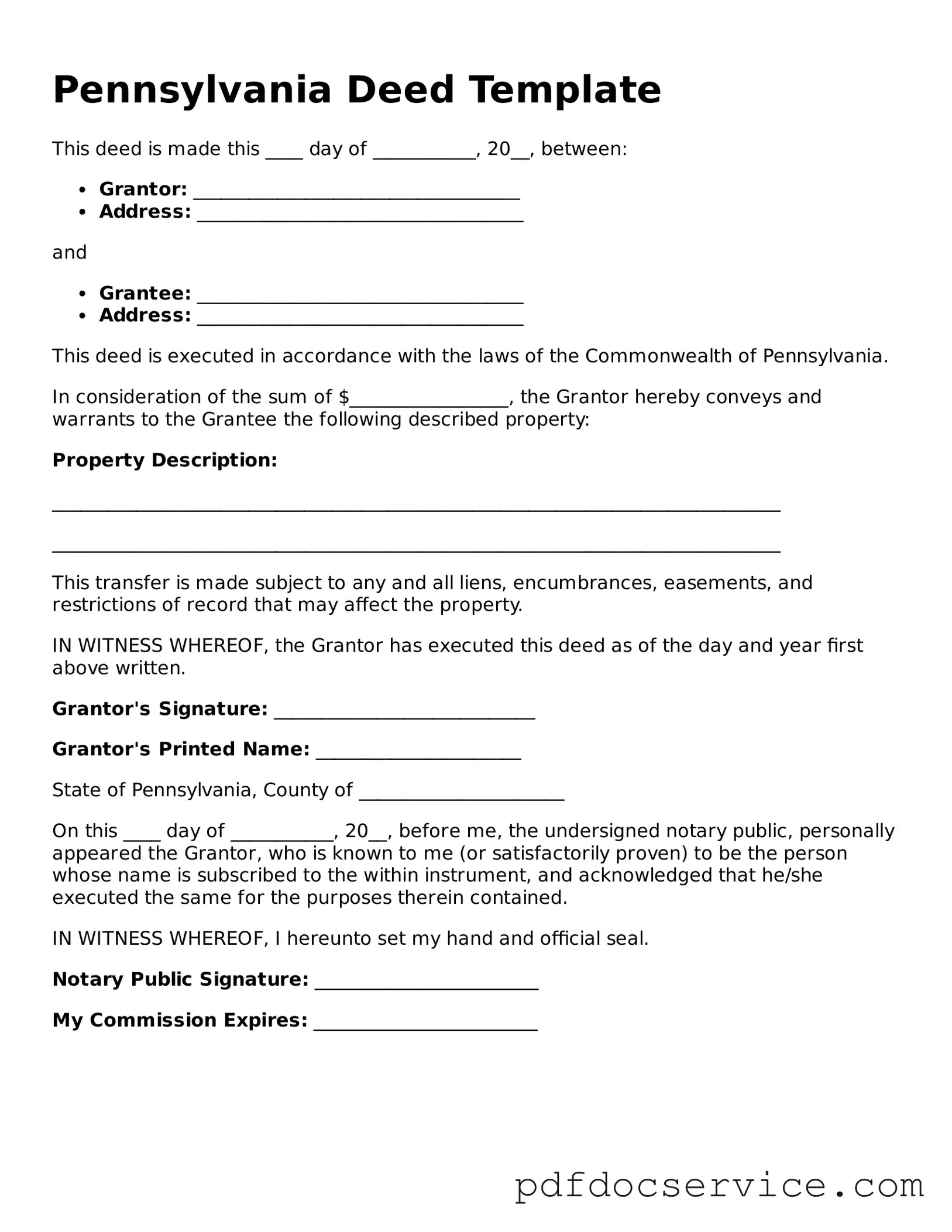

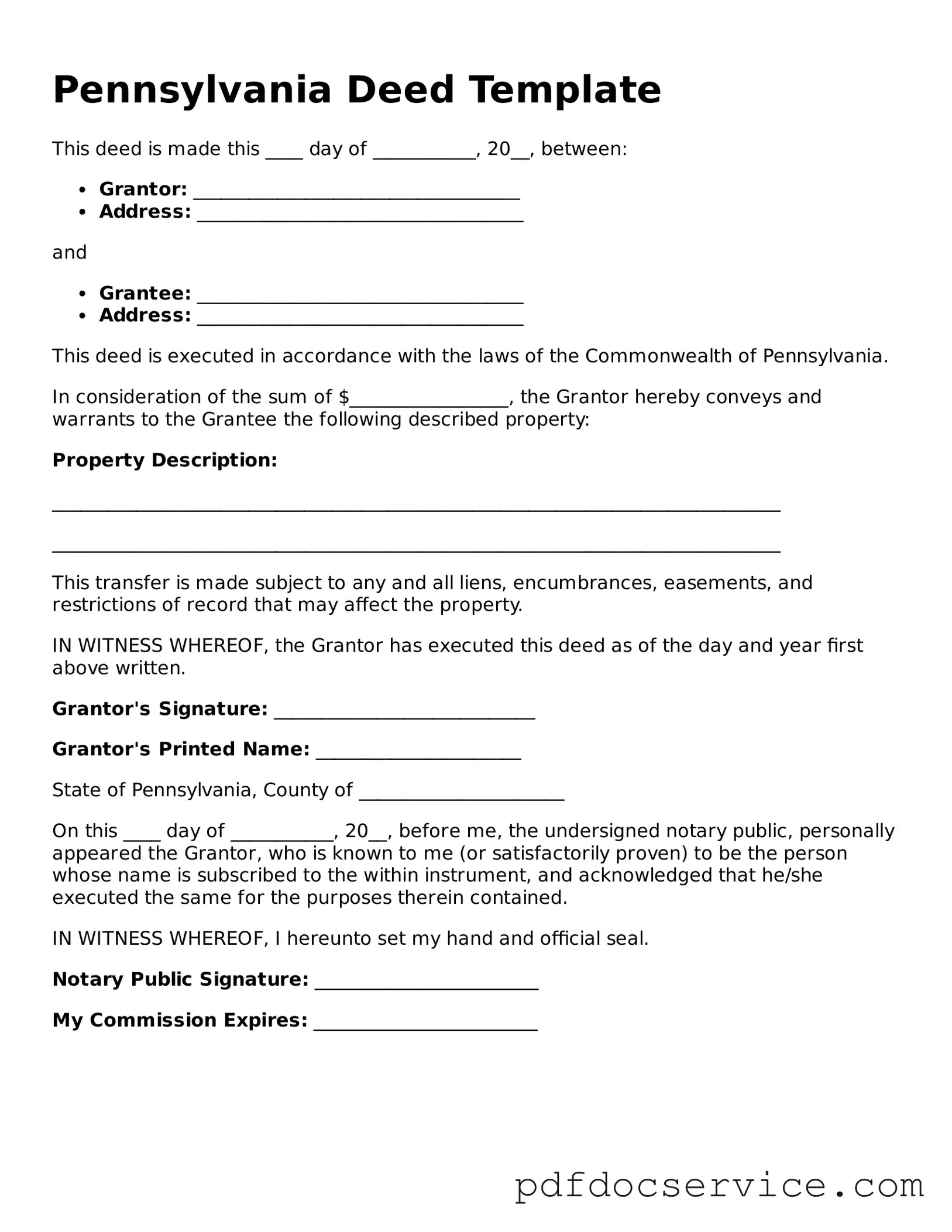

Printable Deed Template for Pennsylvania

A Pennsylvania Deed form is a legal document used to transfer ownership of real estate from one party to another. This form outlines essential details, such as the names of the parties involved, a description of the property, and any conditions of the transfer. Understanding this form is crucial for anyone looking to buy or sell property in Pennsylvania.

Open Deed Editor

Printable Deed Template for Pennsylvania

Open Deed Editor

Open Deed Editor

or

Get Deed PDF

Finish the form now and be done

Finish Deed online using simple edit, save, and download steps.