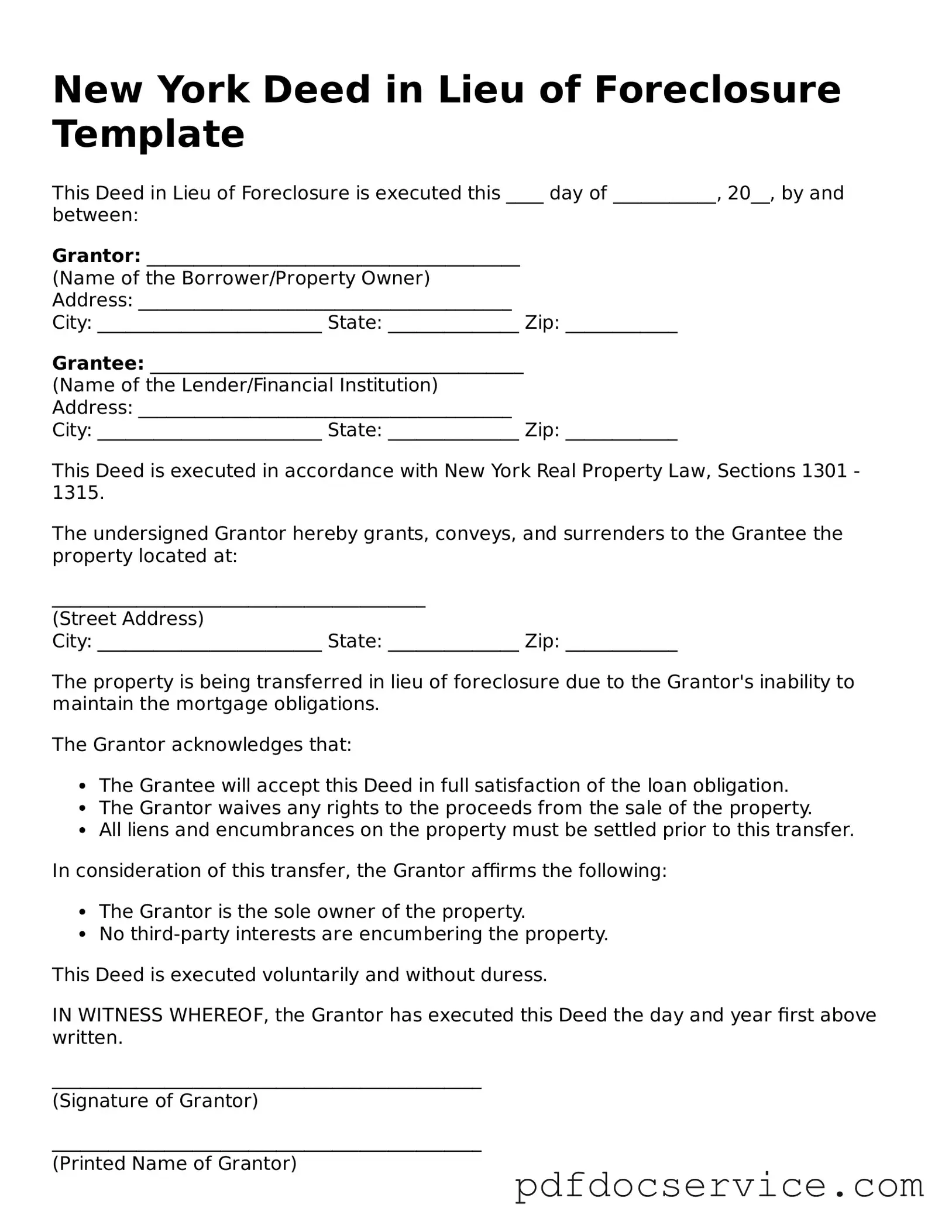

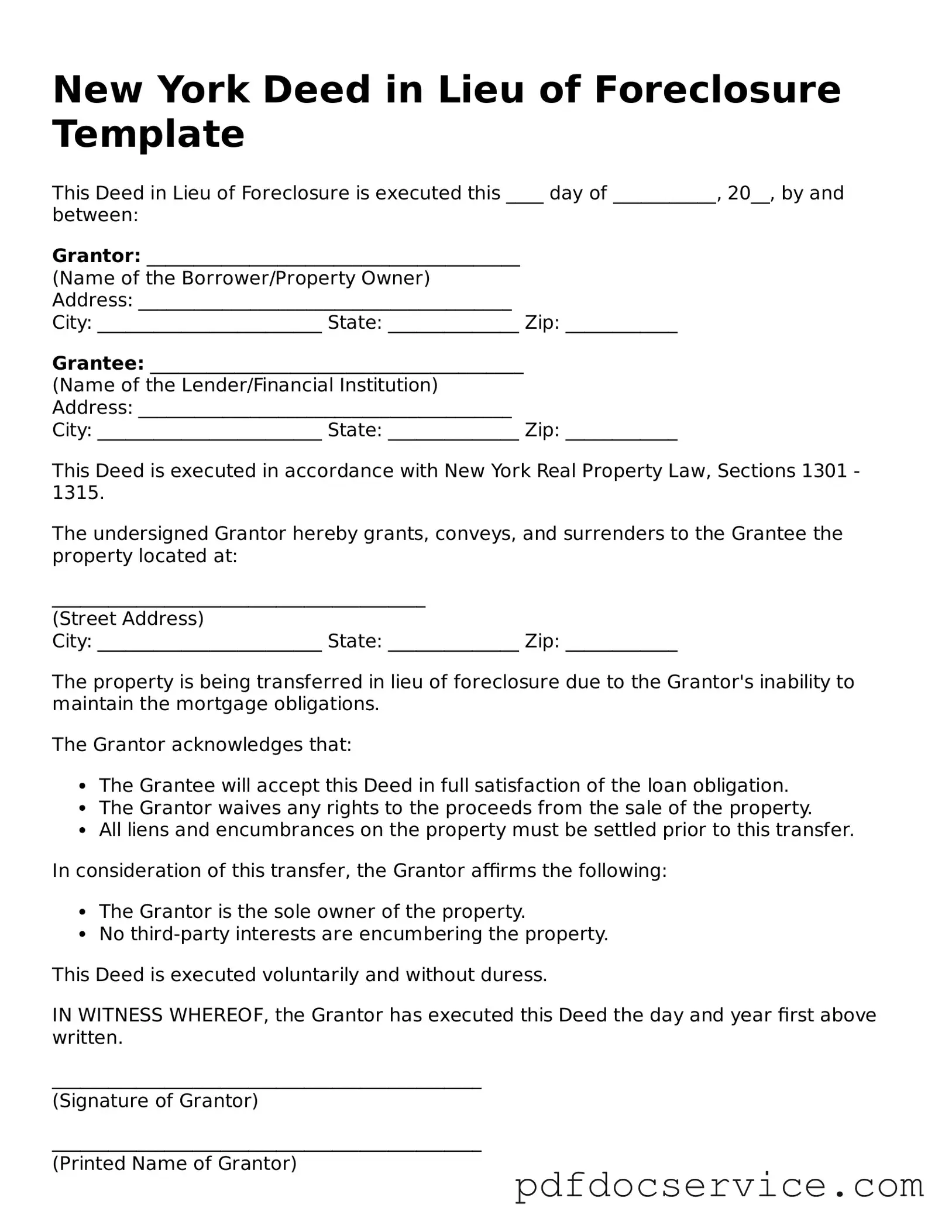

Printable Deed in Lieu of Foreclosure Template for New York

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer their property to the lender to avoid foreclosure proceedings. This option can provide a smoother transition for both parties, often eliminating the lengthy foreclosure process. Understanding this form can help homeowners make informed decisions during challenging financial times.

Open Deed in Lieu of Foreclosure Editor

Printable Deed in Lieu of Foreclosure Template for New York

Open Deed in Lieu of Foreclosure Editor

Open Deed in Lieu of Foreclosure Editor

or

Get Deed in Lieu of Foreclosure PDF

Finish the form now and be done

Finish Deed in Lieu of Foreclosure online using simple edit, save, and download steps.