What is a Durable Power of Attorney in New York?

A Durable Power of Attorney is a legal document that allows you to appoint someone to manage your financial affairs if you become unable to do so yourself. Unlike a regular Power of Attorney, a Durable Power of Attorney remains effective even if you become incapacitated. This ensures that your financial matters can be handled seamlessly, without court intervention.

Who can be appointed as an agent under a Durable Power of Attorney?

You can choose any adult as your agent, as long as they are mentally competent. This person is often a trusted friend, family member, or financial advisor. It’s crucial to select someone who understands your wishes and can act in your best interest.

What powers can be granted to the agent?

The Durable Power of Attorney can grant your agent a wide range of powers, including:

-

Managing bank accounts

-

Paying bills

-

Handling real estate transactions

-

Making investment decisions

-

Filing taxes

However, you can limit the powers based on your preferences. Clearly outline any restrictions in the document to ensure your wishes are followed.

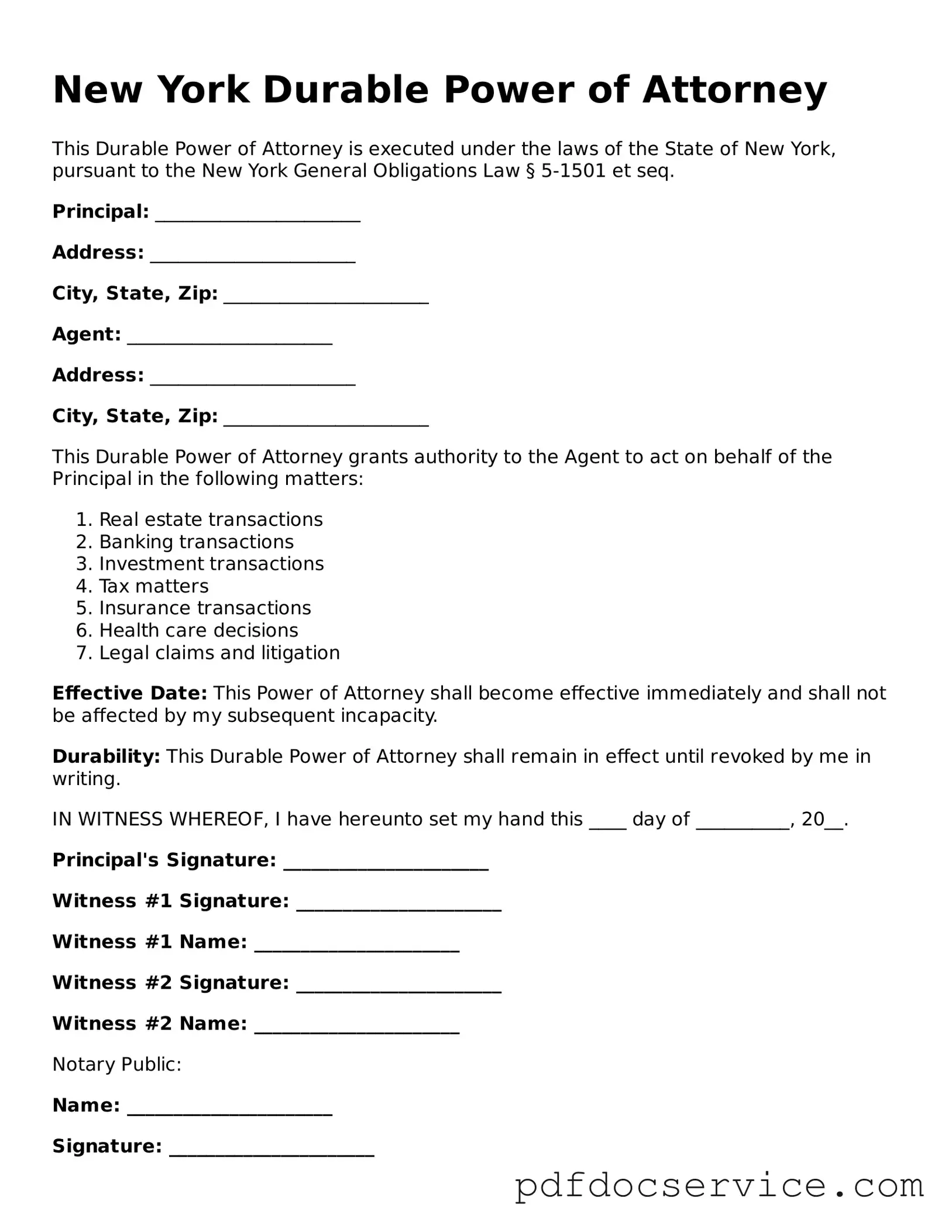

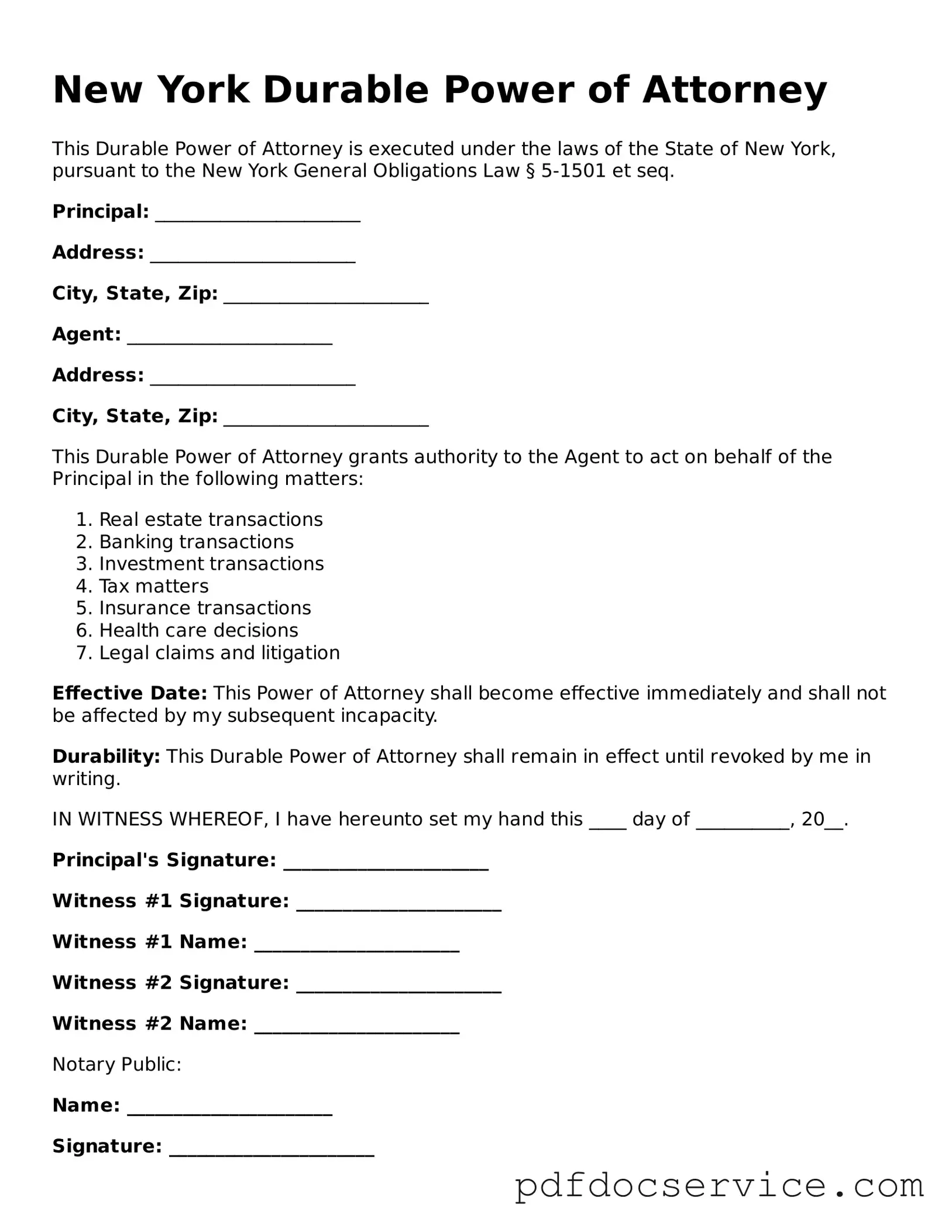

How do I create a Durable Power of Attorney in New York?

To create a Durable Power of Attorney in New York, you must complete a specific form provided by the state. This form needs to be signed by you and acknowledged by a notary public. It’s recommended to discuss your choices with a legal professional to ensure that the document meets your needs and complies with state laws.

Can I revoke my Durable Power of Attorney?

Yes, you can revoke your Durable Power of Attorney at any time as long as you are mentally competent. To do so, you must create a written revocation document and notify your agent and any institutions that may have relied on the original document. This ensures that your wishes are clear and legally binding.

What happens if I become incapacitated and don’t have a Durable Power of Attorney?

If you become incapacitated without a Durable Power of Attorney, your loved ones may need to go through a court process to obtain guardianship over your financial affairs. This process can be time-consuming and costly. Having a Durable Power of Attorney in place helps avoid this situation and allows for smoother management of your affairs.

Is a Durable Power of Attorney the same as a Health Care Proxy?

No, a Durable Power of Attorney focuses on financial matters, while a Health Care Proxy allows someone to make medical decisions on your behalf if you are unable to do so. It’s advisable to have both documents in place to ensure comprehensive management of your affairs in case of incapacity.

Can I use a Durable Power of Attorney in other states?

A Durable Power of Attorney created in New York is generally valid in other states, but each state has its own laws regarding these documents. It’s wise to check the specific requirements in the state where you intend to use it. If you move to another state, consider consulting a local attorney to ensure compliance with that state’s laws.