What is a Transfer-on-Death Deed in North Dakota?

A Transfer-on-Death Deed (TOD Deed) allows property owners in North Dakota to transfer real estate to beneficiaries upon their death. This deed does not take effect until the owner's death, allowing the owner to retain full control of the property during their lifetime.

Who can use a Transfer-on-Death Deed?

Any individual who owns real property in North Dakota can use a Transfer-on-Death Deed. This includes homeowners and property investors. However, the owner must be of sound mind and at least 18 years old when executing the deed.

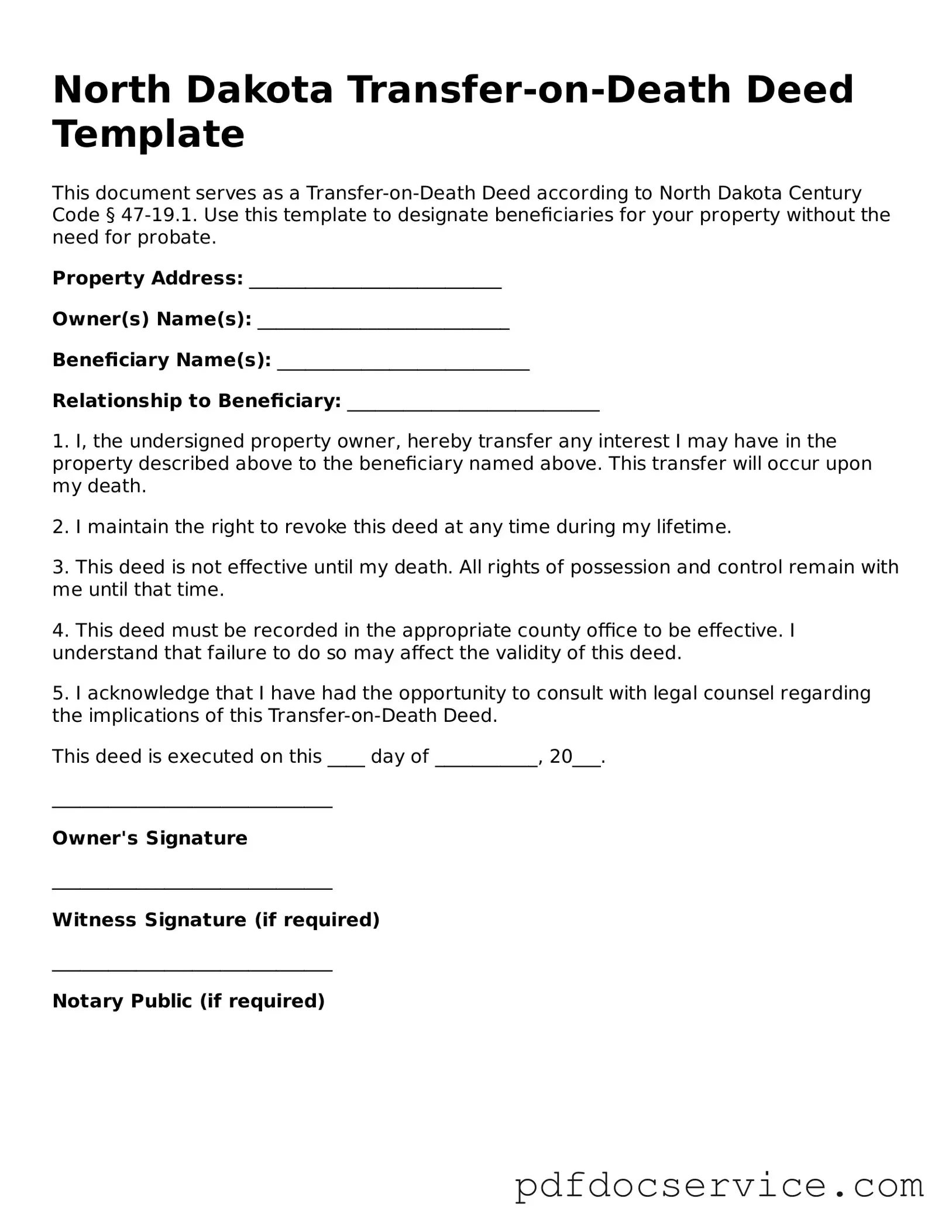

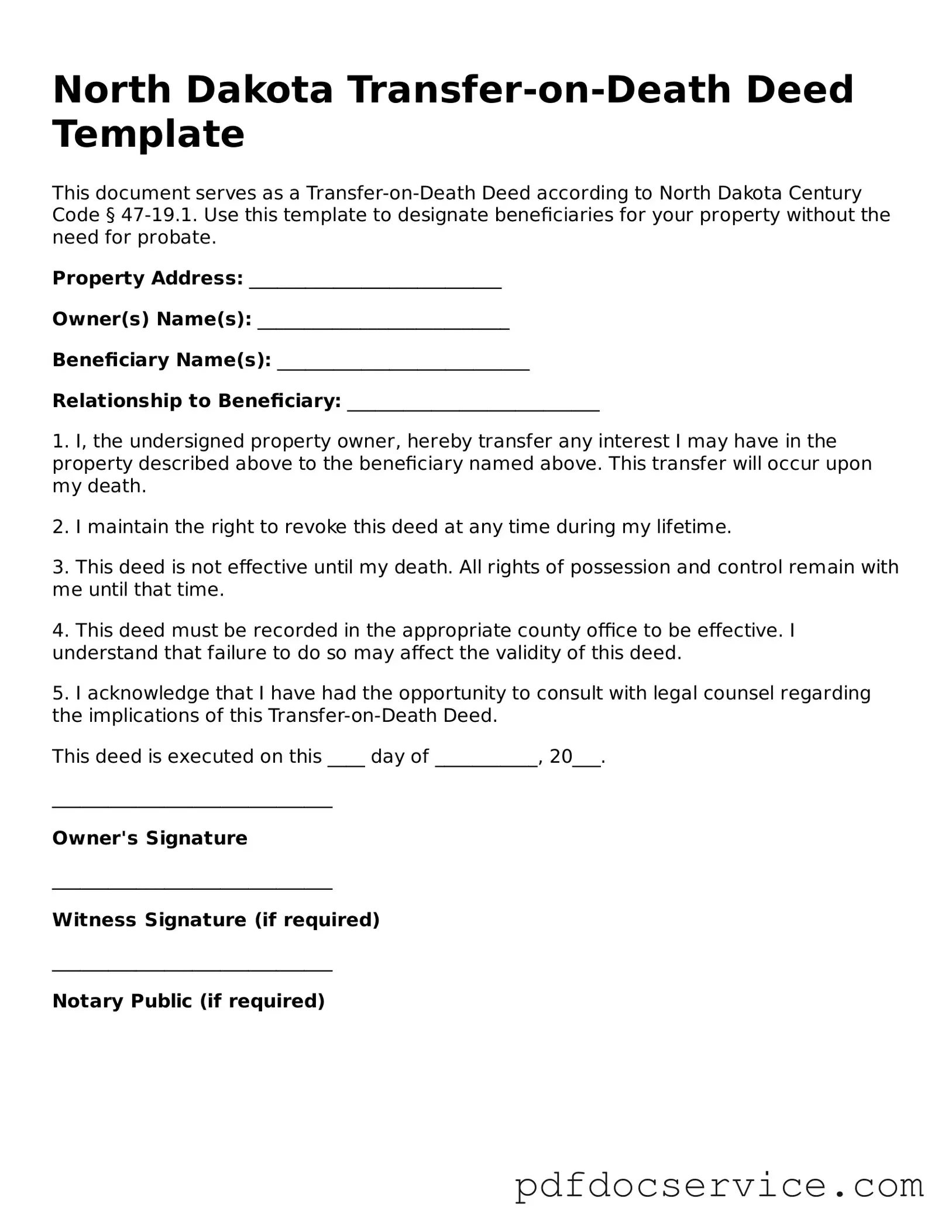

How do I create a Transfer-on-Death Deed?

To create a TOD Deed, follow these steps:

-

Obtain the appropriate form from the North Dakota Secretary of State's website or a legal resource.

-

Fill out the form with accurate property and beneficiary information.

-

Sign the deed in the presence of a notary public.

-

File the completed deed with the county recorder's office where the property is located.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a TOD Deed at any time before your death. To do this, you must create a new deed or a formal revocation document. Both must be properly signed and filed with the county recorder's office to be effective.

What happens if I do not name a beneficiary?

If you do not name a beneficiary on your Transfer-on-Death Deed, the property will not transfer upon your death. Instead, it will become part of your estate and will be distributed according to your will or, if there is no will, according to state intestacy laws.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when using a Transfer-on-Death Deed. The property remains part of your estate until your death, at which point the beneficiaries may be responsible for any applicable estate taxes. It is advisable to consult a tax professional for specific guidance.

Is a Transfer-on-Death Deed the same as a will?

No, a Transfer-on-Death Deed is not the same as a will. A will outlines how your assets will be distributed after your death and must go through probate. In contrast, a TOD Deed allows for the direct transfer of property outside of probate, simplifying the process for your beneficiaries.

Can I use a Transfer-on-Death Deed for all types of property?

A Transfer-on-Death Deed can only be used for real property, such as land and buildings. It cannot be used for personal property like vehicles or bank accounts. For those assets, other estate planning tools, such as wills or trusts, may be more appropriate.

What if I have multiple beneficiaries?

You can name multiple beneficiaries on a Transfer-on-Death Deed. If you choose to do so, be sure to specify how the property will be divided among them. This can be done by stating percentages or specific shares in the deed. Ensure that all beneficiaries understand their rights and responsibilities regarding the property.