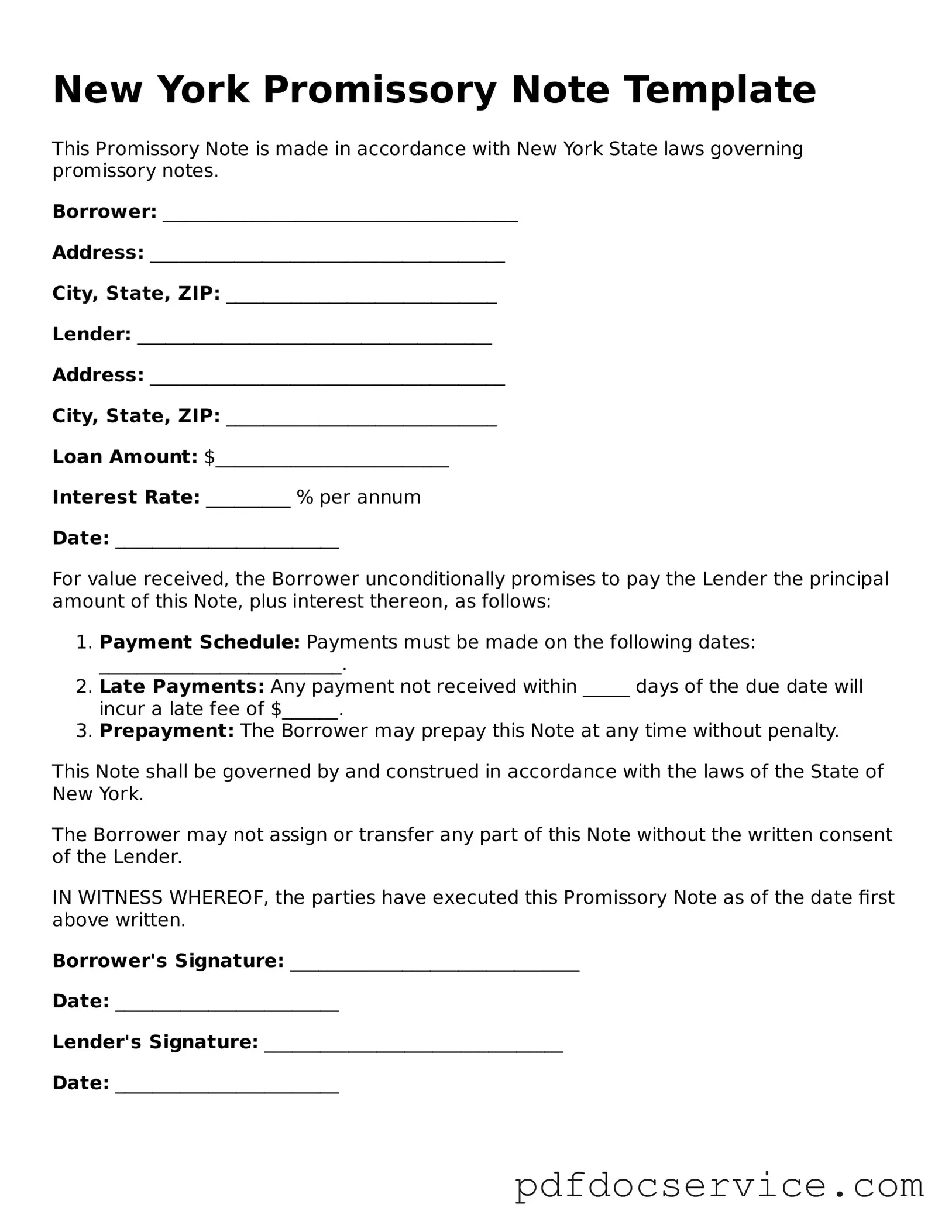

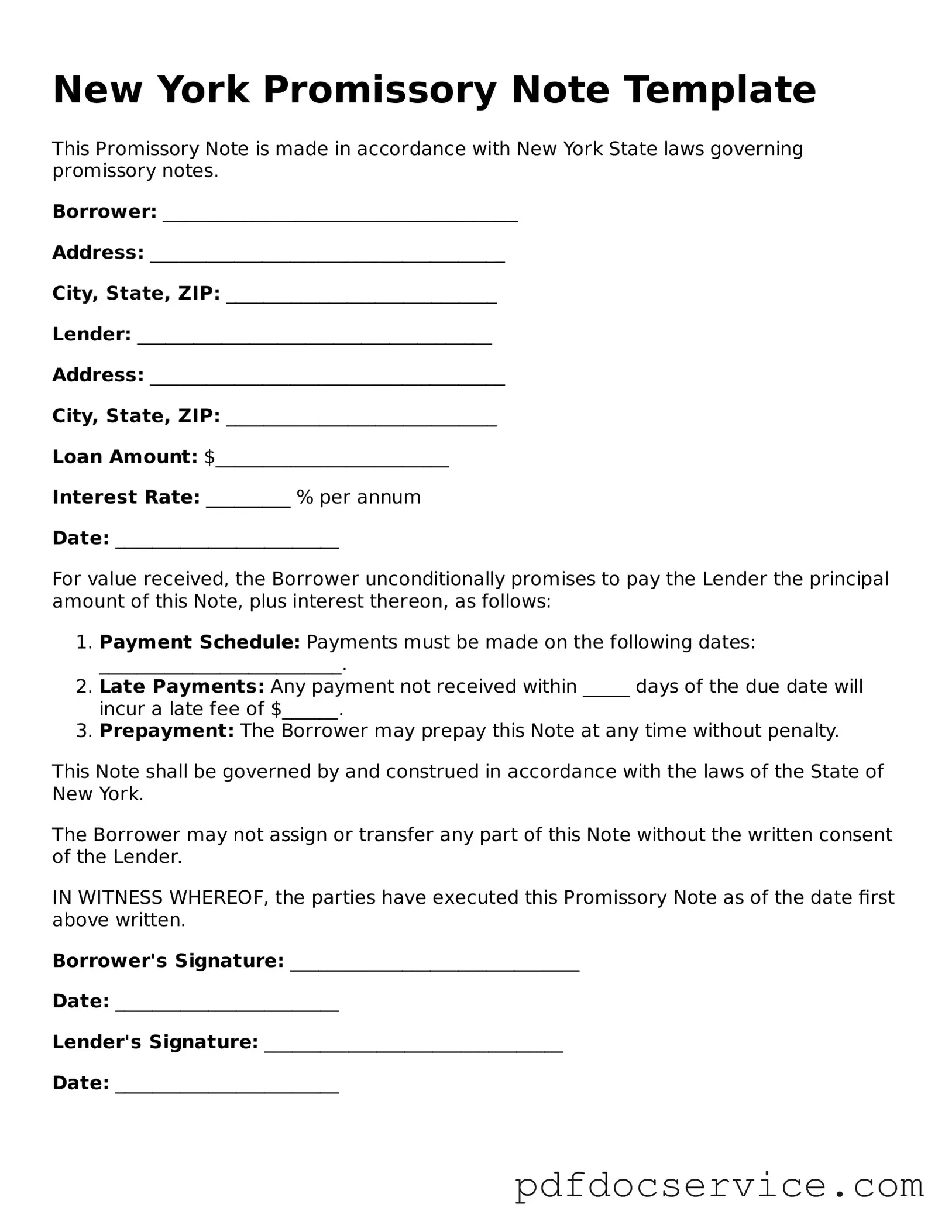

What is a New York Promissory Note?

A New York Promissory Note is a legal document that outlines a borrower's promise to repay a loan to a lender. It specifies the amount borrowed, the interest rate, repayment schedule, and any consequences for defaulting on the loan. This document serves as a formal agreement between the parties involved.

Who can use a Promissory Note in New York?

Any individual or business can use a Promissory Note in New York. This includes personal loans between friends or family members, as well as formal agreements between businesses. It is important that both parties understand the terms and conditions laid out in the note.

A typical Promissory Note will include:

-

The names and addresses of the borrower and lender

-

The principal amount of the loan

-

The interest rate

-

The repayment schedule

-

Any collateral securing the loan

-

Consequences of defaulting on the loan

-

Governing law (which in this case would be New York law)

Is a Promissory Note legally binding?

Yes, a properly executed Promissory Note is legally binding. Both parties must agree to the terms and sign the document for it to be enforceable in a court of law. It is advisable to have witnesses or notarization to strengthen the validity of the note.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified if both the borrower and lender agree to the changes. It is essential to document any modifications in writing and have both parties sign the updated agreement. This helps prevent misunderstandings in the future.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender may take several actions. These can include:

