What is a Transfer-on-Death Deed in Ohio?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows a property owner in Ohio to transfer real estate to a beneficiary upon their death, without the need for probate. This means that the property will pass directly to the designated beneficiary, simplifying the transfer process and potentially saving time and money.

Who can create a Transfer-on-Death Deed?

Any individual who owns real estate in Ohio can create a Transfer-on-Death Deed. This includes homeowners, co-owners, and individuals holding property in their name. However, the deed must be executed according to Ohio law to be valid.

How do I create a Transfer-on-Death Deed?

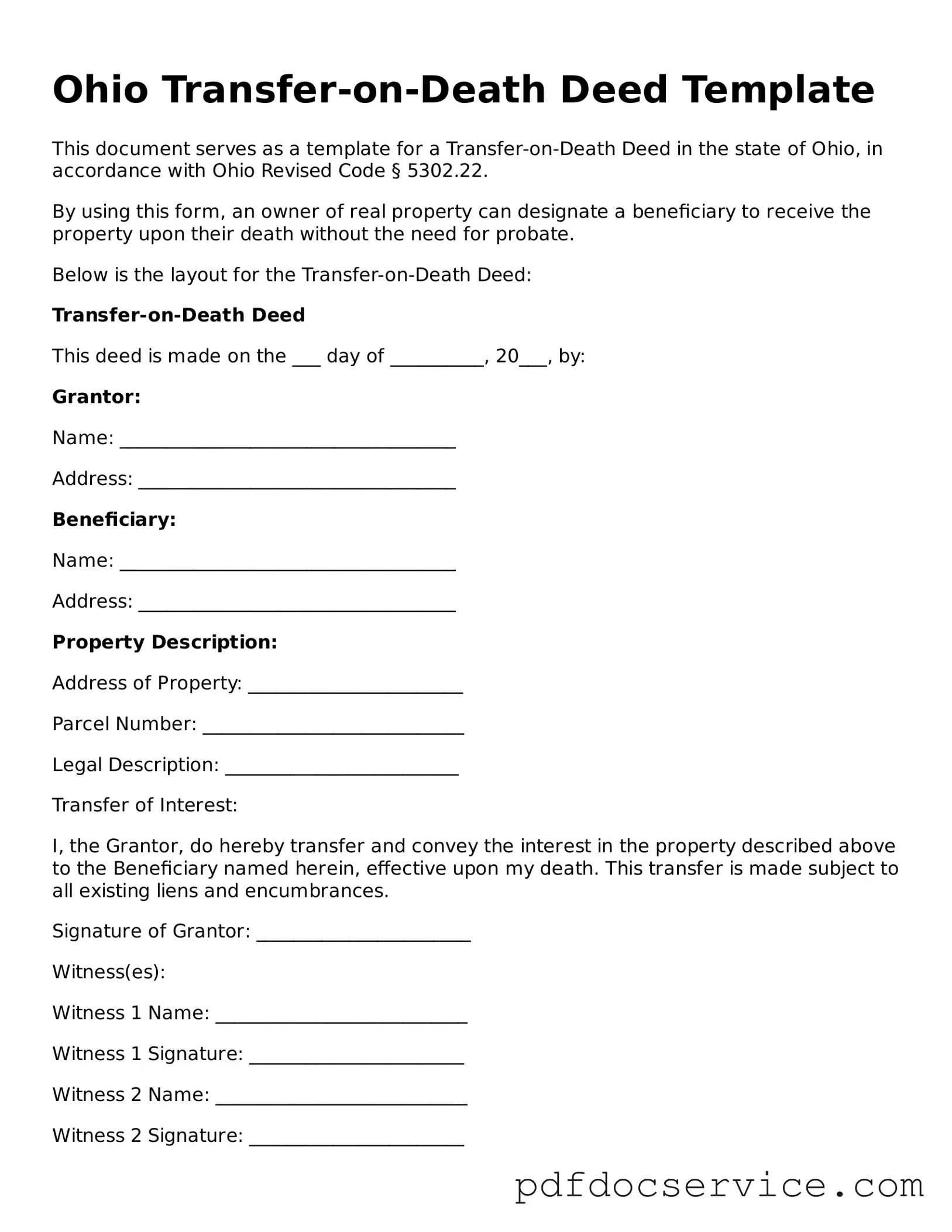

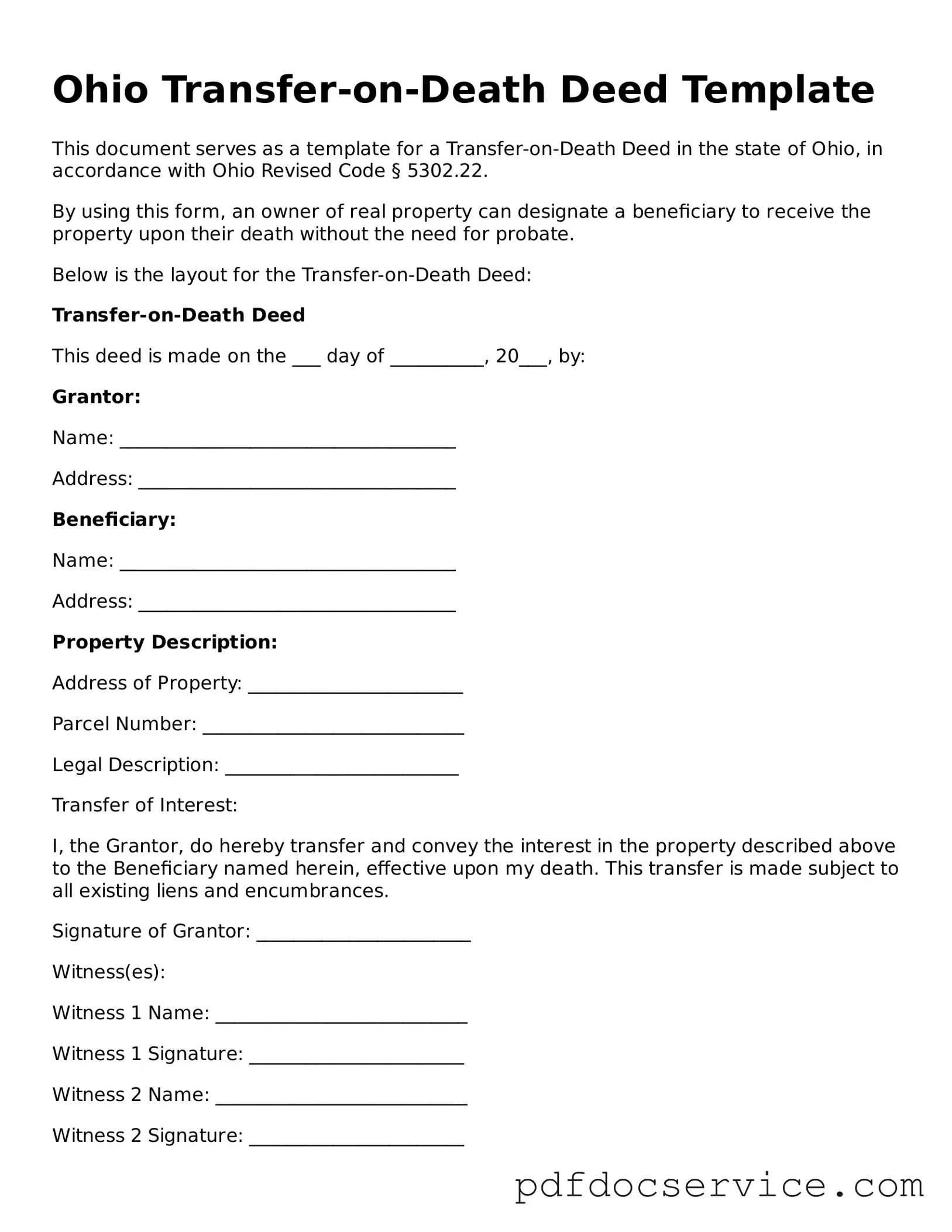

To create a TOD Deed, follow these steps:

-

Obtain the appropriate form, which can typically be found online or through local legal resources.

-

Complete the form by providing the necessary details, including the property description and the beneficiary's information.

-

Sign the deed in the presence of a notary public.

-

Record the signed deed with the county recorder's office where the property is located.

It is advisable to consult with a legal professional to ensure that the deed is properly executed and recorded.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do this, you must create a new deed that explicitly revokes the previous one or simply record a revocation document. It is important to ensure that any changes are properly documented and recorded to avoid confusion later on.

What happens if the beneficiary predeceases me?

If the beneficiary named in the Transfer-on-Death Deed dies before you, the deed does not automatically transfer to their heirs. Instead, the property will revert to your estate and will be distributed according to your will or Ohio intestacy laws if you do not have a will. To avoid this situation, consider naming an alternate beneficiary in the deed.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when creating a Transfer-on-Death Deed. The property is not considered a gift during your lifetime, so you will not incur gift taxes. However, the beneficiary may be responsible for property taxes once the property is transferred. It is wise to consult a tax professional to understand any potential future tax consequences.

Is a Transfer-on-Death Deed the right option for everyone?

A Transfer-on-Death Deed can be a beneficial tool for many property owners, but it may not be suitable for everyone. Considerations include the complexity of your estate, the nature of your relationships with potential beneficiaries, and any existing estate planning strategies. Consulting with a legal professional can help determine if this option aligns with your overall estate planning goals.

For more information, you can visit the Ohio Secretary of State's website or consult with local legal resources. Many law firms also provide resources and guidance on estate planning and Transfer-on-Death Deeds. Engaging with a legal professional can provide tailored advice based on your specific situation.