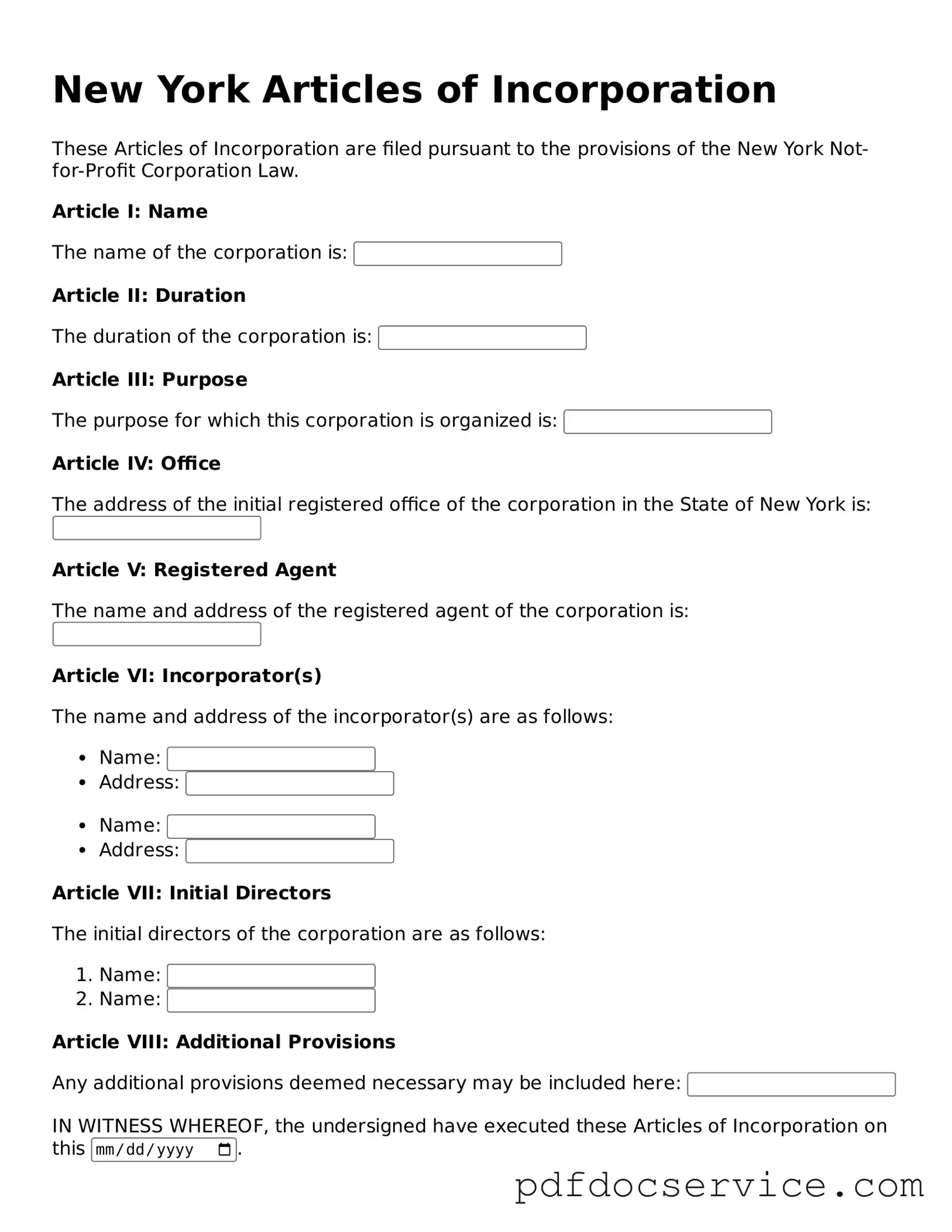

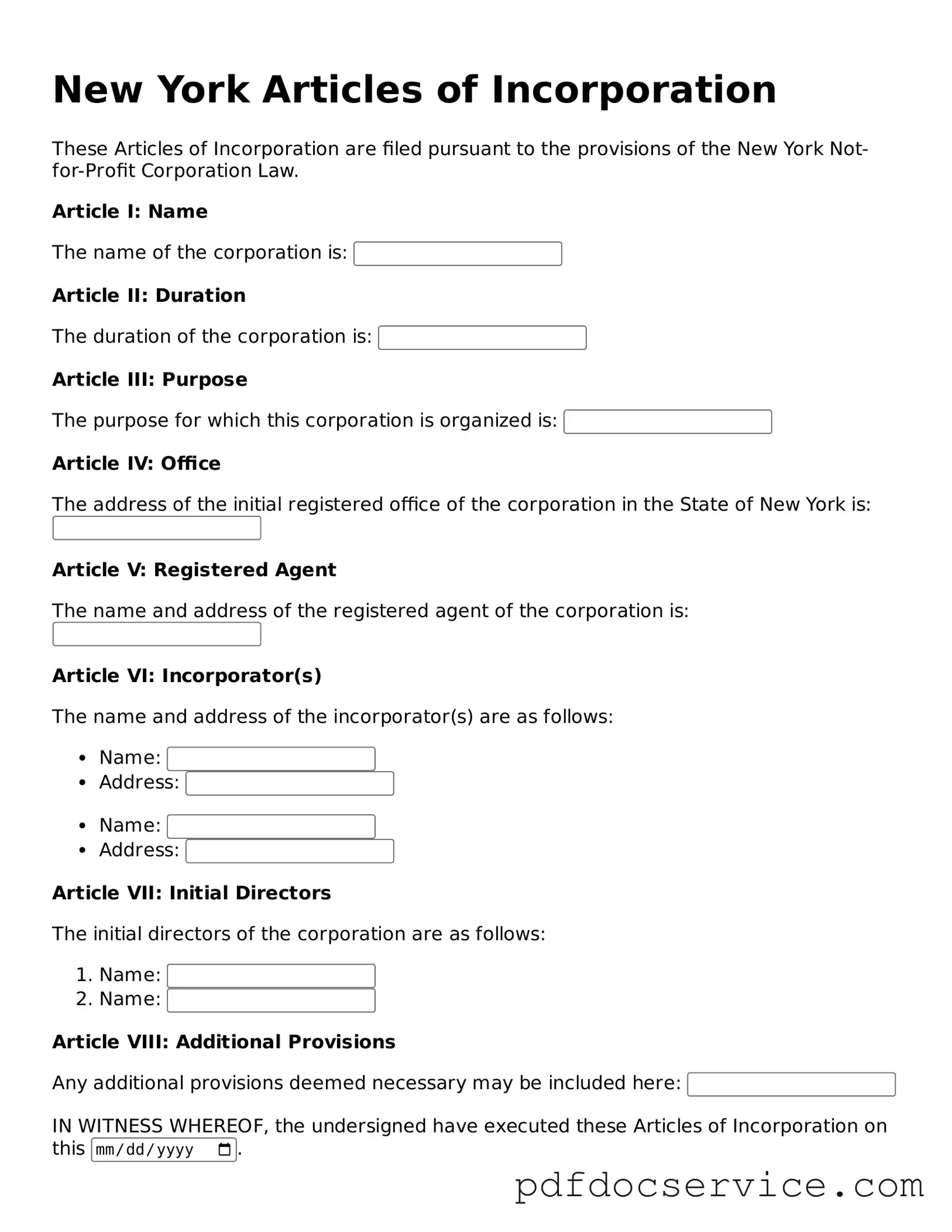

Printable Articles of Incorporation Template for New York

The New York Articles of Incorporation form serves as a crucial document for establishing a corporation in the state of New York. This form outlines essential information about the corporation, including its name, purpose, and structure. Completing this form accurately is vital for ensuring compliance with state regulations and for securing the legal status necessary to operate as a corporation.

Open Articles of Incorporation Editor

Printable Articles of Incorporation Template for New York

Open Articles of Incorporation Editor

Open Articles of Incorporation Editor

or

Get Articles of Incorporation PDF

Finish the form now and be done

Finish Articles of Incorporation online using simple edit, save, and download steps.