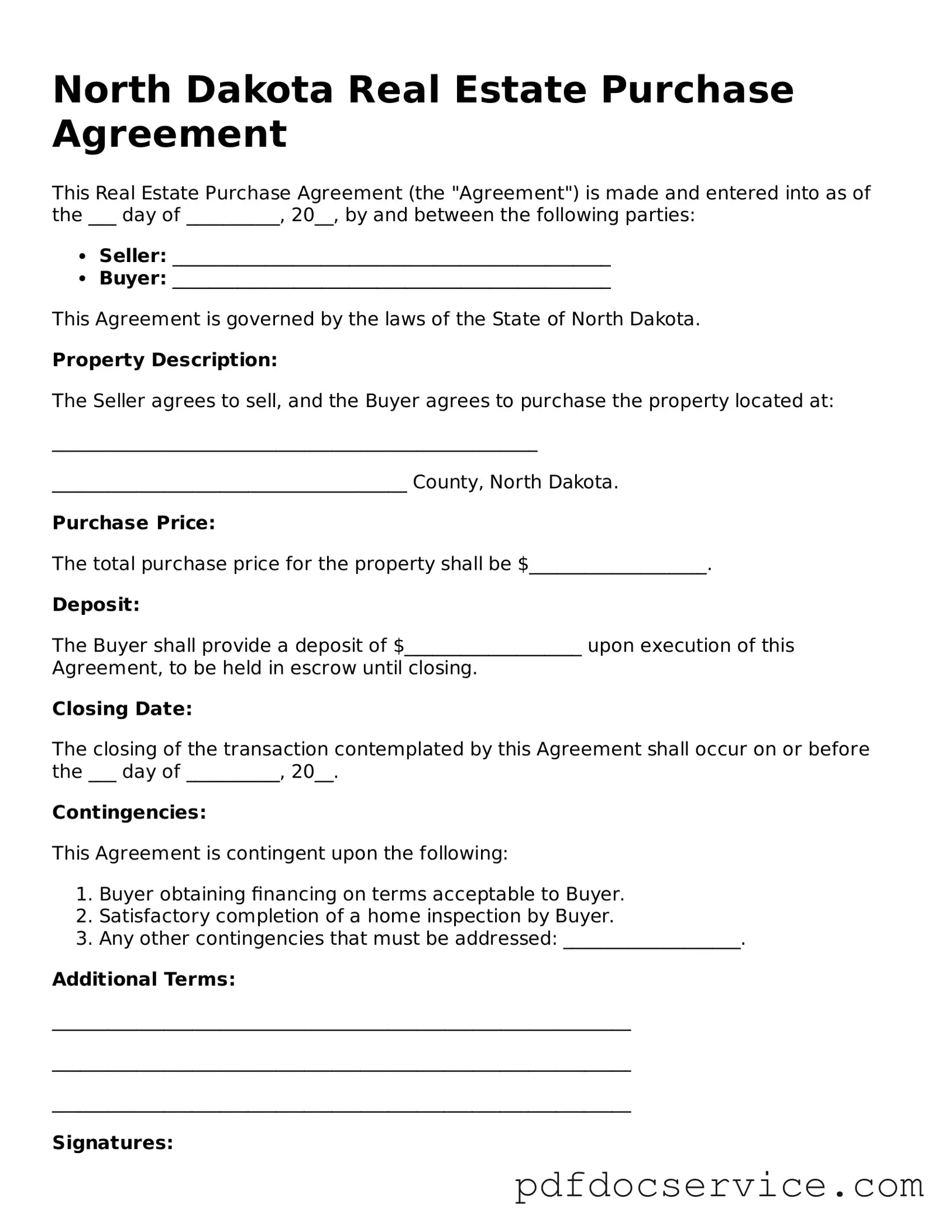

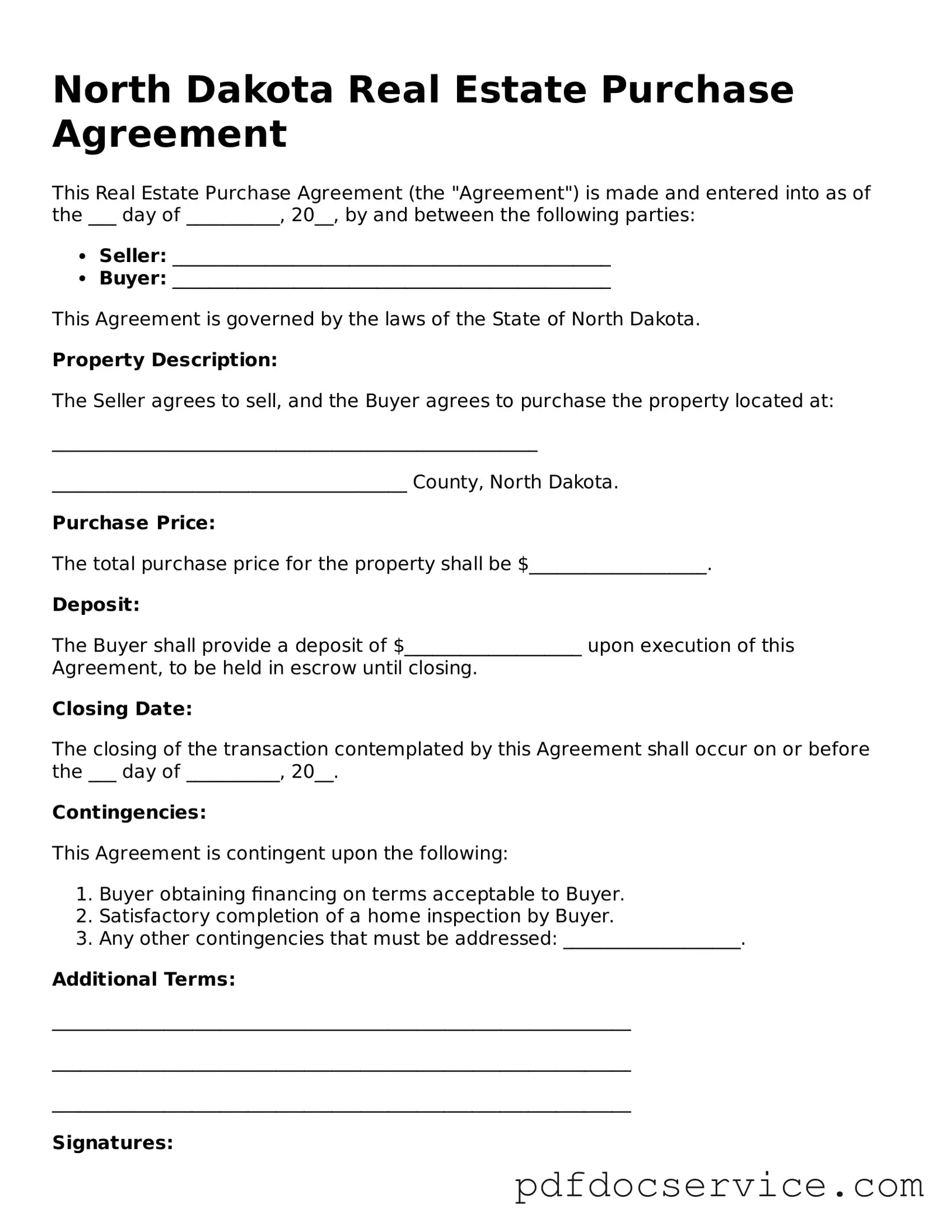

What is a North Dakota Real Estate Purchase Agreement?

A North Dakota Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a property will be sold. This agreement includes details about the buyer, seller, property description, purchase price, and any contingencies that must be met for the sale to proceed. It serves as a binding contract once signed by both parties.

What are the key components of this agreement?

The key components of a North Dakota Real Estate Purchase Agreement typically include:

-

Identification of the buyer and seller

-

Property description

-

Purchase price and payment terms

-

Contingencies, such as financing or inspection

-

Closing date and possession details

-

Disclosures and any special provisions

Is a Real Estate Purchase Agreement required in North Dakota?

While it is not legally required to have a written agreement for all real estate transactions, it is highly recommended. A written Real Estate Purchase Agreement protects the interests of both the buyer and seller by clearly outlining the terms of the sale and reducing the potential for disputes.

What contingencies can be included in the agreement?

Contingencies are conditions that must be met for the sale to proceed. Common contingencies in a North Dakota Real Estate Purchase Agreement may include:

-

Financing contingency: The buyer must secure a mortgage.

-

Inspection contingency: The buyer can conduct a home inspection.

-

Appraisal contingency: The property must appraise for at least the purchase price.

-

Sale of current home: The buyer must sell their existing home before purchasing.

How is the purchase price determined?

The purchase price is usually determined through negotiations between the buyer and seller. Factors that may influence the price include the current market conditions, comparable sales in the area, and the condition of the property. An appraisal may also provide an objective value for the property.

What happens if one party wants to back out of the agreement?

If one party wishes to back out of the agreement, the consequences depend on the terms outlined in the contract. If the buyer withdraws without a valid contingency, they may forfeit their earnest money. If the seller backs out, the buyer may have legal grounds to seek damages or enforce the contract.

Can the agreement be modified after it is signed?

Yes, a Real Estate Purchase Agreement can be modified after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the buyer and seller to ensure clarity and enforceability.

What should I do if I have questions about the agreement?

If you have questions about the North Dakota Real Estate Purchase Agreement, it is advisable to consult with a real estate attorney or a qualified real estate professional. They can provide guidance tailored to your specific situation and help ensure that your interests are protected throughout the transaction.