What is a Durable Power of Attorney in Pennsylvania?

A Durable Power of Attorney is a legal document that allows one person, known as the principal, to appoint another person, called the agent, to make decisions on their behalf. This document remains effective even if the principal becomes incapacitated. It is a way to ensure that someone you trust can manage your financial and legal matters when you are unable to do so yourself.

Why should I consider creating a Durable Power of Attorney?

Creating a Durable Power of Attorney can provide peace of mind. It allows you to choose someone you trust to handle your affairs if you become unable to do so. This can include managing your bank accounts, paying bills, or making healthcare decisions. It helps avoid potential confusion and disputes among family members during difficult times.

Who can be appointed as an agent?

In Pennsylvania, you can appoint anyone as your agent, as long as they are at least 18 years old and mentally competent. Common choices include family members, close friends, or trusted advisors. It’s essential to choose someone who understands your values and wishes, as they will be making significant decisions on your behalf.

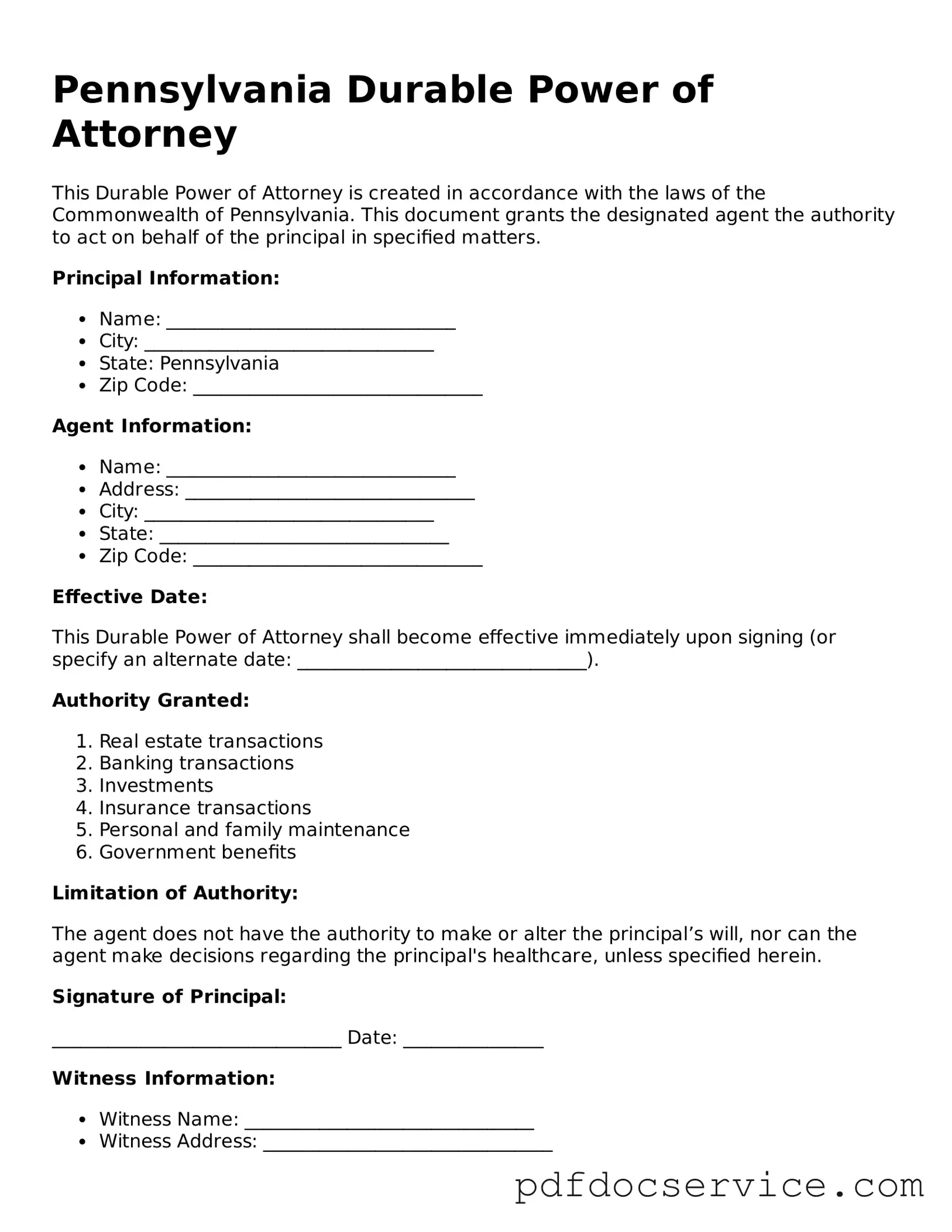

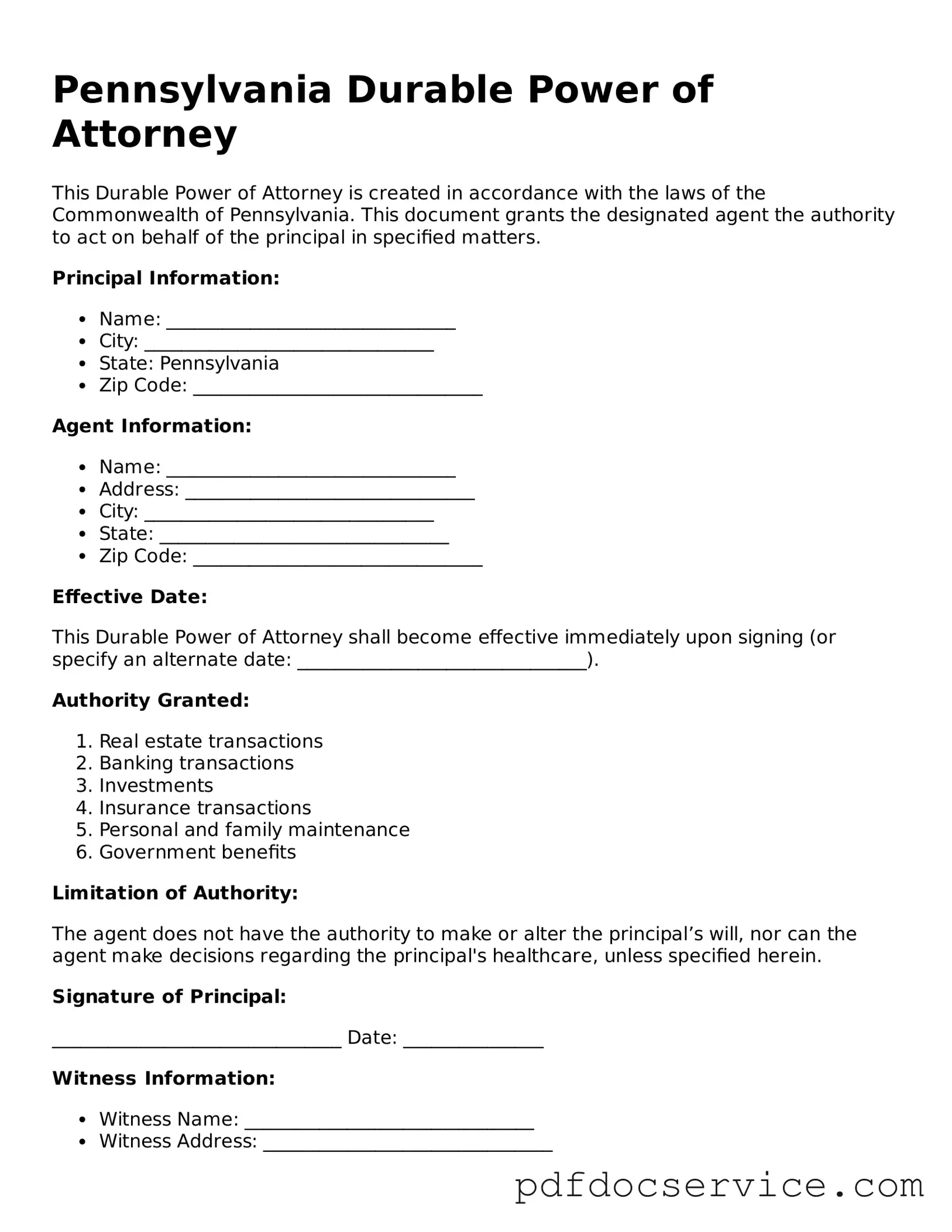

How do I create a Durable Power of Attorney in Pennsylvania?

To create a Durable Power of Attorney in Pennsylvania, follow these steps:

-

Choose your agent carefully.

-

Obtain the Durable Power of Attorney form, which can be found online or through legal resources.

-

Fill out the form, specifying the powers you want to grant your agent.

-

Sign the document in the presence of a notary public.

Once completed, keep the document in a safe place and provide copies to your agent and any relevant institutions.

