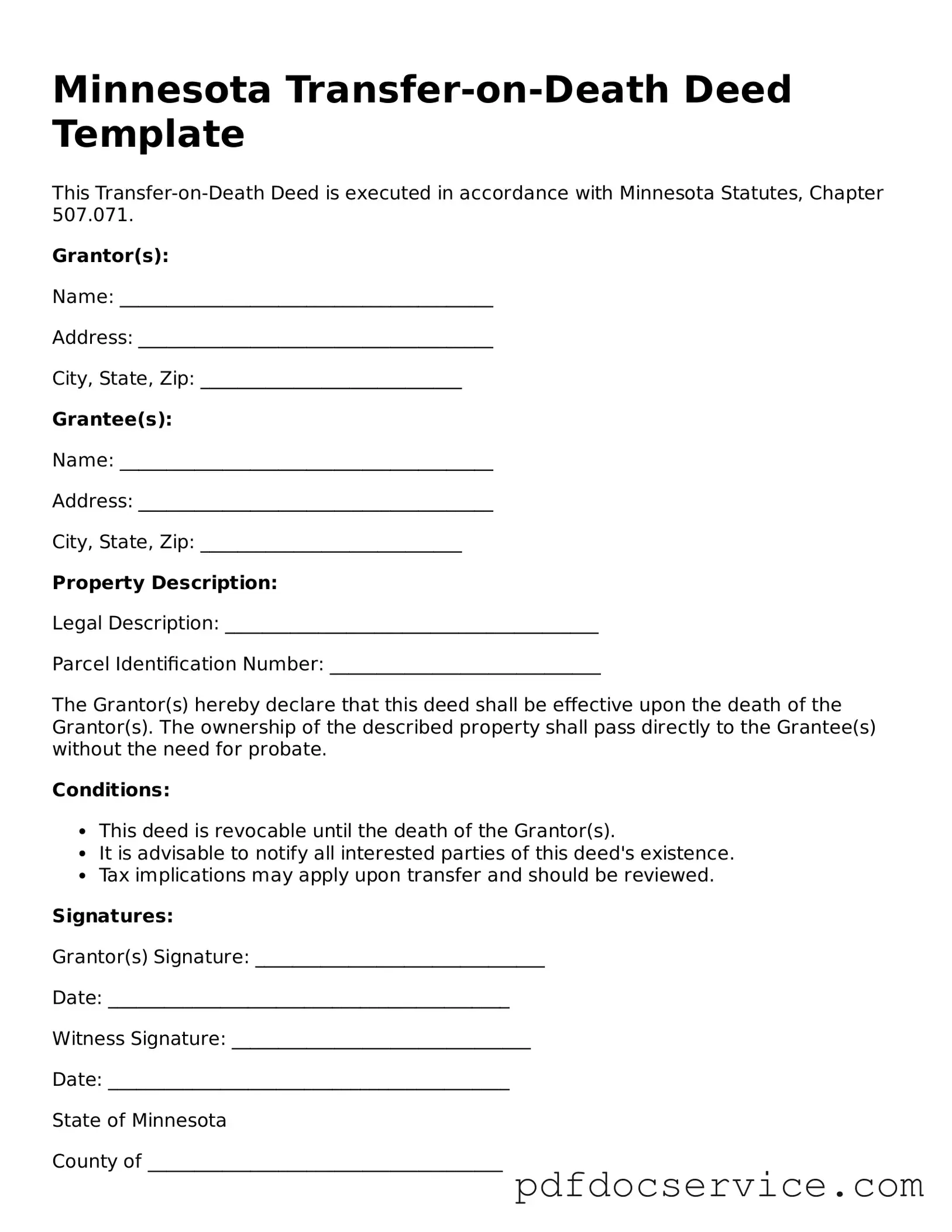

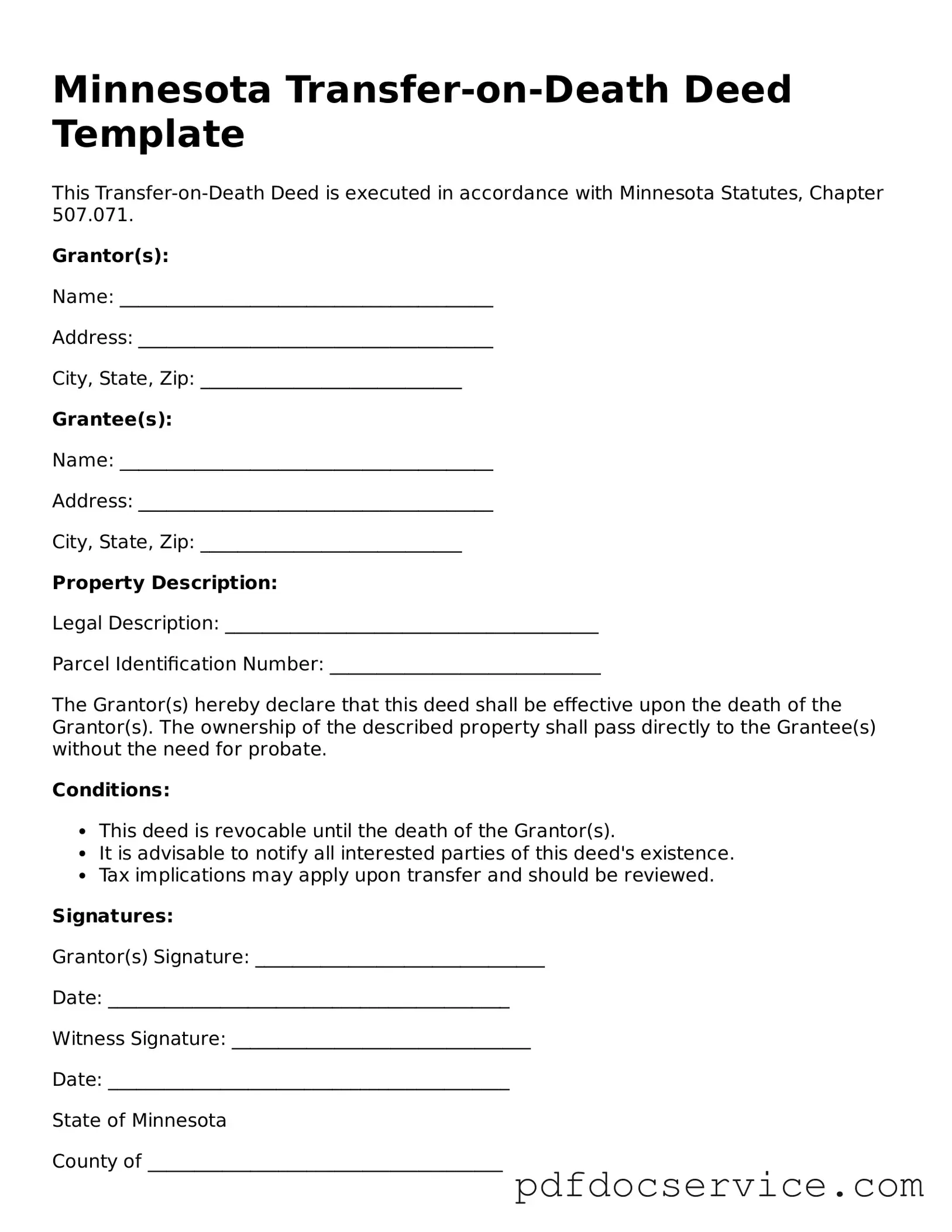

Printable Transfer-on-Death Deed Template for Minnesota

The Minnesota Transfer-on-Death Deed form is a legal instrument that allows property owners to designate beneficiaries who will receive their real estate upon their death, bypassing the probate process. This form provides a straightforward way to transfer property, ensuring that assets go directly to loved ones without the delays and costs associated with traditional inheritance methods. Understanding the nuances of this deed can empower individuals to make informed decisions about their estate planning.

Open Transfer-on-Death Deed Editor

Printable Transfer-on-Death Deed Template for Minnesota

Open Transfer-on-Death Deed Editor

Open Transfer-on-Death Deed Editor

or

Get Transfer-on-Death Deed PDF

Finish the form now and be done

Finish Transfer-on-Death Deed online using simple edit, save, and download steps.