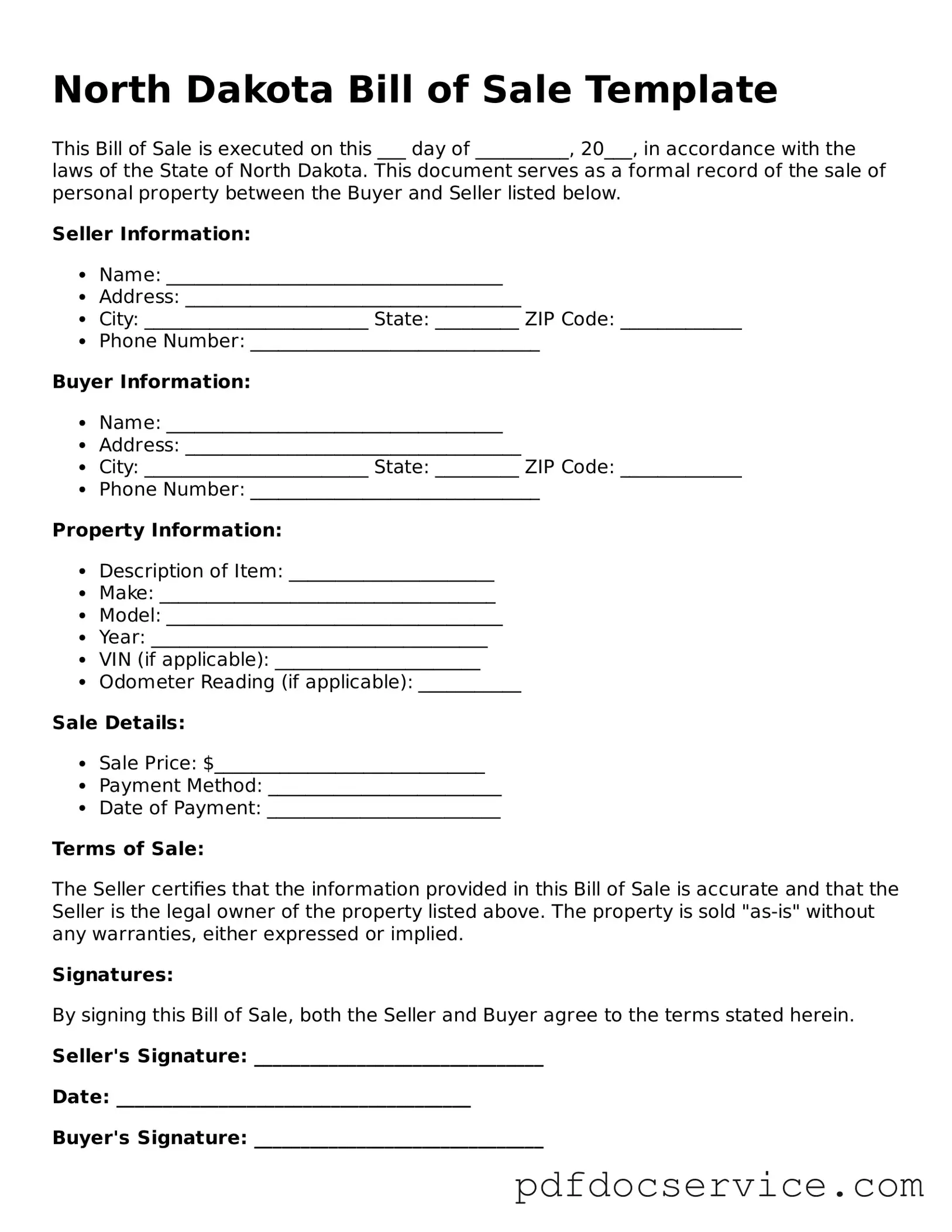

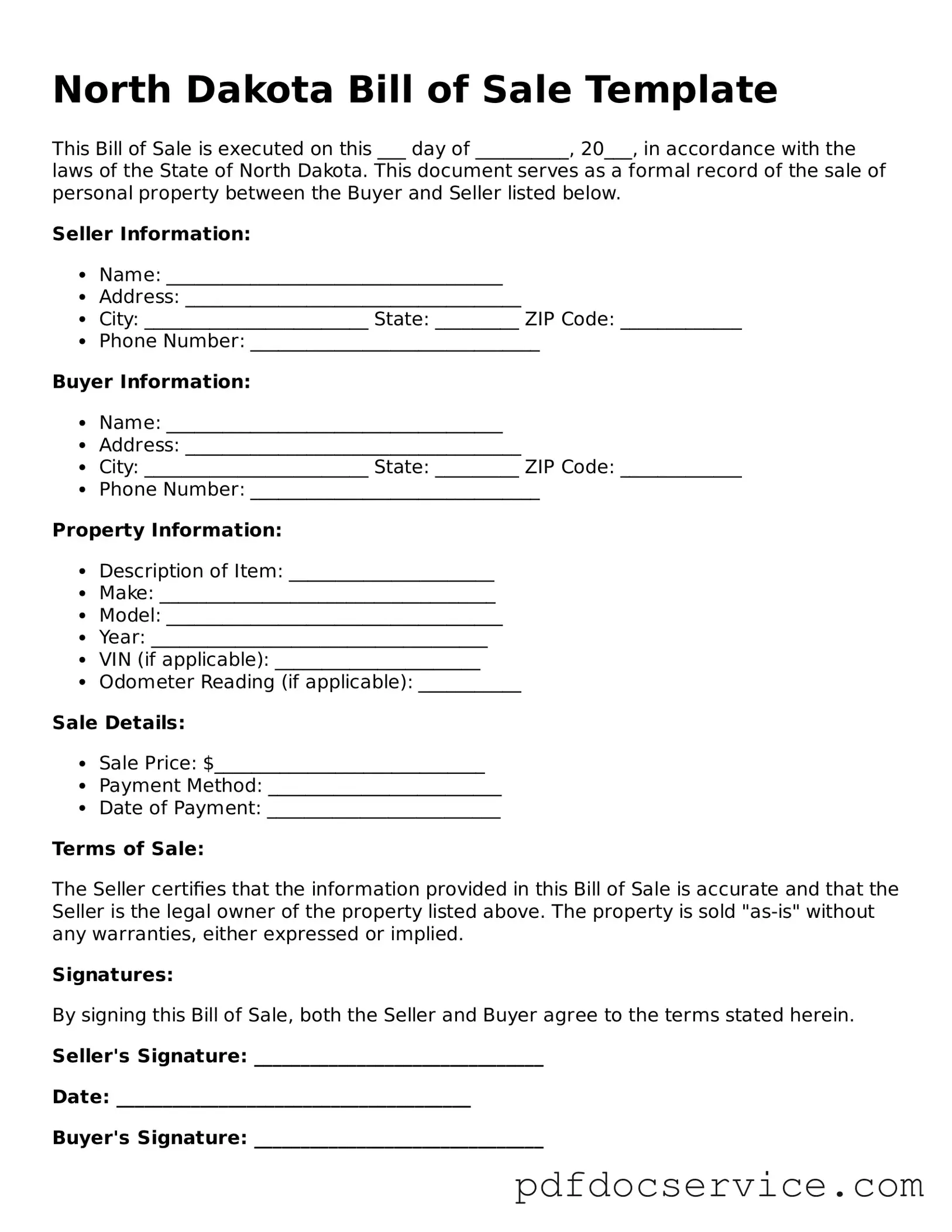

What is a North Dakota Bill of Sale?

A North Dakota Bill of Sale is a legal document that records the transfer of ownership of personal property from one party to another. This document serves as proof of the transaction and outlines the details of the sale, including the items being sold, the purchase price, and the identities of the buyer and seller.

When do I need a Bill of Sale in North Dakota?

A Bill of Sale is typically required when selling or purchasing items such as vehicles, boats, trailers, or any significant personal property. While it is not always legally required for every transaction, having one can protect both parties by providing a clear record of the sale.

Key details to include in a Bill of Sale are:

-

The names and addresses of both the buyer and seller.

-

A description of the item being sold, including make, model, year, and Vehicle Identification Number (VIN) for vehicles.

-

The purchase price.

-

The date of the transaction.

-

Signatures of both parties.

Is a Bill of Sale required for vehicle sales in North Dakota?

Yes, a Bill of Sale is required for vehicle sales in North Dakota. It is necessary for registering the vehicle with the Department of Transportation. This document helps establish the new owner's rights to the vehicle and may be needed for tax purposes as well.

Can I create my own Bill of Sale in North Dakota?

Yes, individuals can create their own Bill of Sale in North Dakota. It is important to ensure that the document includes all necessary information and is signed by both parties. Templates are available online, but customizing a document to fit the specific details of the transaction is advisable.

Do I need to have the Bill of Sale notarized?

In North Dakota, notarization is not typically required for a Bill of Sale. However, having the document notarized can add an extra layer of legitimacy and may be beneficial if disputes arise in the future.

What if the item being sold is not a vehicle?

A Bill of Sale can be used for various types of personal property, not just vehicles. This includes items like boats, trailers, equipment, and even high-value personal items such as jewelry or art. The same basic principles apply, ensuring that all relevant details are documented.

How long should I keep a Bill of Sale?

It is advisable to keep a Bill of Sale for at least a few years after the transaction. This document serves as proof of ownership and can be important for tax purposes or if any legal issues arise regarding the sale.

What happens if I lose my Bill of Sale?

If a Bill of Sale is lost, it can be recreated if the original details are known. Both the buyer and seller can draft a new document, including all pertinent information. It is recommended to keep multiple copies of important documents to avoid such situations.

Where can I find a Bill of Sale template for North Dakota?

Bill of Sale templates for North Dakota can be found online through various legal websites, government resources, and document creation platforms. It is important to choose a template that is specific to North Dakota law to ensure compliance with state requirements.