What is a Quitclaim Deed in New York?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another. Unlike other types of deeds, a quitclaim deed does not guarantee that the person transferring the property has clear title. Instead, it simply conveys whatever interest the grantor has in the property at the time of the transfer.

When should I use a Quitclaim Deed?

Quitclaim Deeds are often used in situations where the parties know each other well, such as between family members, divorcing spouses, or business partners. They are also commonly used to clear up title issues or to add or remove someone from the title of a property. However, it's important to understand the risks, as this type of deed offers no warranties regarding the property’s title.

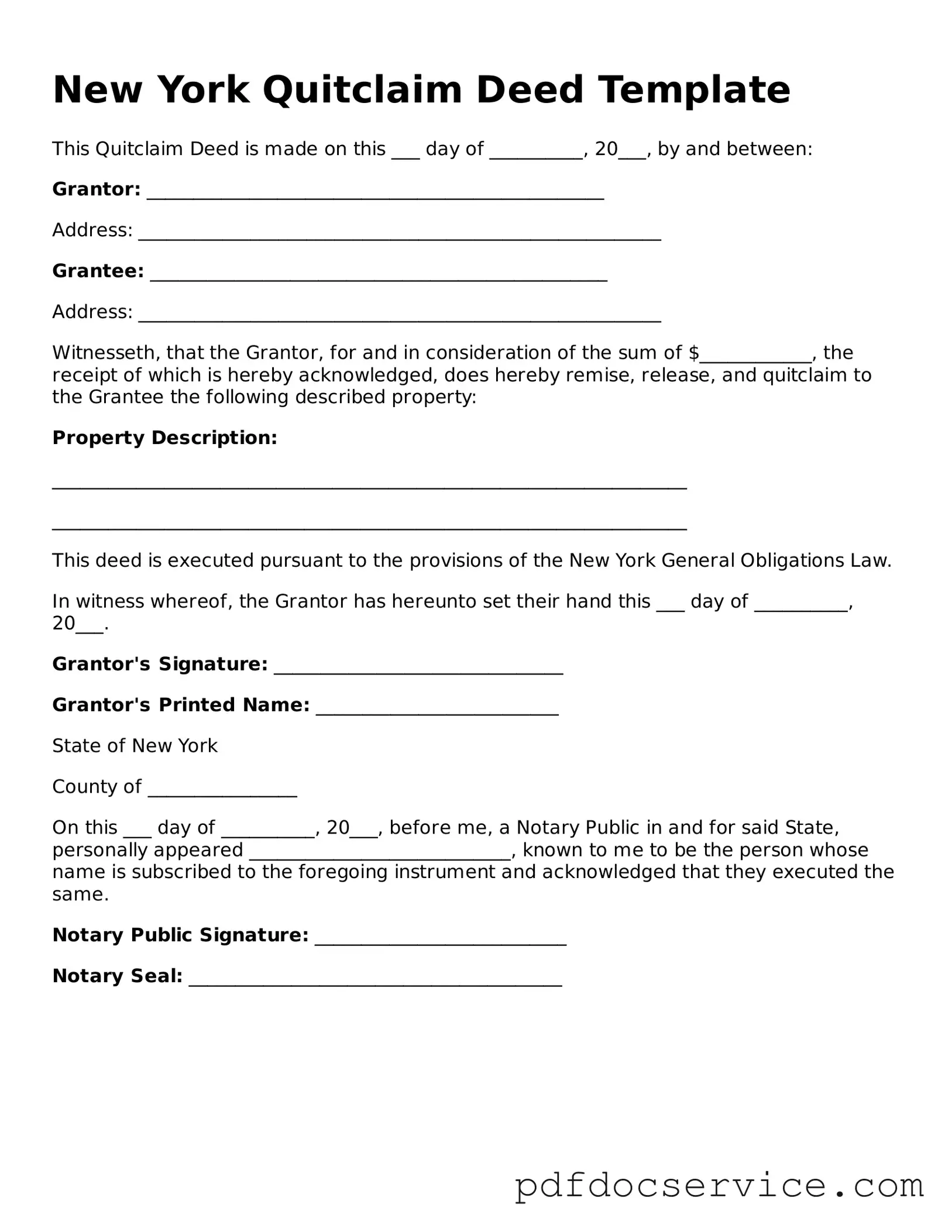

A Quitclaim Deed typically includes the following information:

-

The names and addresses of the grantor (the person transferring the property) and the grantee (the person receiving the property).

-

A legal description of the property being transferred.

-

The date of the transfer.

-

The signature of the grantor, which must be notarized.

Do I need to have the Quitclaim Deed notarized?

Yes, in New York, the signature of the grantor must be notarized for the Quitclaim Deed to be valid. This step helps ensure that the transfer is legally binding and that the grantor has willingly signed the document.

Is there a fee associated with filing a Quitclaim Deed in New York?

Yes, there is typically a fee for filing a Quitclaim Deed with the county clerk's office. The fee may vary by county, so it’s advisable to check with your local office for the exact amount. Additionally, you may need to pay transfer taxes, depending on the circumstances of the transfer.

How do I file a Quitclaim Deed in New York?

To file a Quitclaim Deed in New York, follow these steps:

-

Complete the Quitclaim Deed form with all required information.

-

Have the grantor sign the document in the presence of a notary public.

-

Take the notarized deed to the county clerk's office in the county where the property is located.

-

Pay any required filing fees and taxes.

Can I revoke a Quitclaim Deed once it’s filed?

No, once a Quitclaim Deed is filed, it cannot be revoked unilaterally. The transfer of ownership is complete, and the new owner has legal title to the property. If you wish to reverse the transaction, both parties would need to agree to a new deed that transfers ownership back to the original owner.

What are the risks of using a Quitclaim Deed?

The primary risk associated with a Quitclaim Deed is that it does not provide any guarantees about the property’s title. If there are existing liens, claims, or other issues related to the property, the grantee may inherit those problems. Therefore, it’s wise to conduct a title search before proceeding with a Quitclaim Deed to understand any potential risks involved.