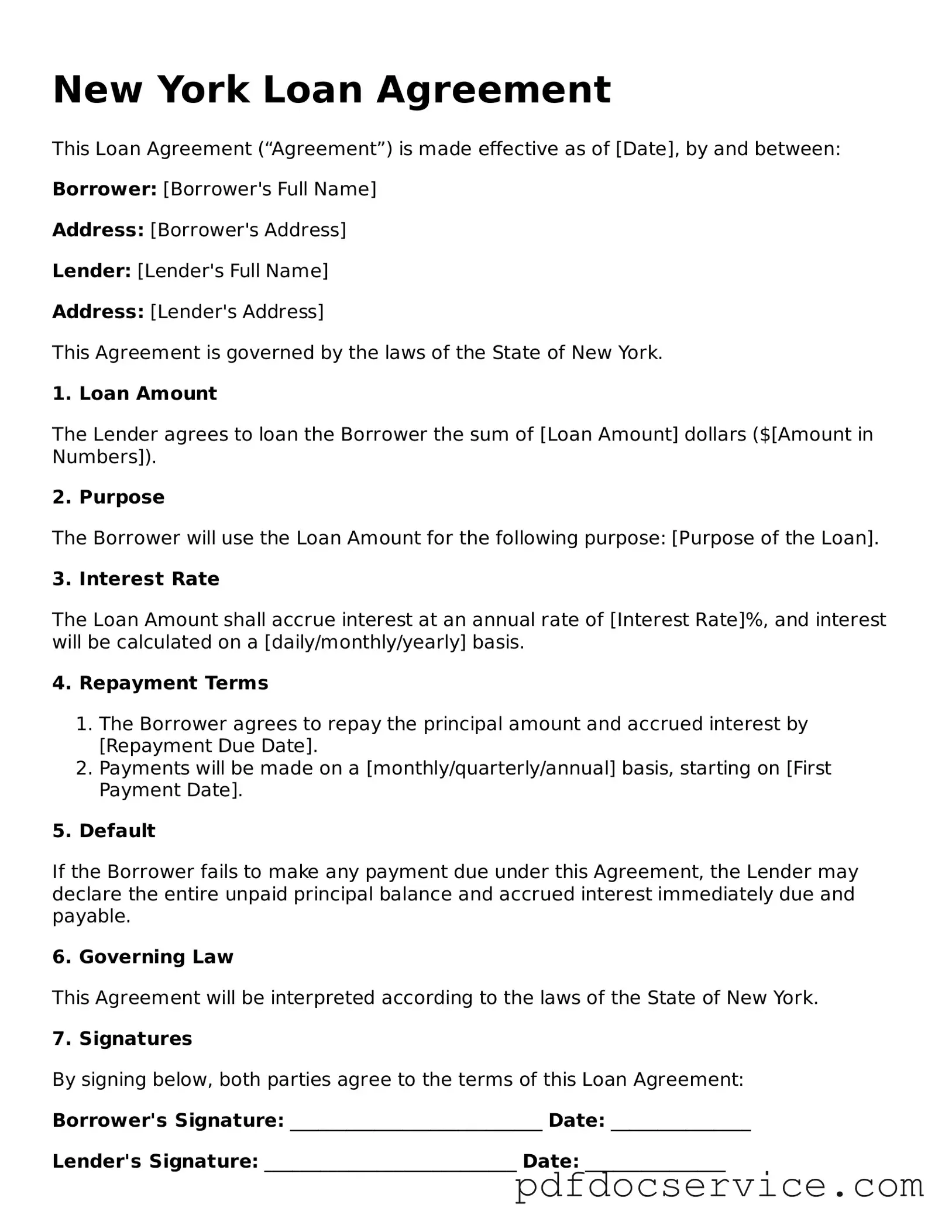

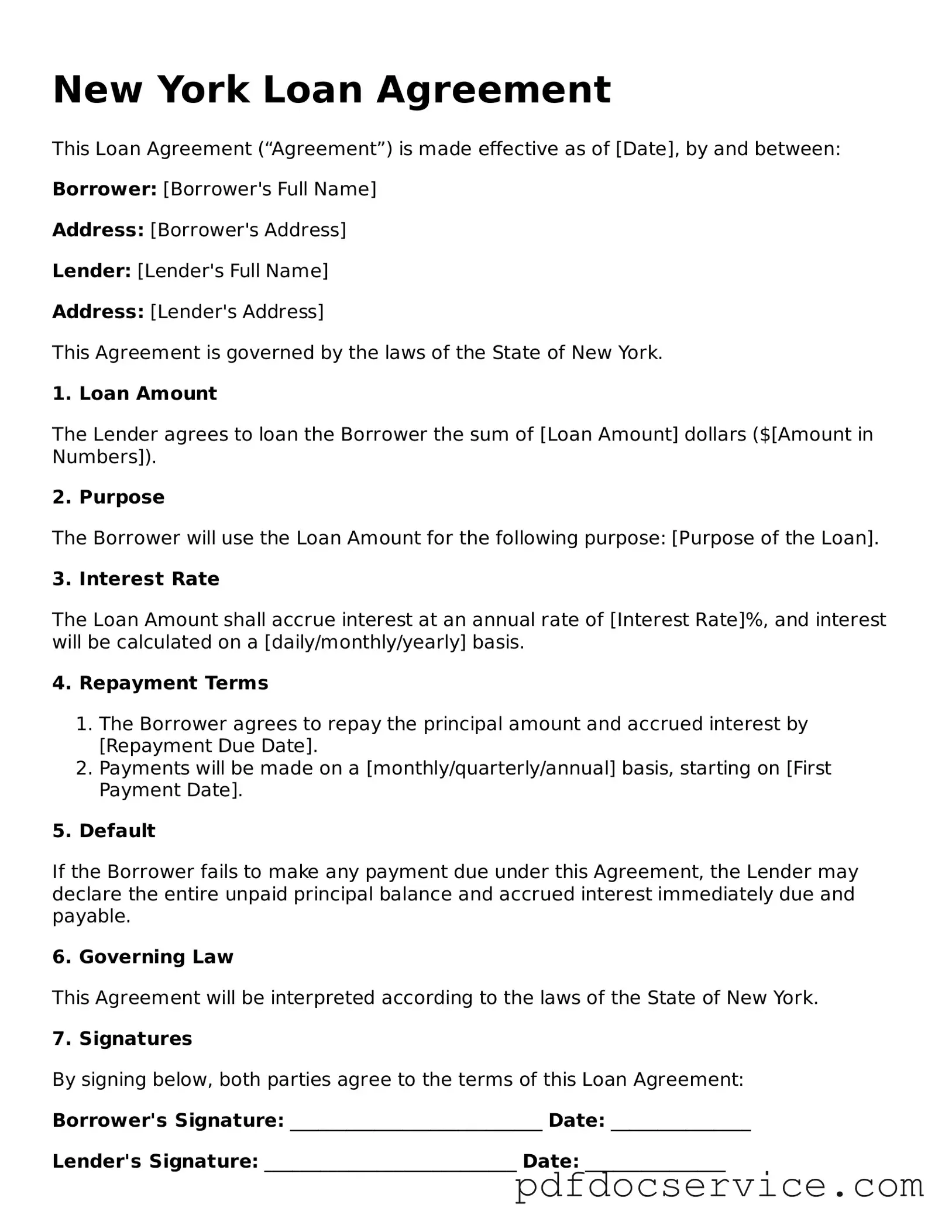

What is a New York Loan Agreement?

A New York Loan Agreement is a legal document that outlines the terms and conditions under which a borrower receives funds from a lender. This agreement specifies the amount borrowed, interest rates, repayment schedule, and any collateral involved. It serves to protect both parties by clearly defining their rights and obligations.

Who needs a Loan Agreement?

Anyone who is borrowing or lending money in New York should consider using a Loan Agreement. This includes individuals, businesses, and organizations. Having a formal agreement helps prevent misunderstandings and provides a clear record of the transaction.

What are the key components of a Loan Agreement?

A comprehensive Loan Agreement typically includes the following components:

-

Names and addresses of the borrower and lender

-

Loan amount

-

Interest rate and payment terms

-

Repayment schedule

-

Default terms and conditions

-

Governing law

-

Signatures of both parties

Is it necessary to have a Loan Agreement in writing?

While verbal agreements can be legally binding, having a written Loan Agreement is highly recommended. A written document provides clear evidence of the terms agreed upon and can be crucial in case of disputes. It also helps both parties understand their responsibilities.

Can a Loan Agreement be modified?

Yes, a Loan Agreement can be modified if both parties agree to the changes. It is advisable to document any modifications in writing and have both parties sign the updated agreement to ensure clarity and enforceability.

What happens if the borrower defaults on the Loan Agreement?

If the borrower fails to meet the repayment terms, the lender has several options. These may include:

-

Negotiating a new repayment plan

-

Charging late fees as outlined in the agreement

-

Taking legal action to recover the owed amount

-

Seizing collateral if applicable

It is important to refer to the default terms specified in the Loan Agreement for guidance.

Are there any legal requirements for a Loan Agreement in New York?

In New York, a Loan Agreement does not need to be notarized to be valid. However, certain types of loans, such as those involving real estate, may have additional requirements. It is wise to ensure compliance with all applicable laws and regulations.

Can a Loan Agreement be enforced in court?

Yes, a properly executed Loan Agreement can be enforced in court. If a dispute arises, either party can bring the matter before a judge. The agreement will serve as evidence of the terms agreed upon, making it easier to resolve the issue.

What should I do if I have questions about my Loan Agreement?

If you have questions or concerns regarding your Loan Agreement, consider consulting a legal professional. They can provide guidance tailored to your specific situation and help ensure that your rights are protected.