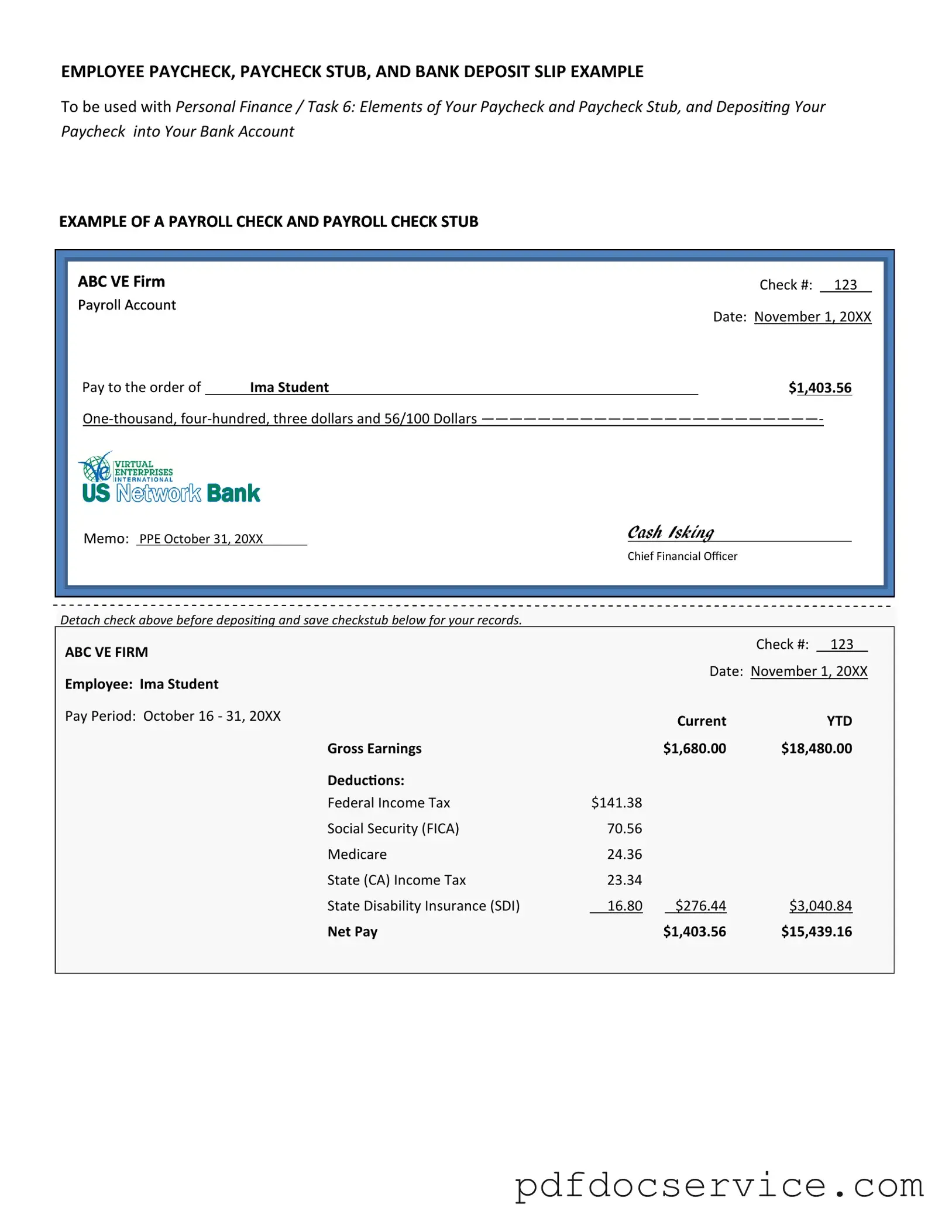

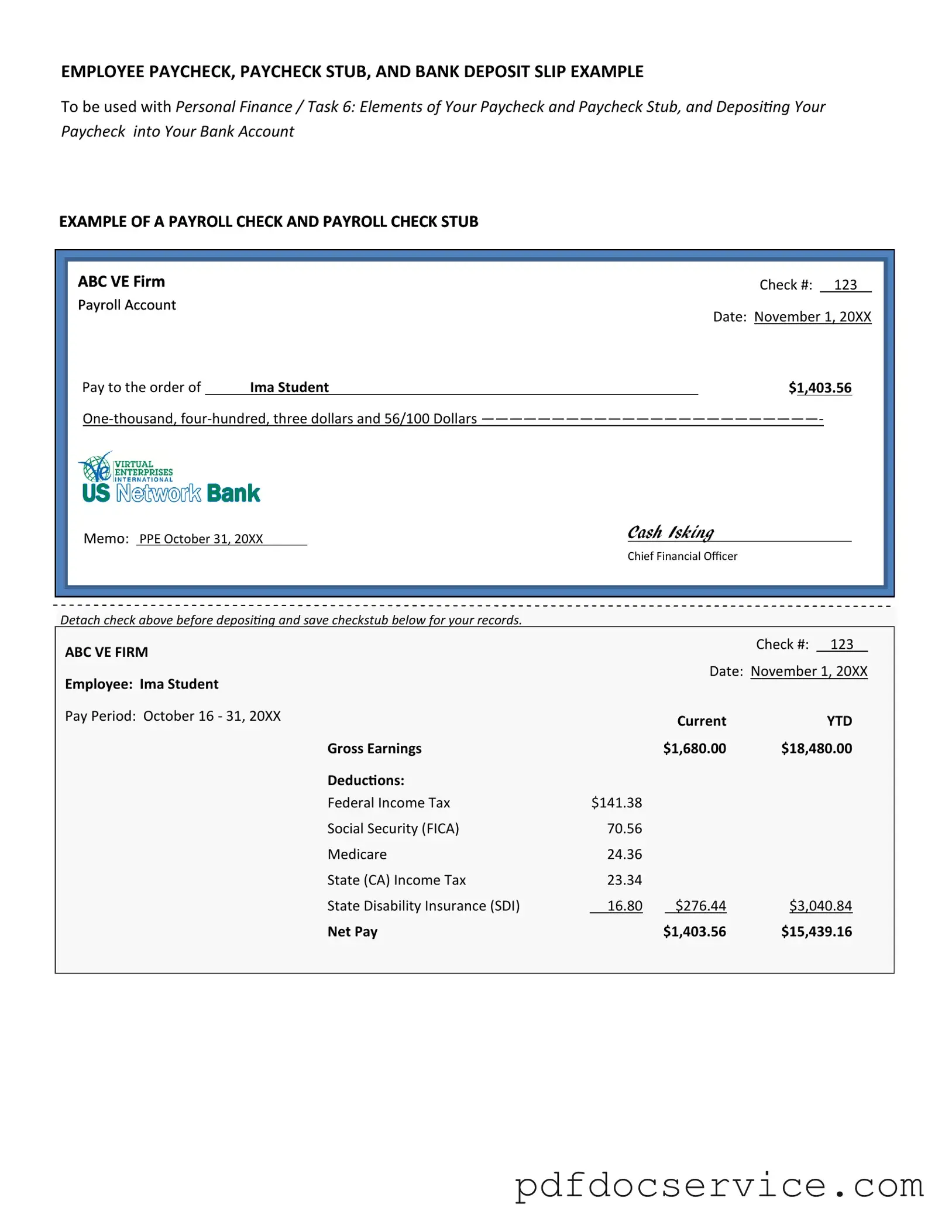

A Payroll Check form is a document used by employers to issue payments to employees for their work. It typically includes details such as the employee's name, pay period, hours worked, and the total amount due. This form ensures that employees receive their wages accurately and on time.

Typically, the Payroll Check form is filled out by the employer or the payroll department. However, employees may need to provide certain information, such as their hours worked or any deductions. This collaboration helps ensure that all information is accurate before payment is issued.

The Payroll Check form generally requires the following information:

-

Employee's name

-

Employee ID or Social Security Number

-

Pay period dates

-

Total hours worked

-

Hourly wage or salary

-

Deductions (if any)

-

Net pay amount

Payroll Check forms should be submitted according to the employer's payroll schedule. This could be weekly, bi-weekly, or monthly. Consistency is crucial to ensure employees receive their payments promptly and to maintain accurate financial records.

If an error is found on the Payroll Check form, it is essential to address it immediately. The employer should correct the mistake and issue a new check if necessary. Employees should always review their paychecks for accuracy and report any discrepancies as soon as possible.

Yes, many employers now allow Payroll Check forms to be submitted electronically. This method can streamline the payroll process and reduce paperwork. However, both employers and employees should ensure that the electronic submission complies with relevant laws and company policies.

Failing to submit a Payroll Check form can lead to delayed payments for employees. This can create financial difficulties for staff and may result in compliance issues for the employer. It is crucial to adhere to submission deadlines to avoid these consequences.

While there is no universal format for the Payroll Check form, it should include all necessary information in a clear and organized manner. Employers may create their own templates or use software designed for payroll processing. Consistency in format helps ensure that all required data is captured effectively.

Payroll Check forms can typically be obtained from the employer’s human resources or payroll department. Additionally, various online resources offer templates that can be customized to meet specific needs. Always ensure that any form used complies with applicable laws and regulations.