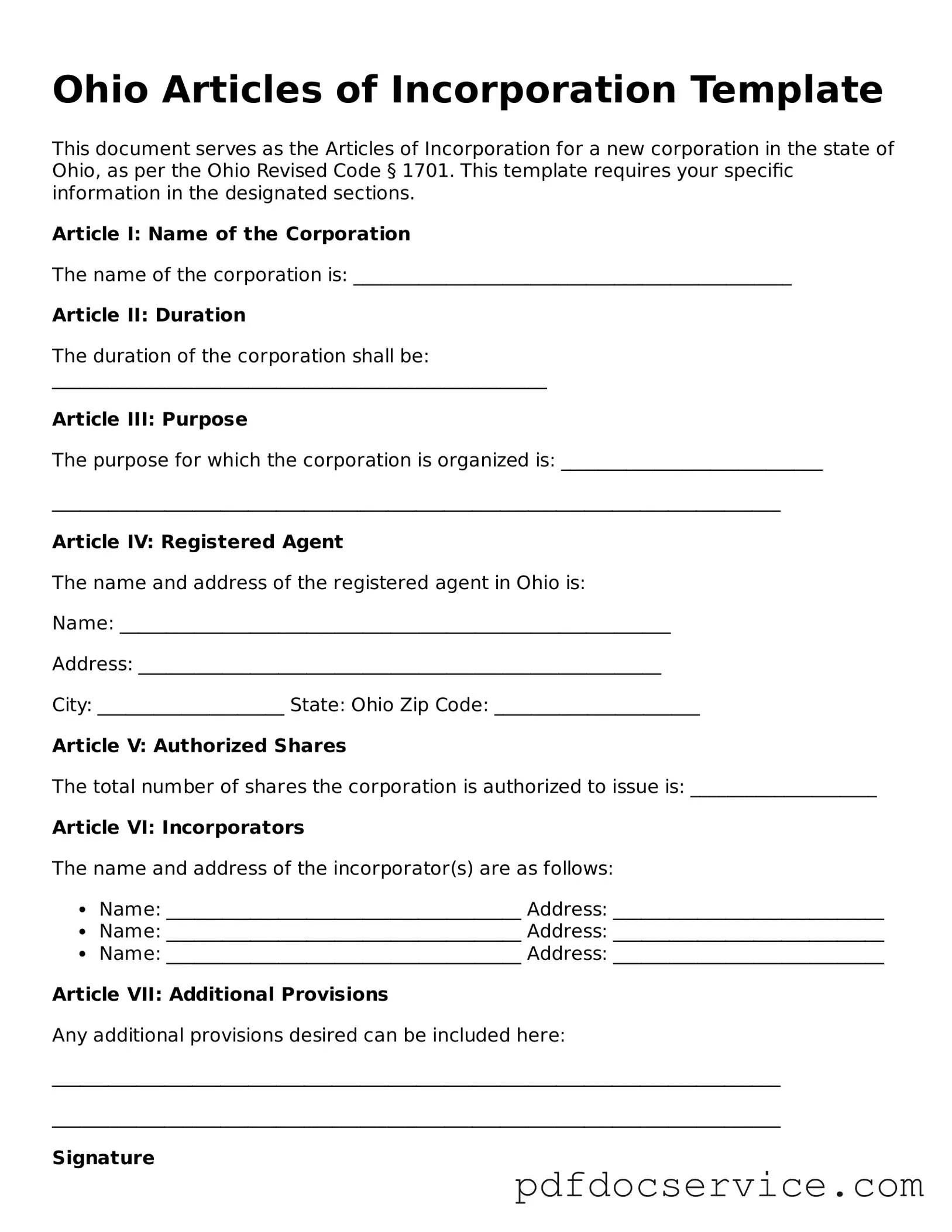

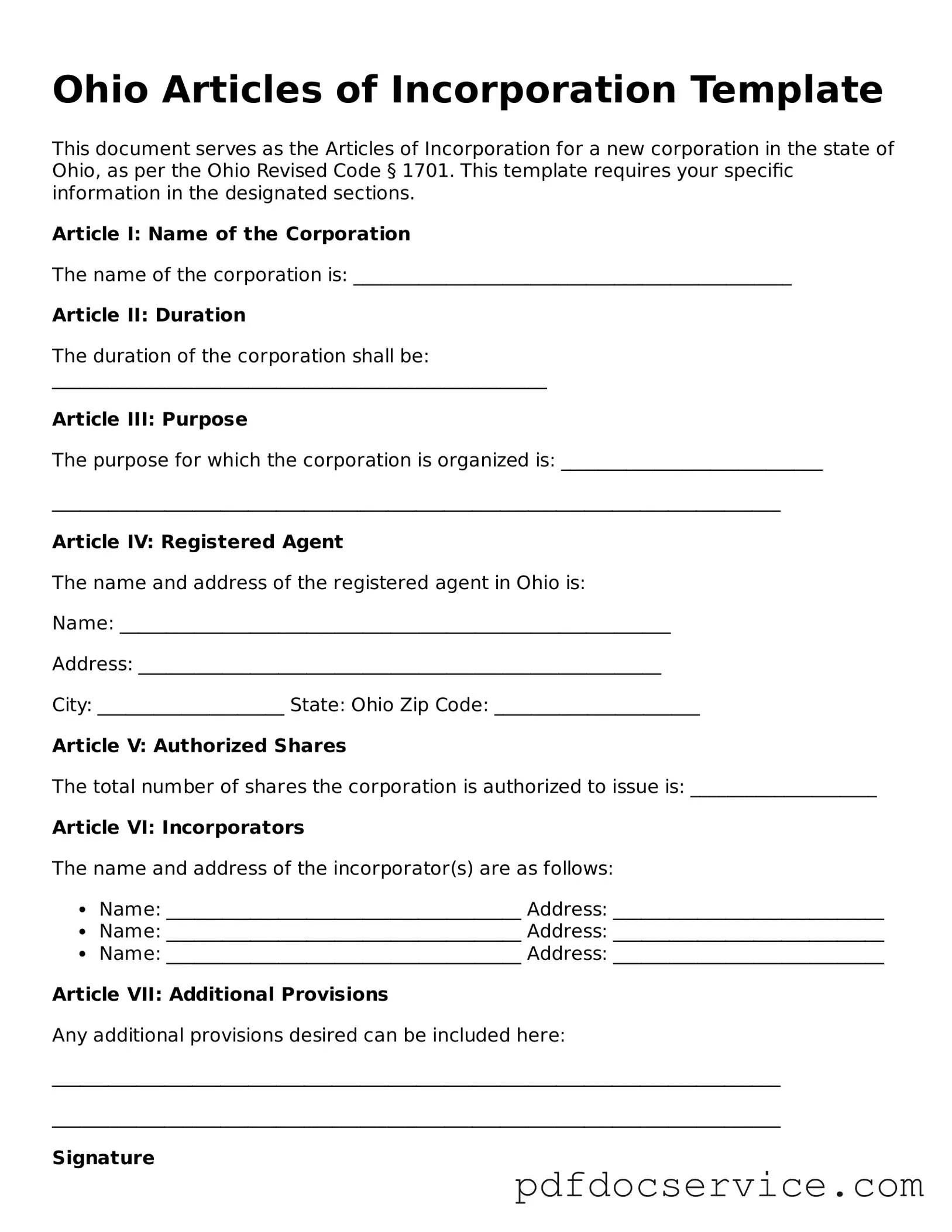

What are the Articles of Incorporation in Ohio?

The Articles of Incorporation is a legal document that establishes a corporation in Ohio. It provides essential information about the business, such as its name, purpose, and structure. Filing this document with the Ohio Secretary of State is the first step in forming a corporation.

What information is required on the Articles of Incorporation form?

When filling out the Articles of Incorporation form, you will need to provide the following information:

-

The name of the corporation.

-

The purpose of the corporation.

-

The address of the principal office.

-

The name and address of the statutory agent.

-

The number of shares the corporation is authorized to issue.

How do I file the Articles of Incorporation in Ohio?

You can file the Articles of Incorporation online or by mail. For online filing, visit the Ohio Secretary of State’s website. If you prefer to file by mail, print the form, complete it, and send it to the appropriate address along with the filing fee. Make sure to check the current fee amount before submitting.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Ohio varies depending on the type of corporation you are forming. Generally, the fee ranges from $99 to $125. It's a good idea to verify the exact amount on the Ohio Secretary of State’s website before you file.

Can I amend the Articles of Incorporation after filing?

Yes, you can amend the Articles of Incorporation after they have been filed. To do this, you will need to file an amendment form with the Ohio Secretary of State. This form will require details about the changes you wish to make, along with any applicable fees.

How long does it take to process the Articles of Incorporation?

Processing times can vary. Typically, online filings are processed faster, often within a few business days. Mail filings may take longer, sometimes up to a couple of weeks. For urgent matters, consider using expedited services if available.

What happens after my Articles of Incorporation are approved?

Once your Articles of Incorporation are approved, you will receive a confirmation from the Ohio Secretary of State. Your corporation will officially exist as a legal entity. After that, you should obtain any necessary business licenses and permits, and set up your corporate records.

Do I need a lawyer to file the Articles of Incorporation?

While it's not required to have a lawyer to file the Articles of Incorporation, it can be beneficial. A legal professional can help ensure that all information is accurate and compliant with Ohio laws. If you have questions or concerns, consulting a lawyer may provide peace of mind.