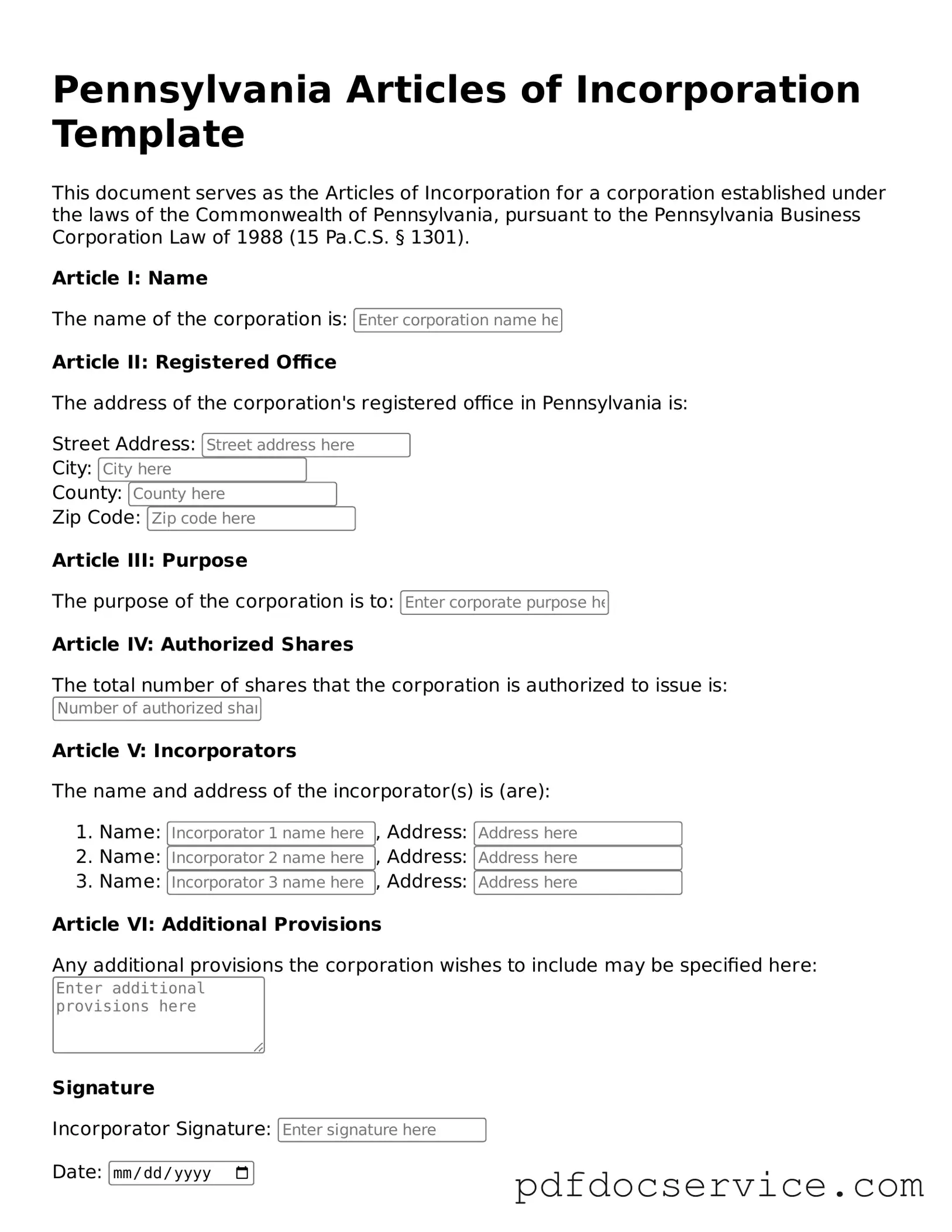

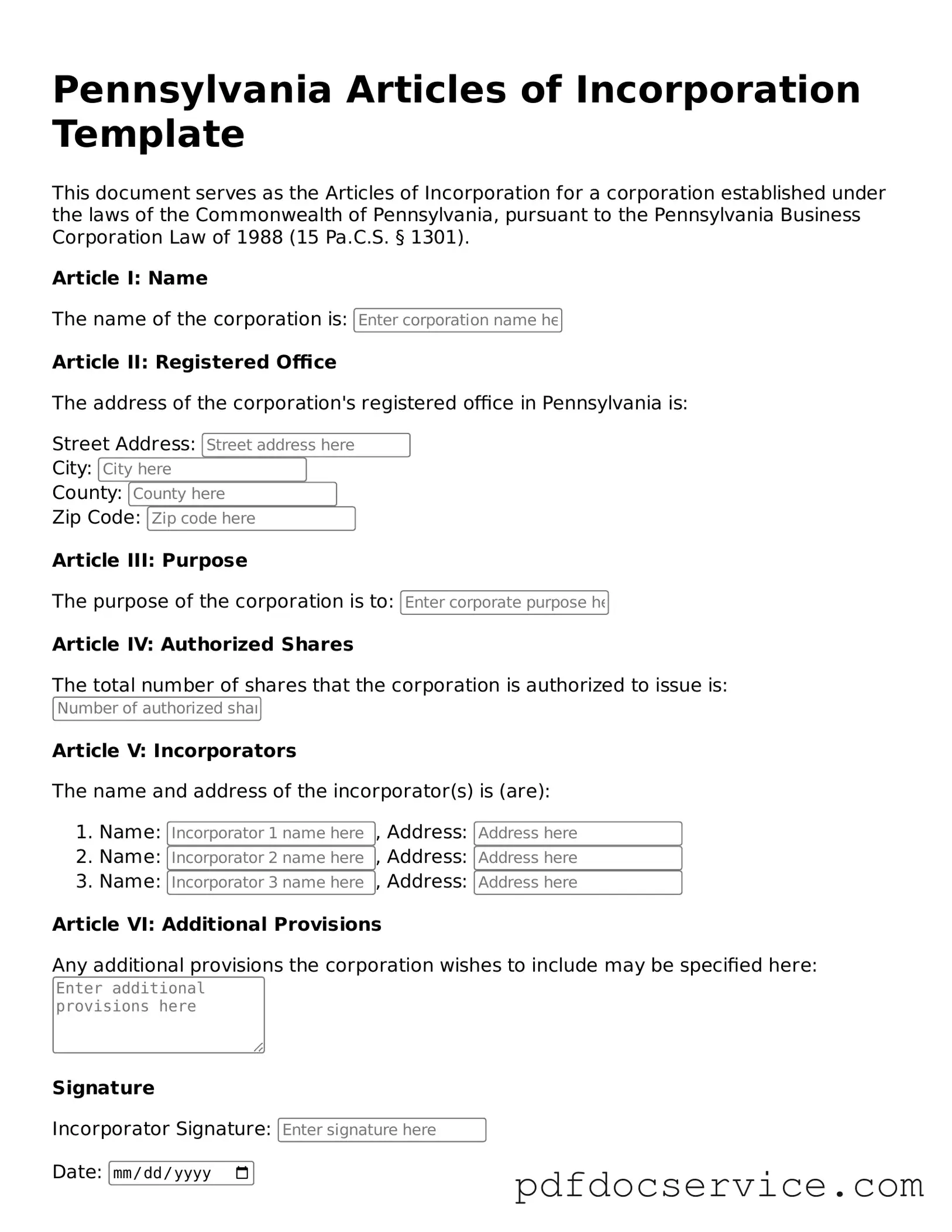

What is the Pennsylvania Articles of Incorporation form?

The Pennsylvania Articles of Incorporation form is a legal document that establishes a corporation in the state of Pennsylvania. This form must be filed with the Pennsylvania Department of State to officially create a corporation. The document outlines essential information about the corporation, including its name, purpose, registered office address, and details about its incorporators.

Who can file the Articles of Incorporation in Pennsylvania?

Any individual or group of individuals can file the Articles of Incorporation in Pennsylvania. There is no requirement for the incorporators to be residents of Pennsylvania. However, it is advisable for at least one incorporator to be familiar with the state's laws and regulations regarding corporations.

What information is required on the Articles of Incorporation form?

The Articles of Incorporation form requires several key pieces of information, including:

-

The name of the corporation, which must be unique and not already in use.

-

The purpose of the corporation, which can be general or specific.

-

The registered office address in Pennsylvania.

-

The names and addresses of the incorporators.

-

The number of shares the corporation is authorized to issue, if applicable.

How much does it cost to file the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Pennsylvania varies depending on the type of corporation being formed. As of October 2023, the fee for a standard corporation is $125. Additional fees may apply for expedited processing or for specific types of corporations, such as nonprofit organizations.

How long does it take to process the Articles of Incorporation?

