What is a Mortgage Statement?

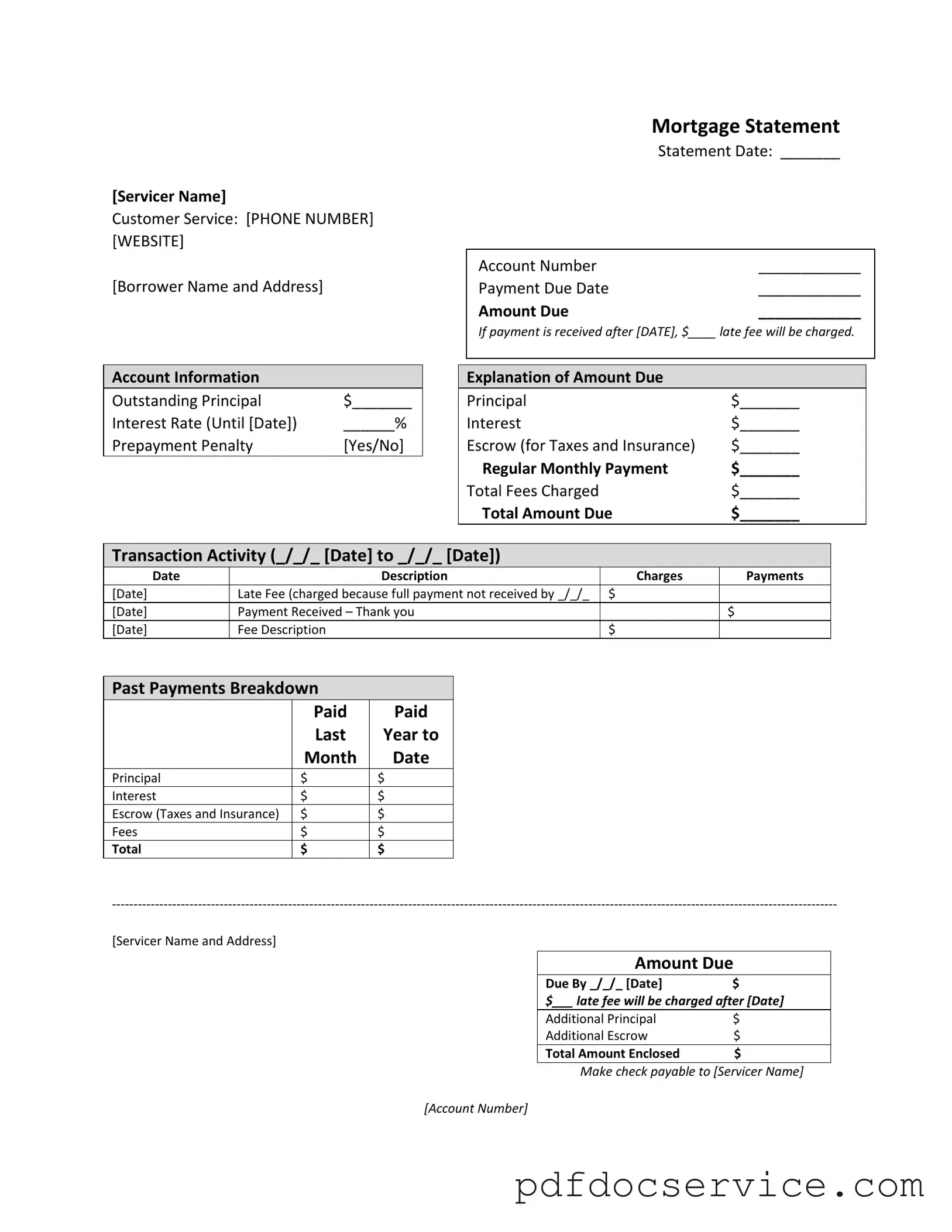

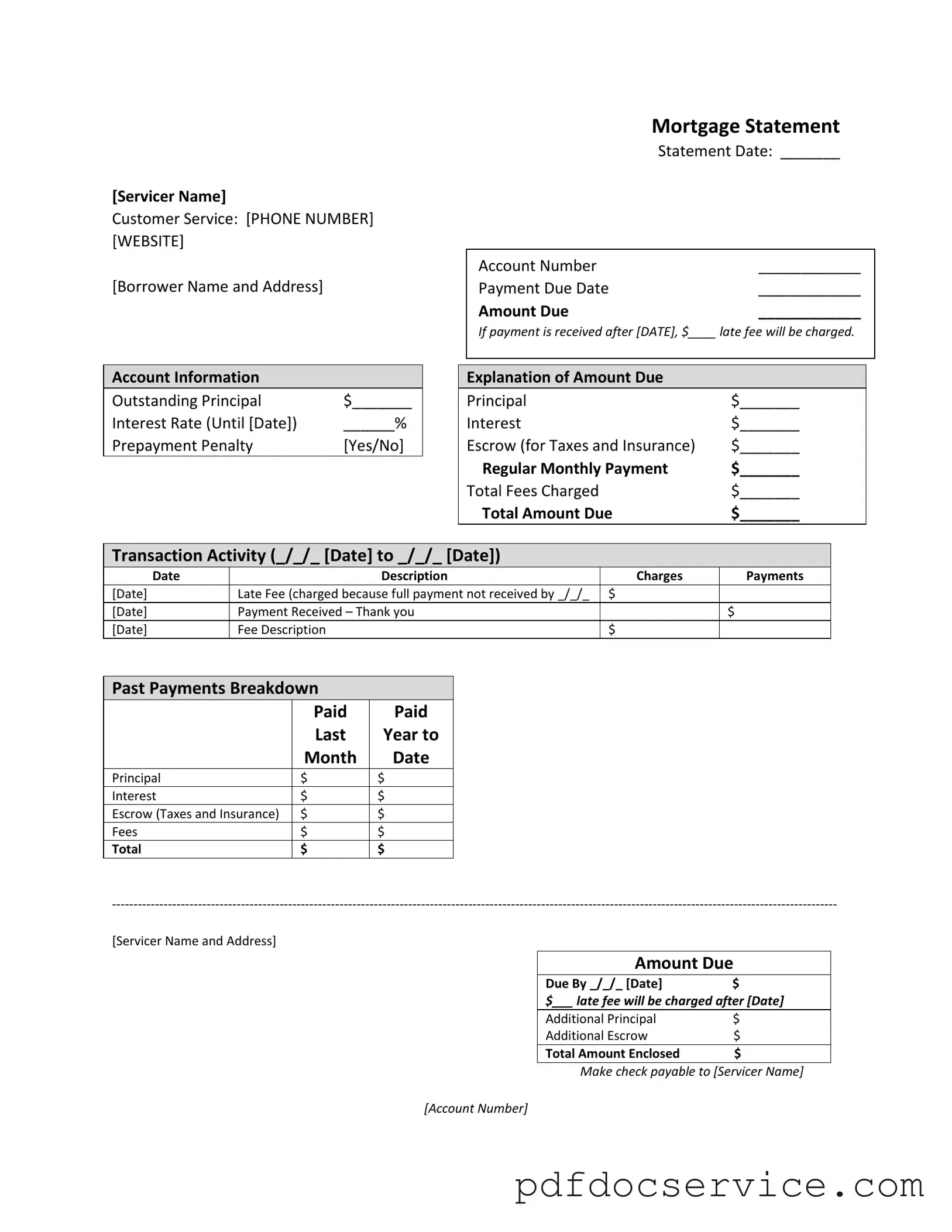

A Mortgage Statement is a document provided by your mortgage servicer that outlines your account information, including the amount due, payment history, and any fees charged. It serves as a record of your mortgage account and helps you understand your financial obligations.

You can reach your mortgage servicer's customer service by calling the phone number listed on your Mortgage Statement. Additionally, their website is also provided, where you can find further assistance and resources.

Your Mortgage Statement includes several key details:

-

Account Number

-

Payment Due Date

-

Outstanding Principal

-

Interest Rate

-

Escrow information for taxes and insurance

-

Transaction activity

-

Recent account history

What happens if I miss a payment?

If you miss a payment, a late fee will be charged as indicated on your Mortgage Statement. It’s important to make your payment by the due date to avoid additional fees and potential consequences such as foreclosure.

What is a partial payment and how is it handled?

Partial payments are amounts that are less than your total monthly payment. These payments are not applied directly to your mortgage but are held in a separate suspense account. To have these funds applied to your mortgage, you must pay the remaining balance of the partial payment.

What is a delinquency notice?

A delinquency notice informs you that you are late on your mortgage payments. It outlines the number of days you are delinquent and warns that failure to bring your loan current may result in fees and foreclosure. It is crucial to address this situation promptly to avoid further complications.

How can I bring my loan current?

To bring your loan current, you must pay the total amount due as indicated on your Mortgage Statement. This includes any outstanding principal, interest, escrow, and fees. Ensure that you make this payment by the specified due date to avoid additional late fees.

What should I do if I am experiencing financial difficulty?

If you are facing financial challenges, it’s important to seek help. Your Mortgage Statement will typically provide information on mortgage counseling or assistance programs. Reach out to your servicer for guidance on available options.

What is an escrow account?

An escrow account is used to hold funds for property taxes and insurance. Your Mortgage Statement will show how much is allocated for escrow each month. This helps ensure that these important payments are made on time, protecting your investment in your home.

How often will I receive a Mortgage Statement?

You will typically receive a Mortgage Statement monthly. However, the frequency may vary based on your mortgage servicer’s policies. It’s important to review each statement carefully to stay informed about your mortgage account.