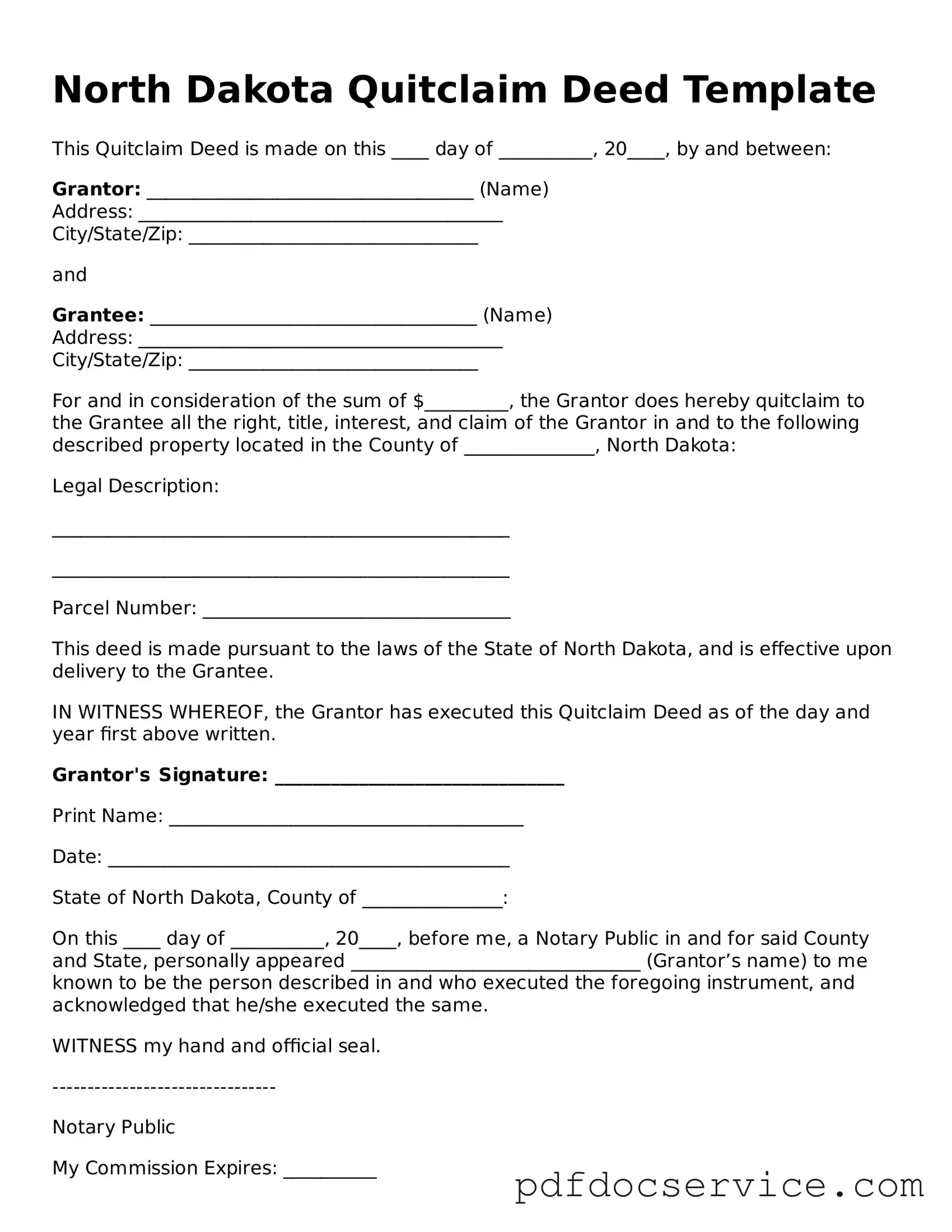

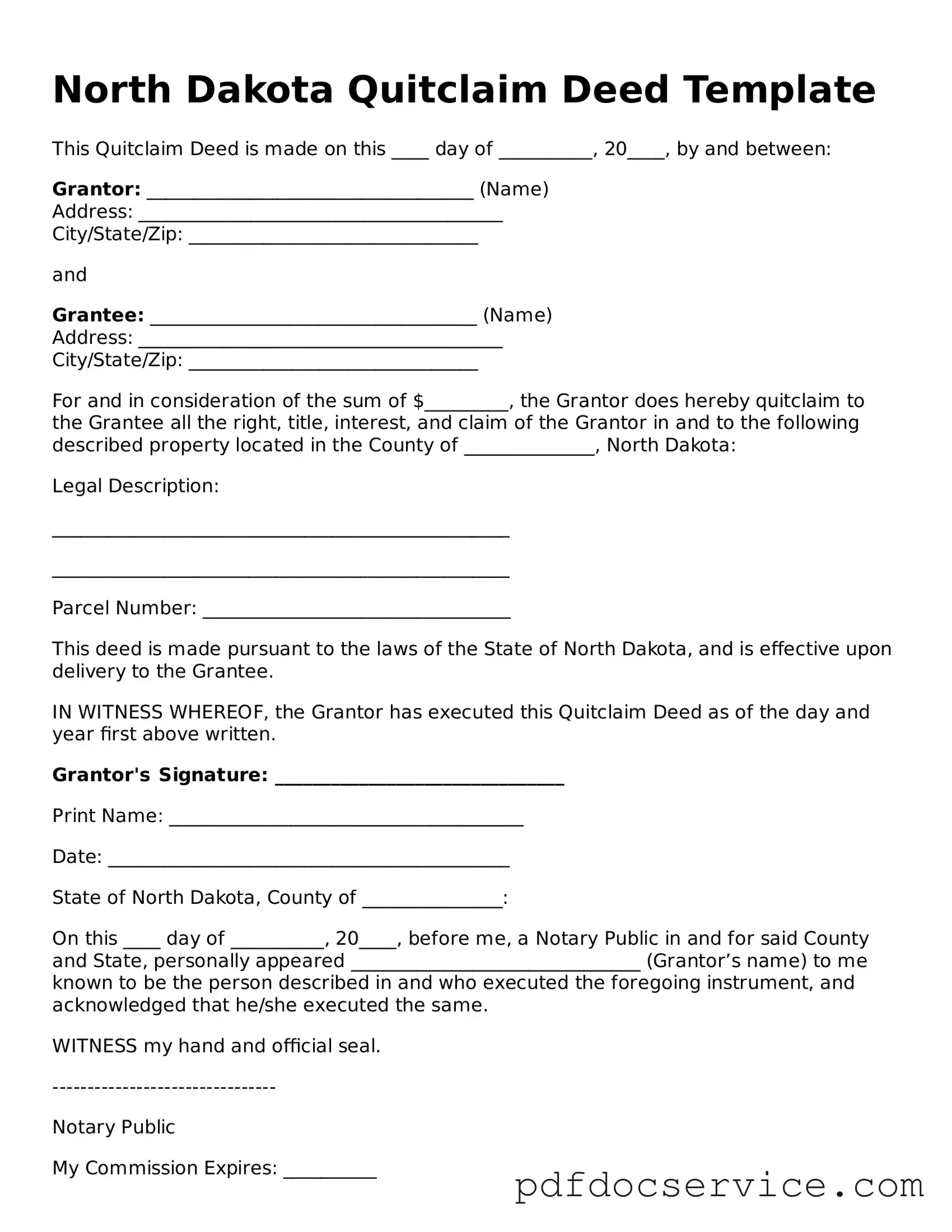

Printable Quitclaim Deed Template for North Dakota

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees about the property’s title. In North Dakota, this form serves as a straightforward way to convey property rights, often utilized among family members or in situations where the seller may not have clear title. Understanding how to properly execute this form is essential for ensuring a smooth transfer of property ownership.

Open Quitclaim Deed Editor

Printable Quitclaim Deed Template for North Dakota

Open Quitclaim Deed Editor

Open Quitclaim Deed Editor

or

Get Quitclaim Deed PDF

Finish the form now and be done

Finish Quitclaim Deed online using simple edit, save, and download steps.