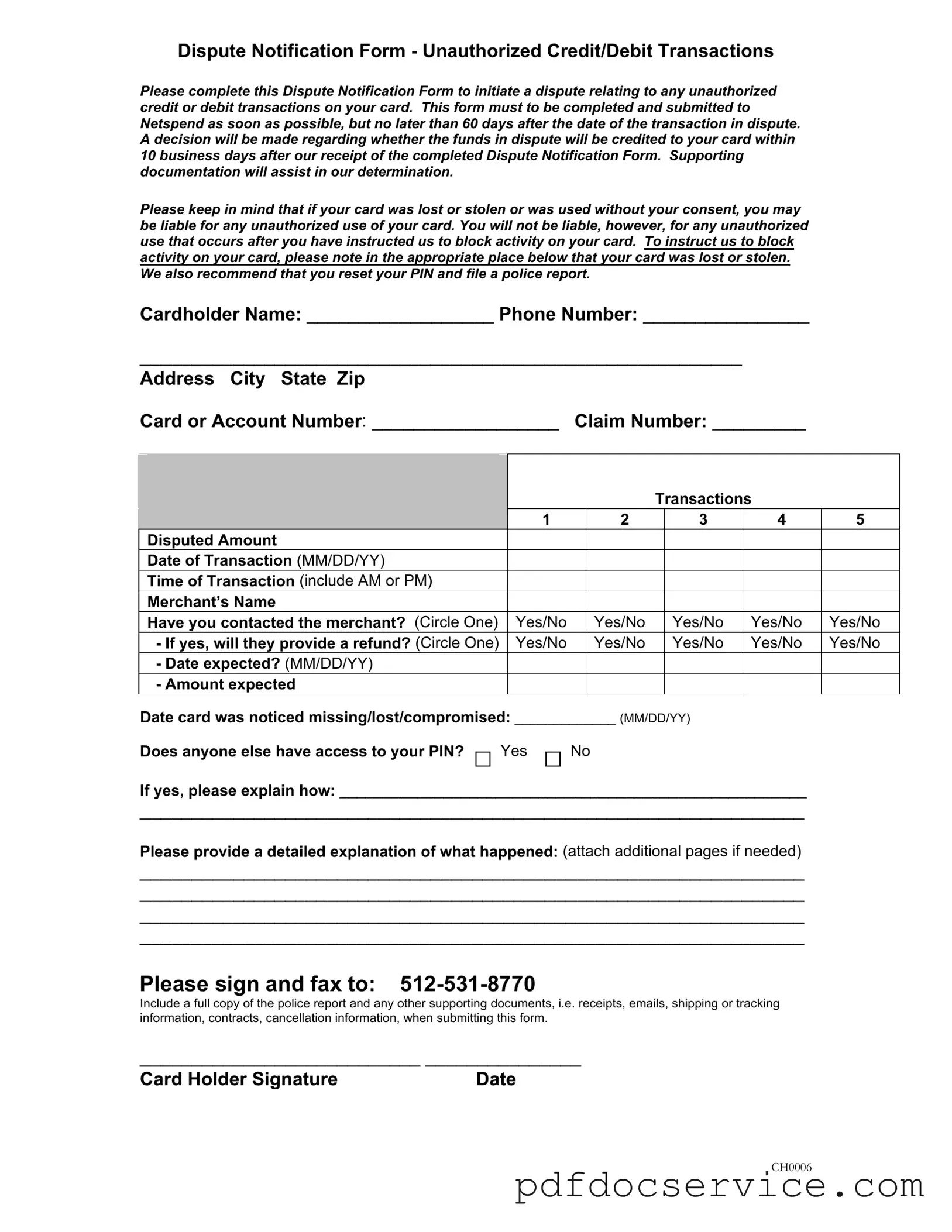

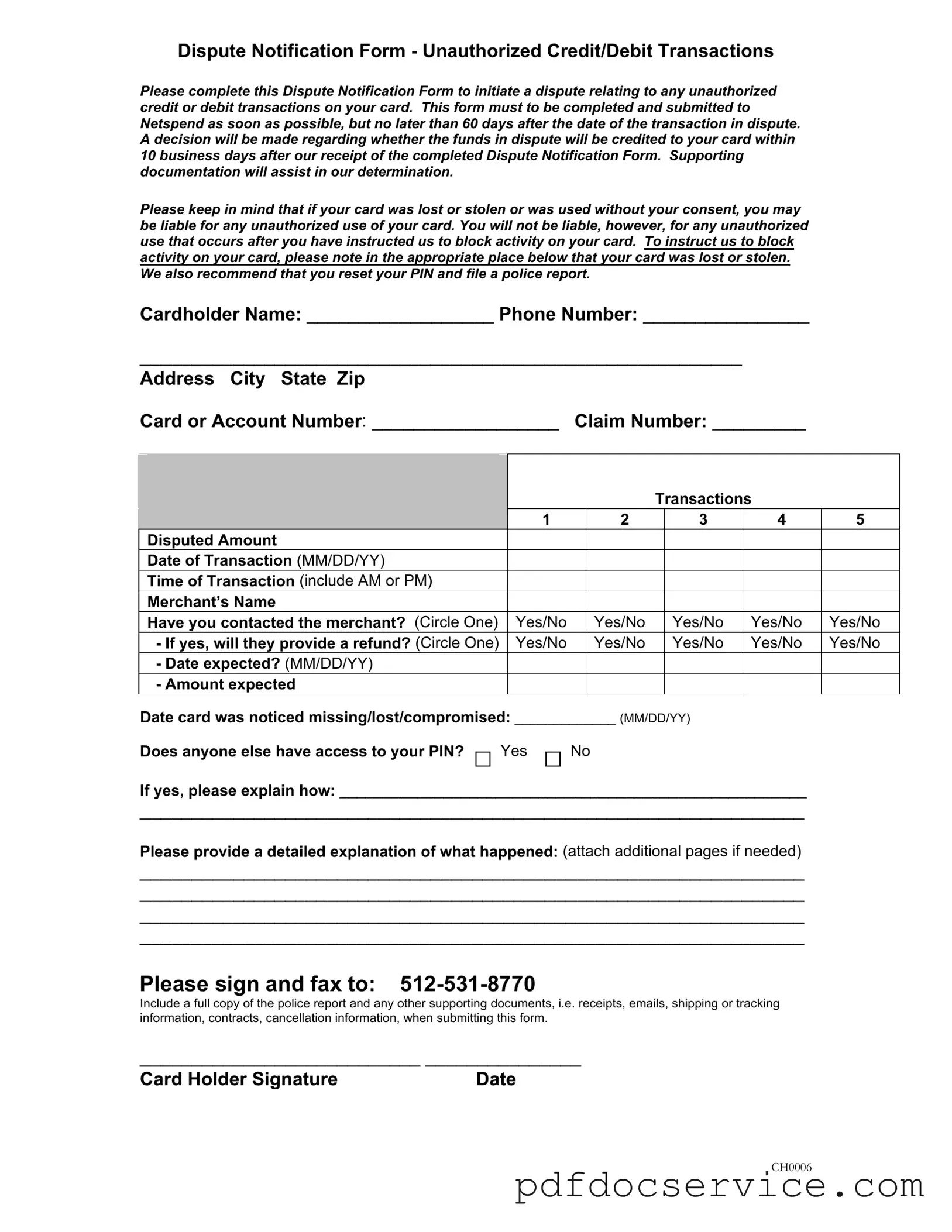

The Netspend Dispute Notification Form is a document that allows cardholders to report unauthorized credit or debit transactions on their Netspend card. By completing this form, users can initiate a dispute process to potentially recover funds lost due to unauthorized transactions.

It is crucial to submit the Dispute Notification Form as soon as possible. You must do this no later than 60 days after the date of the transaction you are disputing. Timely submission helps ensure a smoother resolution process.

Once Netspend receives your completed Dispute Notification Form, they will review the information provided. A decision regarding whether the disputed funds will be credited back to your card will be made within 10 business days. Supporting documentation can significantly aid in this determination.

What kind of supporting documentation should I include?

To strengthen your case, include any relevant supporting documents. This may consist of:

-

A full copy of the police report (if applicable)

-

Receipts related to the transactions

-

Emails or correspondence with the merchant

-

Shipping or tracking information

-

Contracts or cancellation information

Am I liable for unauthorized transactions?

Liability for unauthorized transactions depends on the circumstances. If your card was lost or stolen, or if it was used without your consent, you may be liable for unauthorized use. However, you will not be held liable for any transactions that occur after you have notified Netspend to block activity on your card.

What should I do if my card is lost or stolen?

If your card is lost or stolen, it is essential to notify Netspend immediately. You can indicate this on the dispute form. Additionally, resetting your PIN and filing a police report are strongly recommended steps to protect your account.

How many transactions can I dispute at once?

You can submit up to five transactions on a single Dispute Notification Form. Be sure to provide detailed information for each transaction, including the disputed amount, date, time, and merchant's name.

If you need to provide more details than the form allows, feel free to attach additional pages. A thorough explanation of the situation can help Netspend better understand your case and expedite the resolution process.

Once you have filled out the Dispute Notification Form and gathered all necessary documentation, you can submit it by faxing it to 512-531-8770. Ensure that all relevant information is included to avoid delays in processing your dispute.