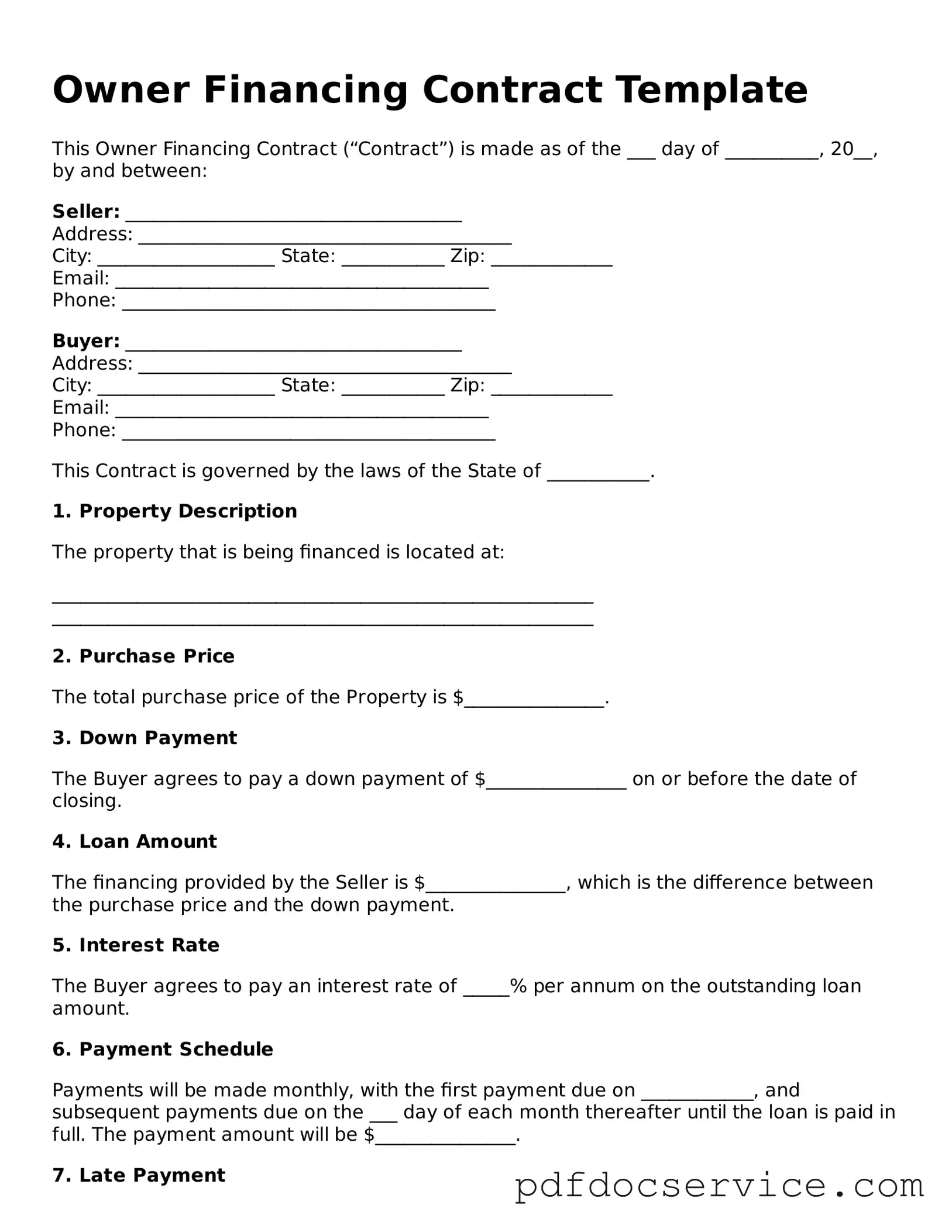

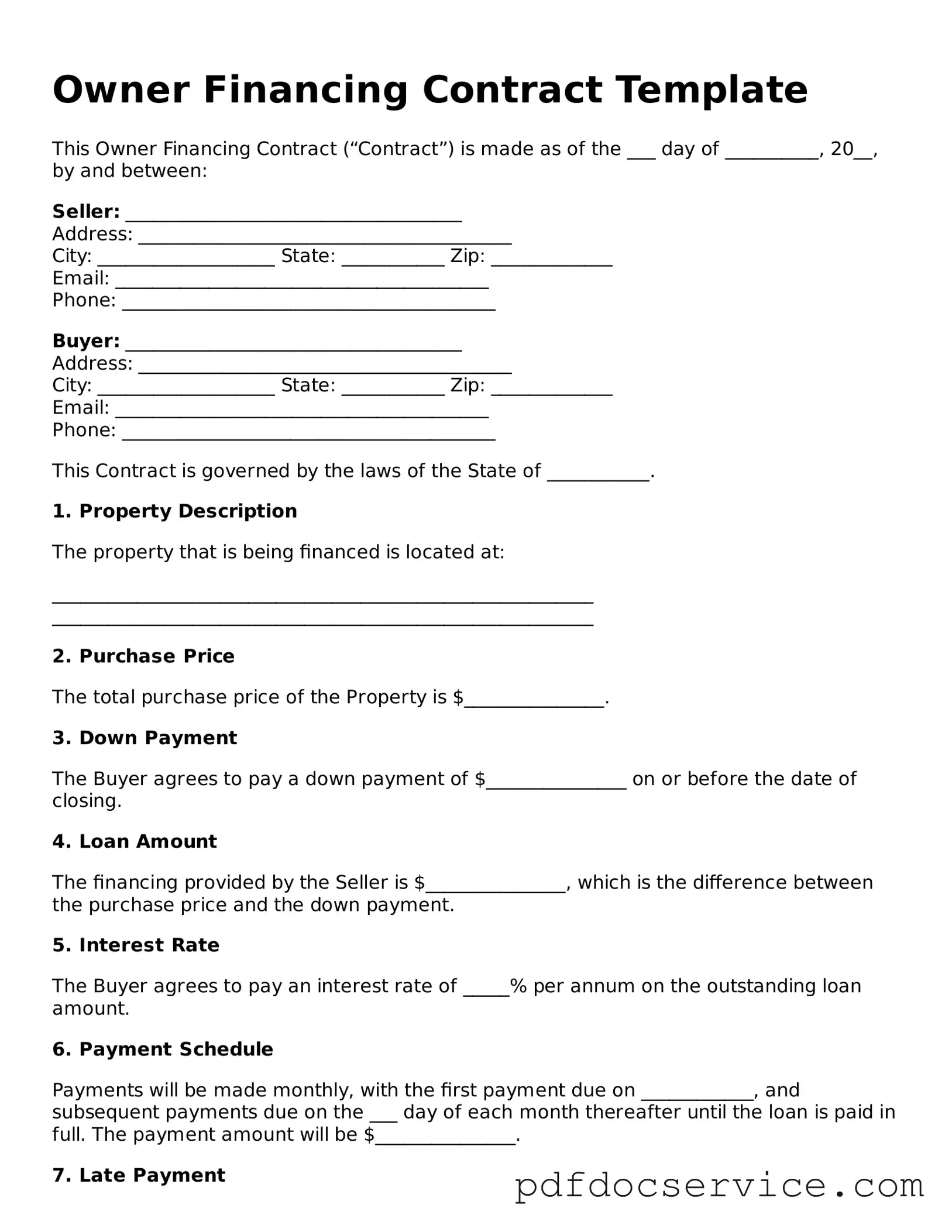

Blank Owner Financing Contract Form

The Owner Financing Contract is a legal agreement that allows a property seller to finance the purchase for the buyer, bypassing traditional mortgage lenders. This arrangement can provide benefits for both parties, including flexibility in payment terms and potential savings on closing costs. Understanding the nuances of this contract is essential for anyone considering owner financing as a viable option in real estate transactions.

Open Owner Financing Contract Editor

Blank Owner Financing Contract Form

Open Owner Financing Contract Editor

Open Owner Financing Contract Editor

or

Get Owner Financing Contract PDF

Finish the form now and be done

Finish Owner Financing Contract online using simple edit, save, and download steps.