The processing time for the Articles of Incorporation can vary. Typically, it takes about 7 to 10 business days for the Pennsylvania Department of State to process standard filings. Expedited services are available for an additional fee, which can significantly reduce the processing time.

What happens after the Articles of Incorporation are filed?

Once the Articles of Incorporation are filed and approved, the corporation is officially formed. The Department of State will issue a Certificate of Incorporation, which serves as proof of the corporation's existence. The corporation can then begin conducting business, opening bank accounts, and entering into contracts under its corporate name.

Are there ongoing requirements after filing the Articles of Incorporation?

Yes, corporations in Pennsylvania have ongoing requirements after filing the Articles of Incorporation. These include:

-

Filing an annual report with the Department of State.

-

Paying any applicable franchise taxes.

-

Maintaining a registered office and registered agent in Pennsylvania.

-

Holding regular meetings of shareholders and directors.

Can the Articles of Incorporation be amended?

Yes, the Articles of Incorporation can be amended. If there are changes to the corporation's name, purpose, or other key information, an amendment must be filed with the Pennsylvania Department of State. This process typically involves submitting a specific form along with the required fee.

Where can I obtain the Articles of Incorporation form?

The Articles of Incorporation form can be obtained online from the Pennsylvania Department of State's website. It is available as a downloadable PDF, which can be filled out and submitted either by mail or electronically, depending on the filing options available.