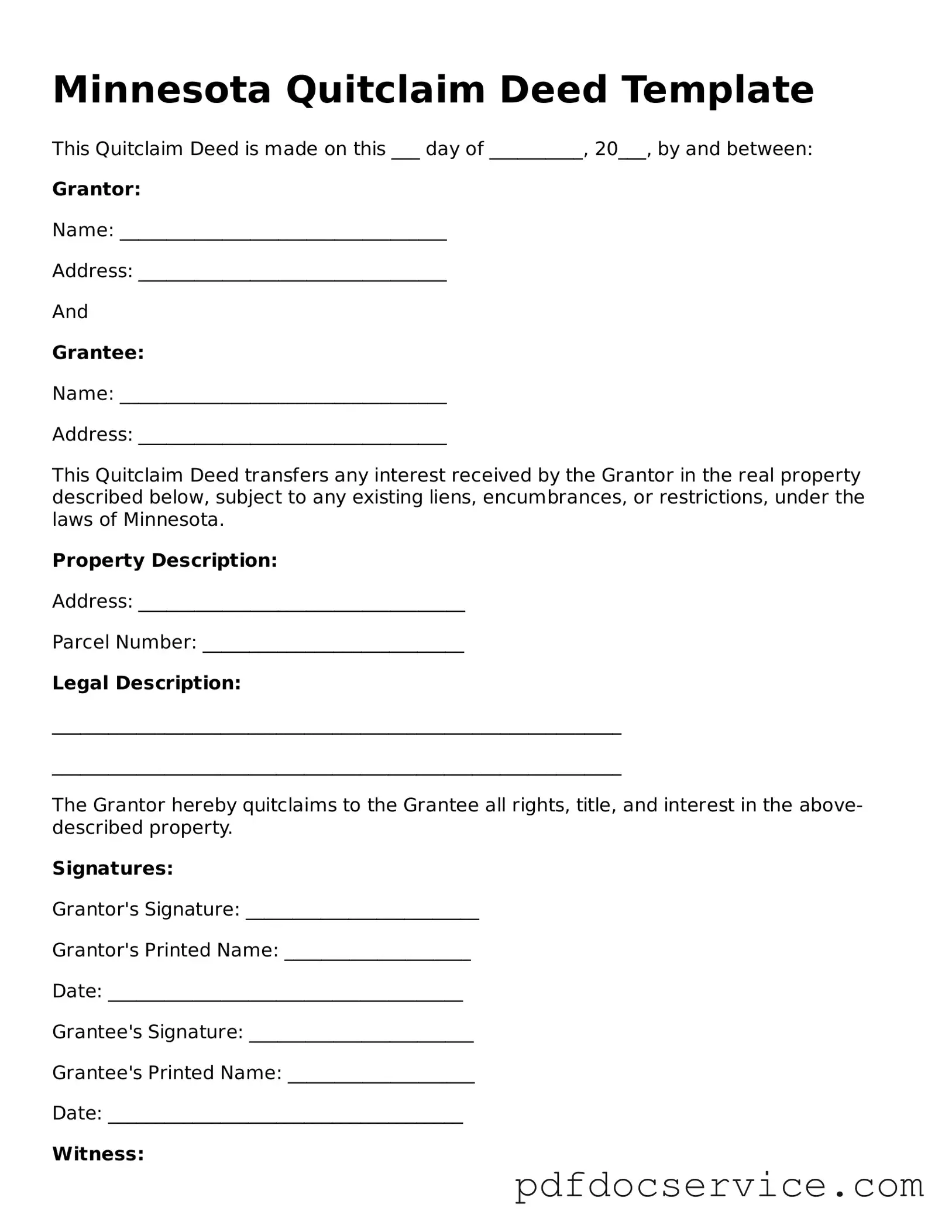

To complete a Quitclaim Deed in Minnesota, follow these steps:

-

Provide the names and addresses of both the grantor and grantee.

-

Include a legal description of the property being transferred.

-

State the consideration, which is often a nominal amount, such as $1.

-

Sign the document in the presence of a notary public.

Do I need to have the Quitclaim Deed notarized?

Yes, in Minnesota, the Quitclaim Deed must be signed in front of a notary public. This step is essential to ensure the document is legally valid. The notary will verify the identities of the signers and witness the signing.

Is there a fee for filing a Quitclaim Deed in Minnesota?

Yes, there is a fee to file a Quitclaim Deed with the county recorder’s office. The amount may vary by county, so it is advisable to check with the local office for the exact fee. Additionally, there may be other costs associated with obtaining a certified copy of the deed.

How do I record a Quitclaim Deed?

To record a Quitclaim Deed in Minnesota, you need to take the signed and notarized document to the county recorder or registrar of titles in the county where the property is located. After paying the filing fee, the office will record the deed and provide you with a copy for your records.

What happens after I file the Quitclaim Deed?

Once the Quitclaim Deed is filed, the property ownership is officially transferred to the grantee. The county office will update their records to reflect this change. It is important for the grantee to keep a copy of the recorded deed as proof of ownership.

Can a Quitclaim Deed be contested?

Yes, a Quitclaim Deed can be contested in certain situations, such as if there is evidence of fraud or if the grantor did not have the legal capacity to sign the deed. If there are disputes regarding the deed, it may be necessary to seek legal advice or take the matter to court.

Are there alternatives to a Quitclaim Deed?

Yes, alternatives to a Quitclaim Deed include Warranty Deeds and Special Warranty Deeds. Unlike a Quitclaim Deed, these alternatives provide certain guarantees about the title and ownership of the property. It is wise to consider your specific situation and possibly consult with a legal professional to determine the best option for your needs.