Can I change or revoke my Durable Power of Attorney?

Yes, you can change or revoke your Durable Power of Attorney at any time, as long as you are mentally competent. To revoke it, you can create a new document that explicitly states the revocation or simply destroy the old document. Inform your agent and any institutions that had a copy of the original document about the change.

What powers can I grant to my agent?

You have the flexibility to grant a wide range of powers to your agent. Common powers include:

-

Managing bank accounts and investments

-

Paying bills

-

Filing taxes

-

Buying or selling property

-

Making healthcare decisions

Be specific about what powers you want to grant to ensure your agent acts in accordance with your wishes.

Does my Durable Power of Attorney need to be notarized?

Yes, in Pennsylvania, your Durable Power of Attorney must be signed in front of a notary public to be legally valid. This step helps confirm your identity and ensures that you are signing the document voluntarily.

What happens if I don’t have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, the court may need to appoint a guardian to manage your affairs. This process can be lengthy, costly, and may not reflect your wishes. Having a Durable Power of Attorney in place can help avoid this situation and ensure that your preferences are honored.

Is a Durable Power of Attorney the same as a healthcare proxy?

No, a Durable Power of Attorney primarily focuses on financial and legal matters. A healthcare proxy, on the other hand, specifically allows someone to make medical decisions for you if you cannot. In Pennsylvania, you can create both documents to ensure comprehensive coverage for your needs.