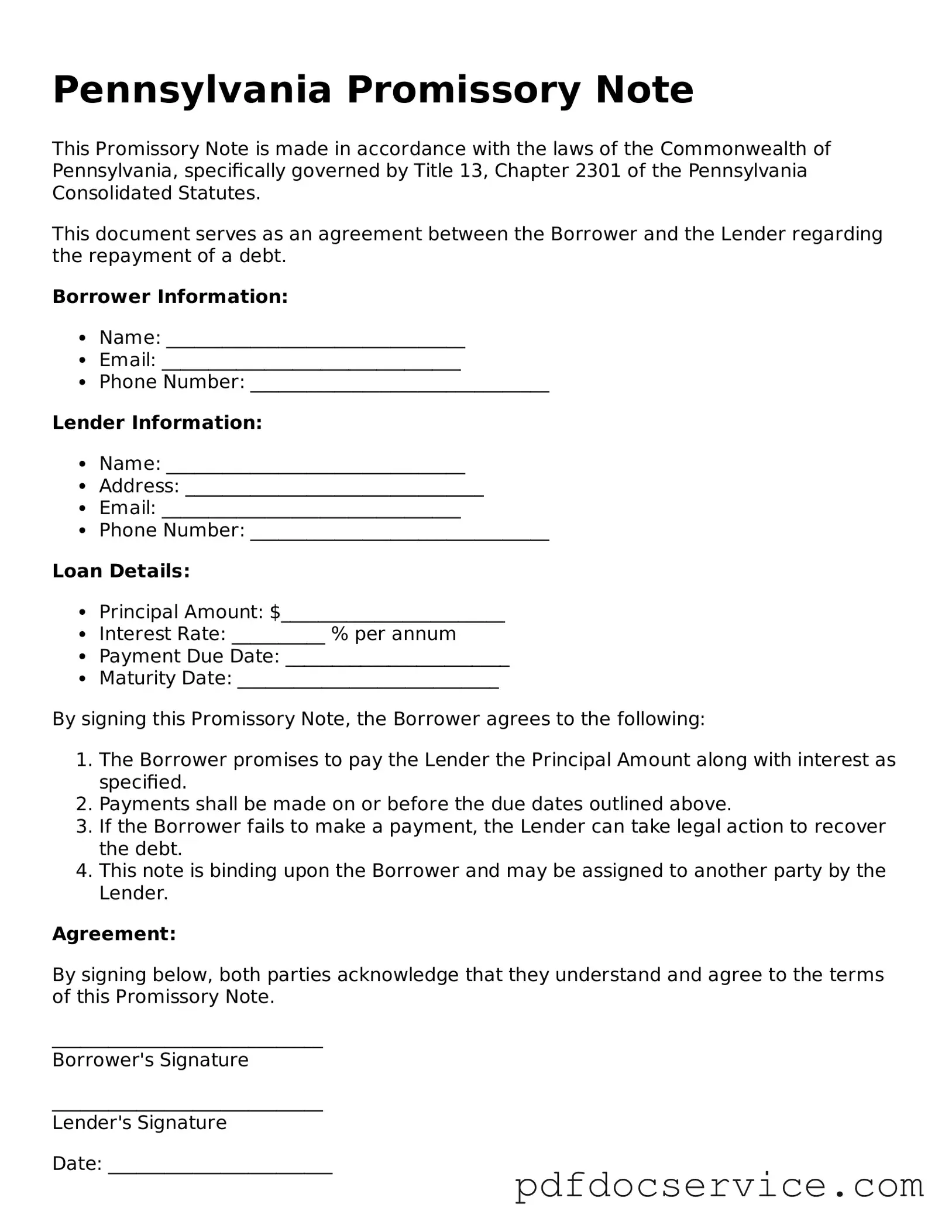

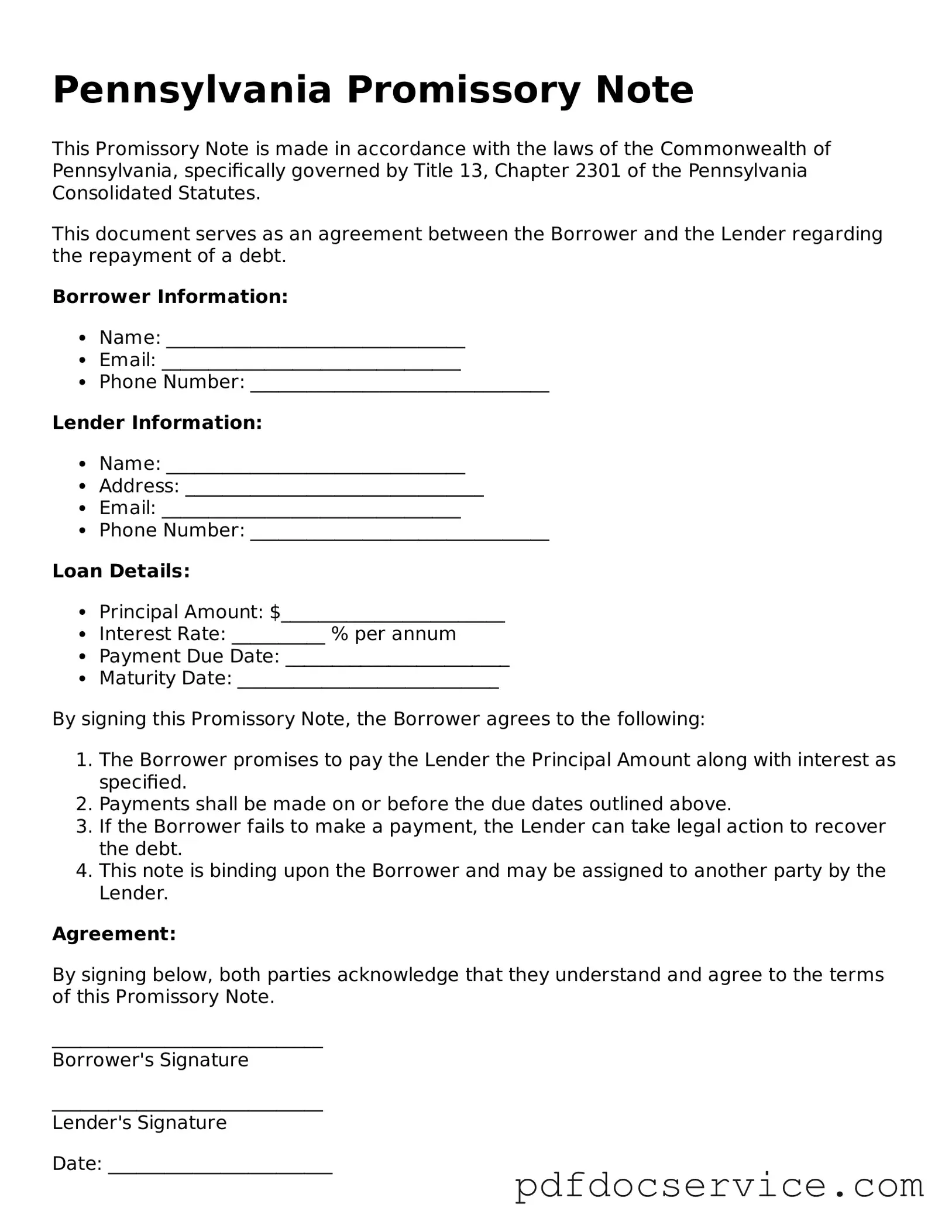

Printable Promissory Note Template for Pennsylvania

A Pennsylvania Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This form serves as a written record of the debt and establishes the rights and obligations of both parties involved. Understanding its components is essential for anyone engaging in a loan agreement in Pennsylvania.

Open Promissory Note Editor

Printable Promissory Note Template for Pennsylvania

Open Promissory Note Editor

Open Promissory Note Editor

or

Get Promissory Note PDF

Finish the form now and be done

Finish Promissory Note online using simple edit, save, and download steps.