-

Sending a demand for payment

-

Negotiating a repayment plan

-

Taking legal action to recover the owed amount

Defaulting can also lead to damage to the borrower’s credit score and may result in the loss of collateral if one was specified in the note.

Do I need a lawyer to create a Promissory Note?

While it is not legally required to have a lawyer draft a Promissory Note, consulting with one can provide valuable guidance. A legal professional can ensure that the document meets all necessary requirements and protects your interests. For straightforward loans, many templates are available online.

How long does a Promissory Note last?

The duration of a Promissory Note depends on the repayment terms agreed upon by both parties. Some notes may be due in a few months, while others may extend over several years. It is crucial to clearly state the maturity date in the document.

Can a Promissory Note be transferred to another party?

Yes, a Promissory Note can be transferred or assigned to another party, unless the note specifically states otherwise. This process typically requires the original lender to notify the borrower of the transfer. The new holder then assumes the rights to collect the debt under the same terms.

What is the difference between a Promissory Note and a loan agreement?

A Promissory Note is a simpler document that primarily focuses on the borrower's promise to repay the loan. In contrast, a loan agreement is more comprehensive and includes detailed terms regarding the loan, such as covenants, representations, and warranties. While both documents serve to formalize a loan, the loan agreement provides a broader framework for the relationship between the parties.