Printable Tractor Bill of Sale Template for Ohio

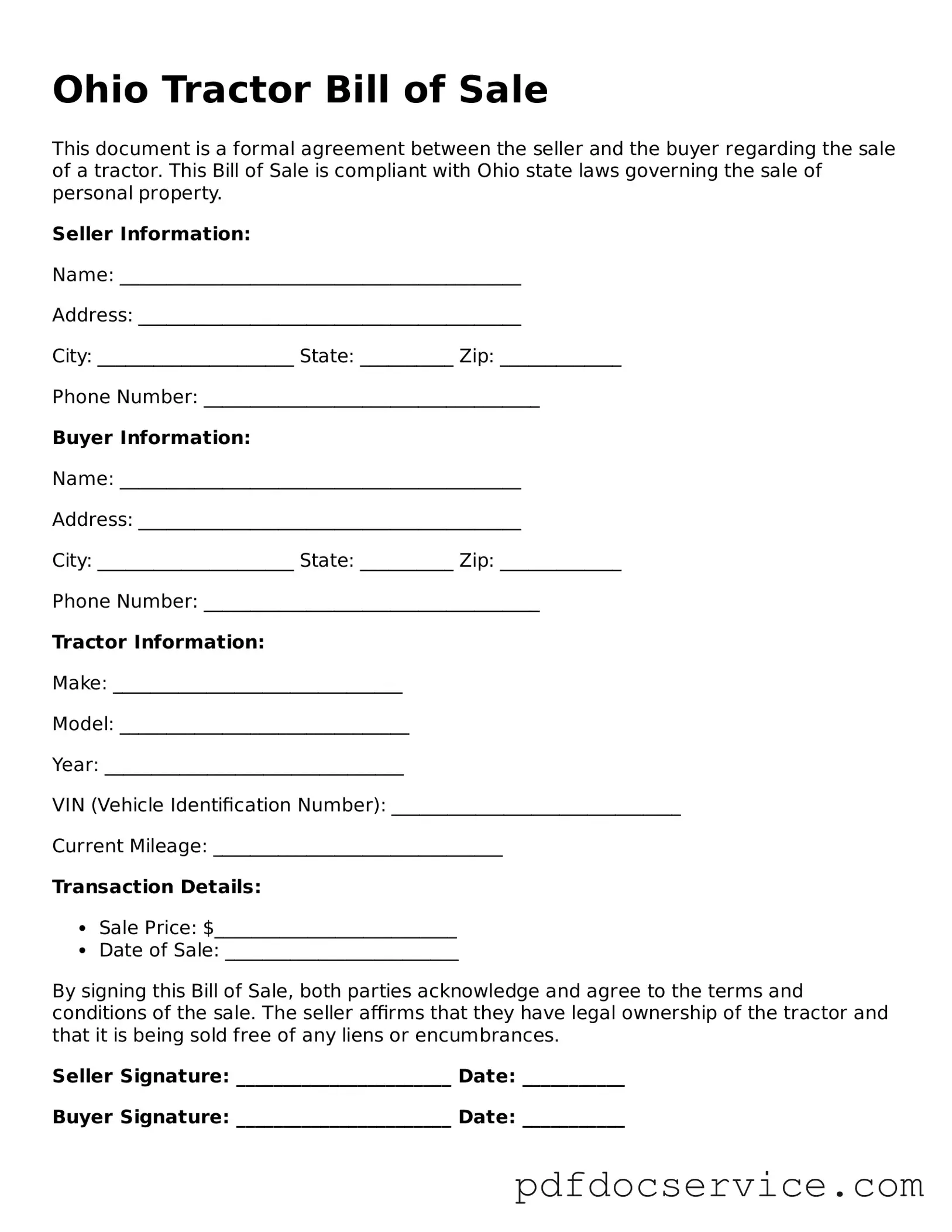

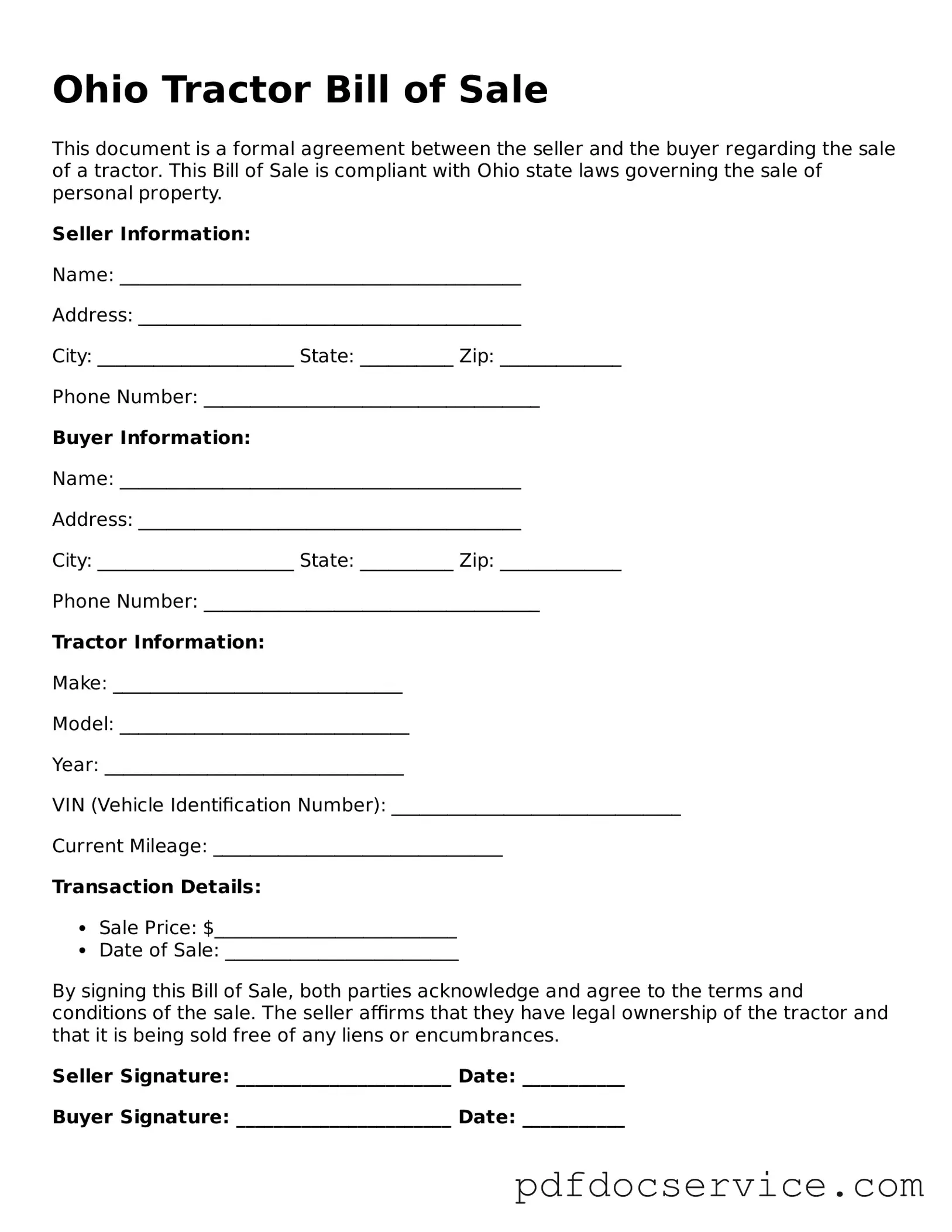

The Ohio Tractor Bill of Sale form is a legal document that records the sale and transfer of ownership of a tractor in Ohio. This form serves as proof of the transaction and outlines important details such as the buyer's and seller's information, the tractor's description, and the sale price. Completing this form ensures that both parties have a clear understanding of the sale and protects their rights in the transaction.

Open Tractor Bill of Sale Editor

Printable Tractor Bill of Sale Template for Ohio

Open Tractor Bill of Sale Editor

Open Tractor Bill of Sale Editor

or

Get Tractor Bill of Sale PDF

Finish the form now and be done

Finish Tractor Bill of Sale online using simple edit, save, and download steps.