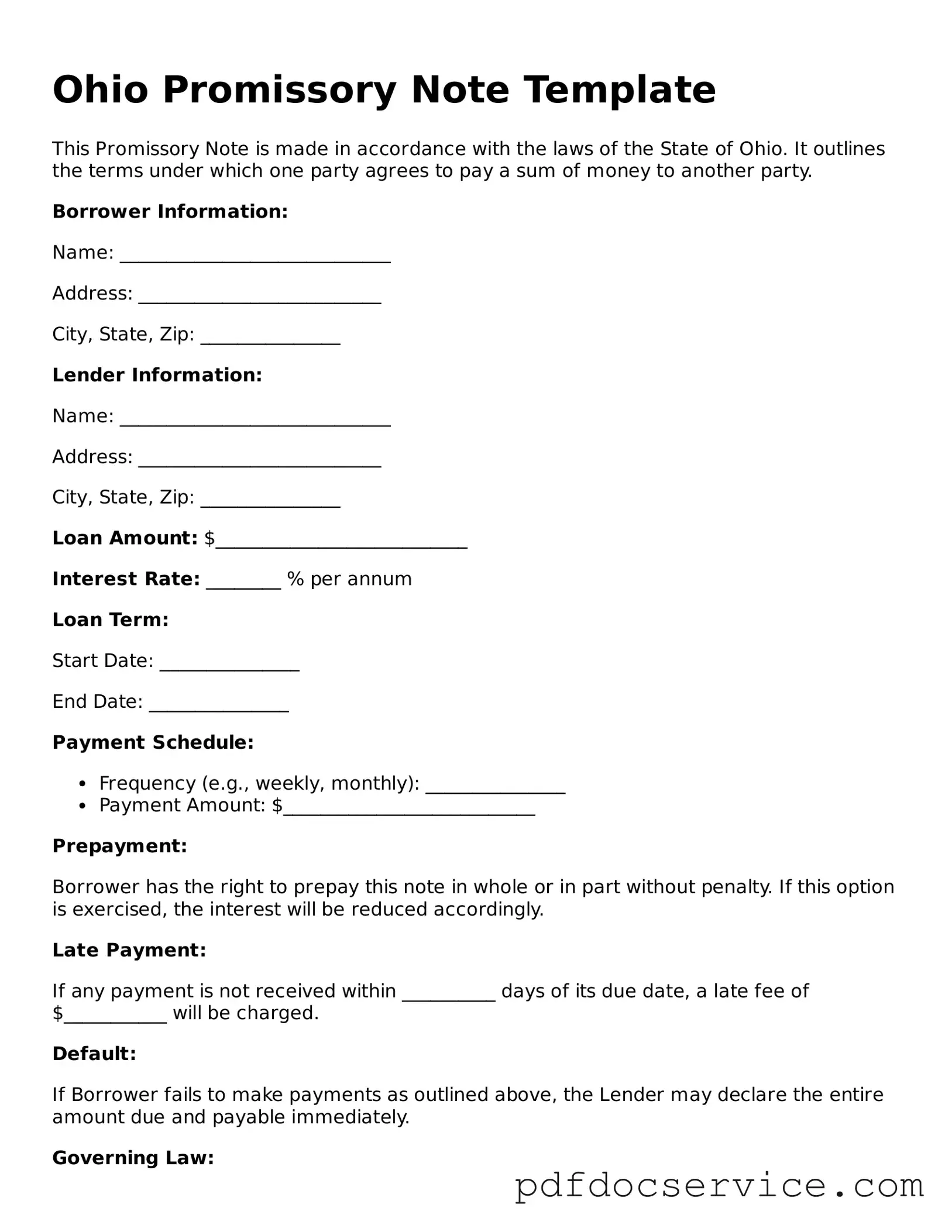

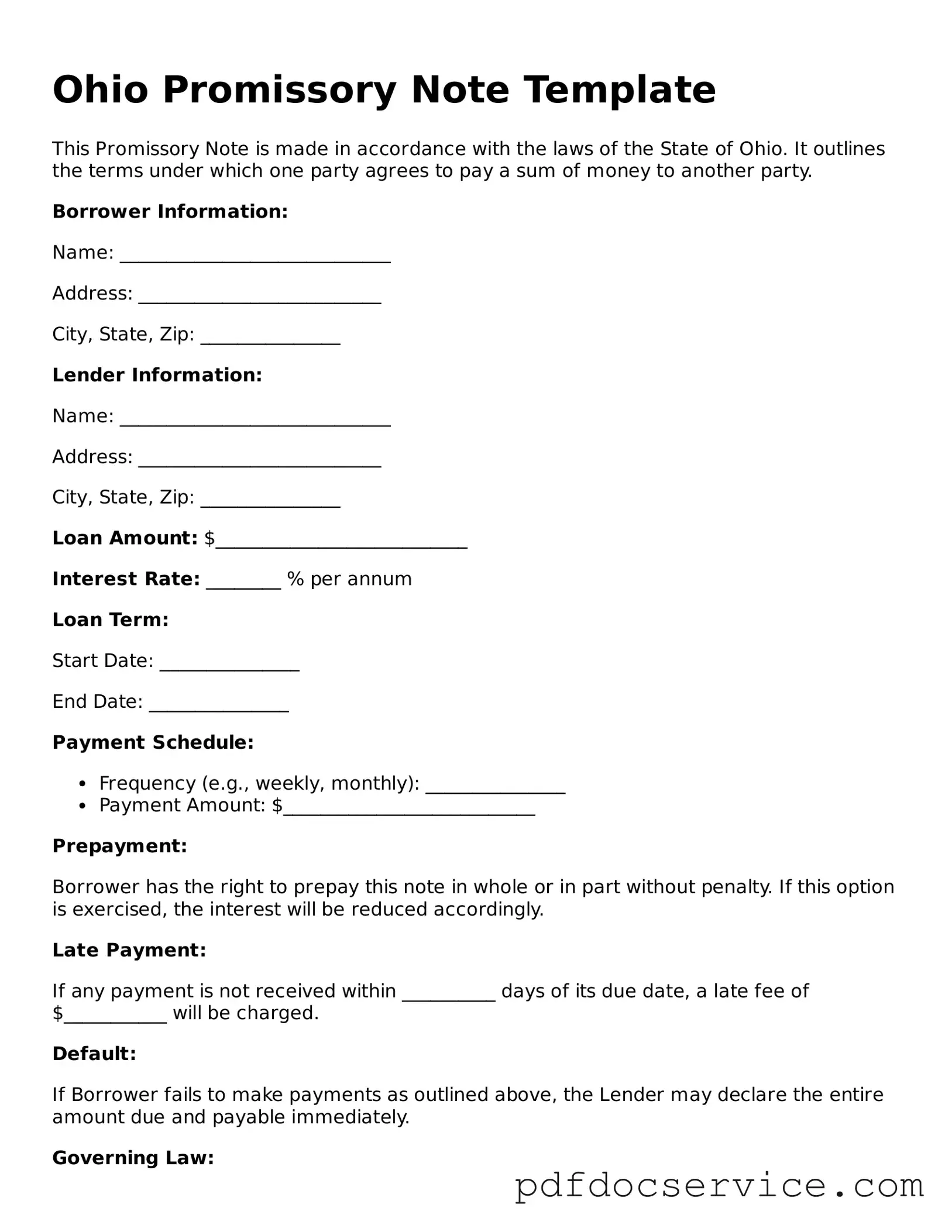

Printable Promissory Note Template for Ohio

A promissory note is a legal document in which one party promises to pay a specific amount of money to another party at a designated time. In Ohio, this form serves as a crucial tool for individuals and businesses alike, facilitating clear and enforceable lending agreements. Understanding the Ohio Promissory Note form can help you navigate financial transactions with confidence.

Open Promissory Note Editor

Printable Promissory Note Template for Ohio

Open Promissory Note Editor

Open Promissory Note Editor

or

Get Promissory Note PDF

Finish the form now and be done

Finish Promissory Note online using simple edit, save, and download steps.