Fill Your P 45 It Form

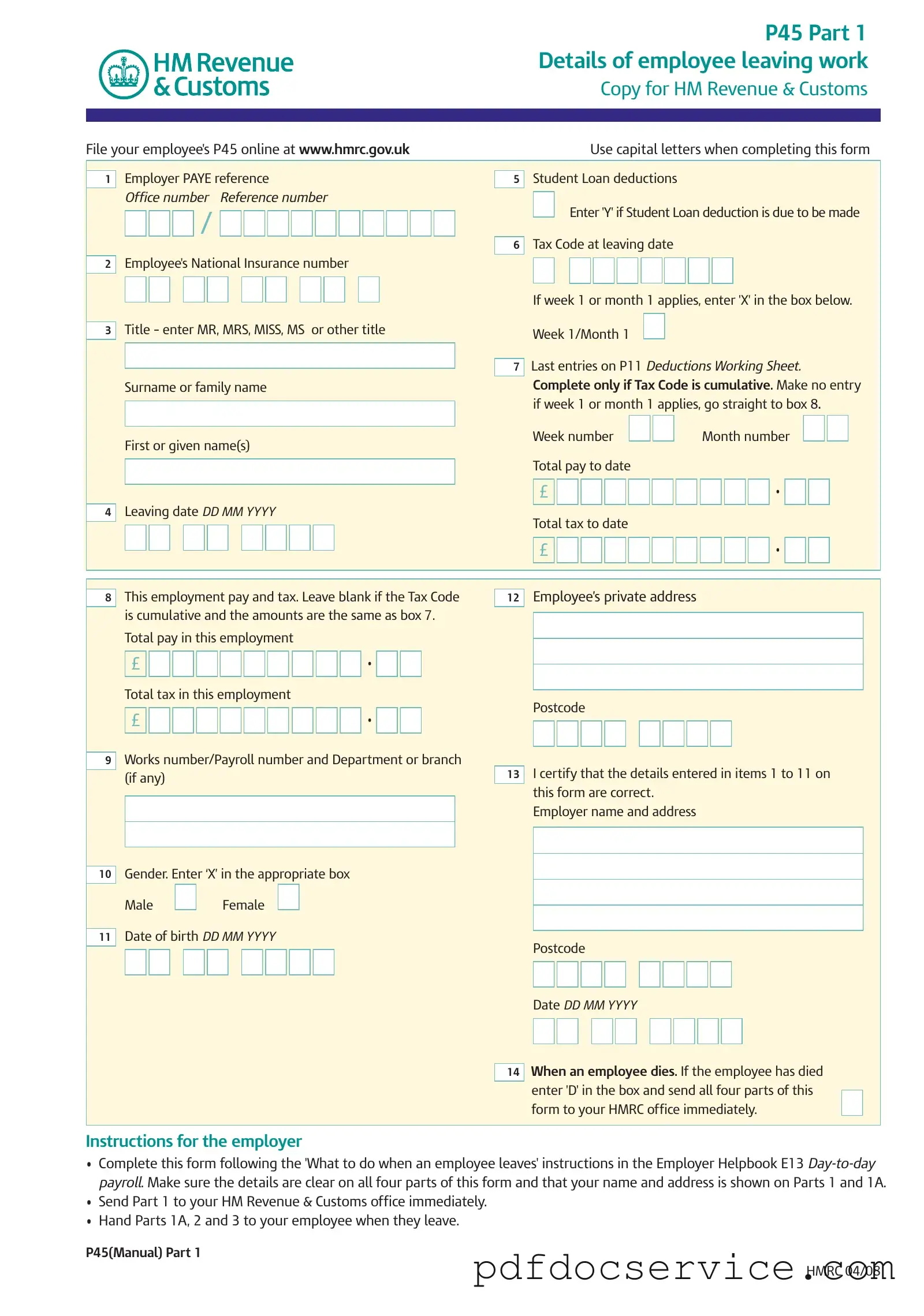

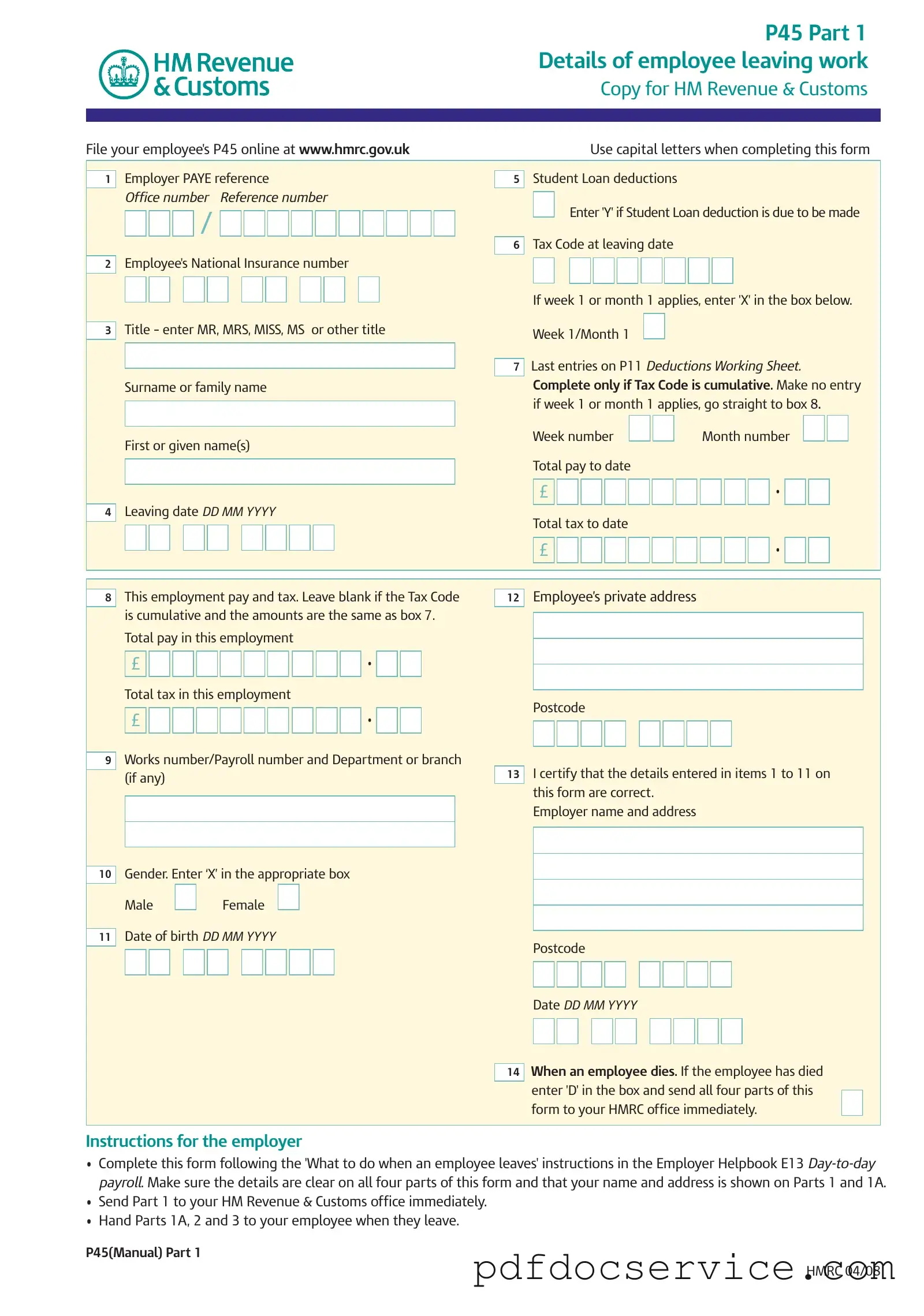

The P45 It form is an important document used in the UK to record details when an employee leaves a job. It helps ensure accurate tax records are maintained and assists in the smooth transition to new employment or benefits. Understanding how to complete and utilize this form is crucial for both employers and employees during this significant change.

Open P 45 It Editor

Fill Your P 45 It Form

Open P 45 It Editor

Open P 45 It Editor

or

Get P 45 It PDF

Finish the form now and be done

Finish P 45 It online using simple edit, save, and download steps.