What is a Pennsylvania Real Estate Purchase Agreement?

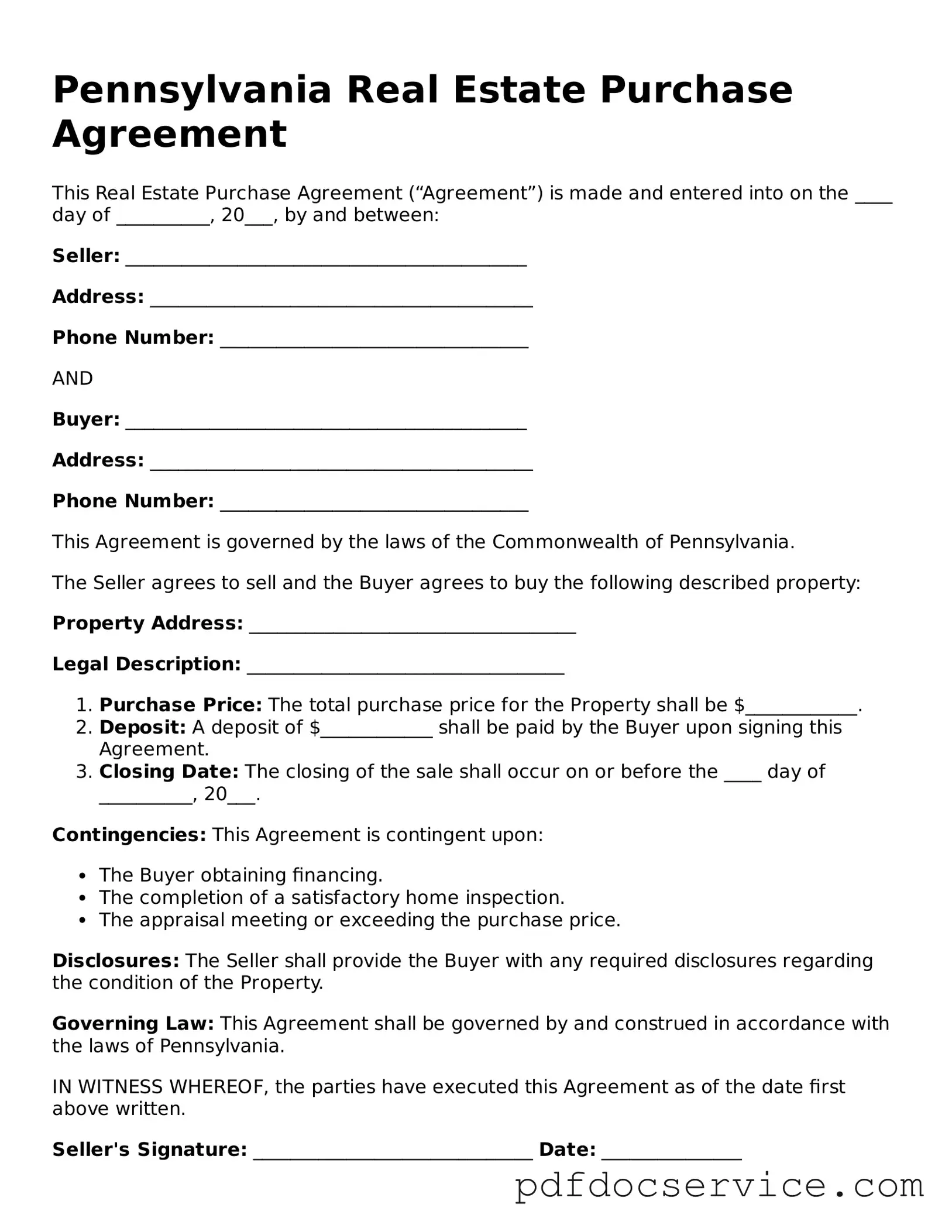

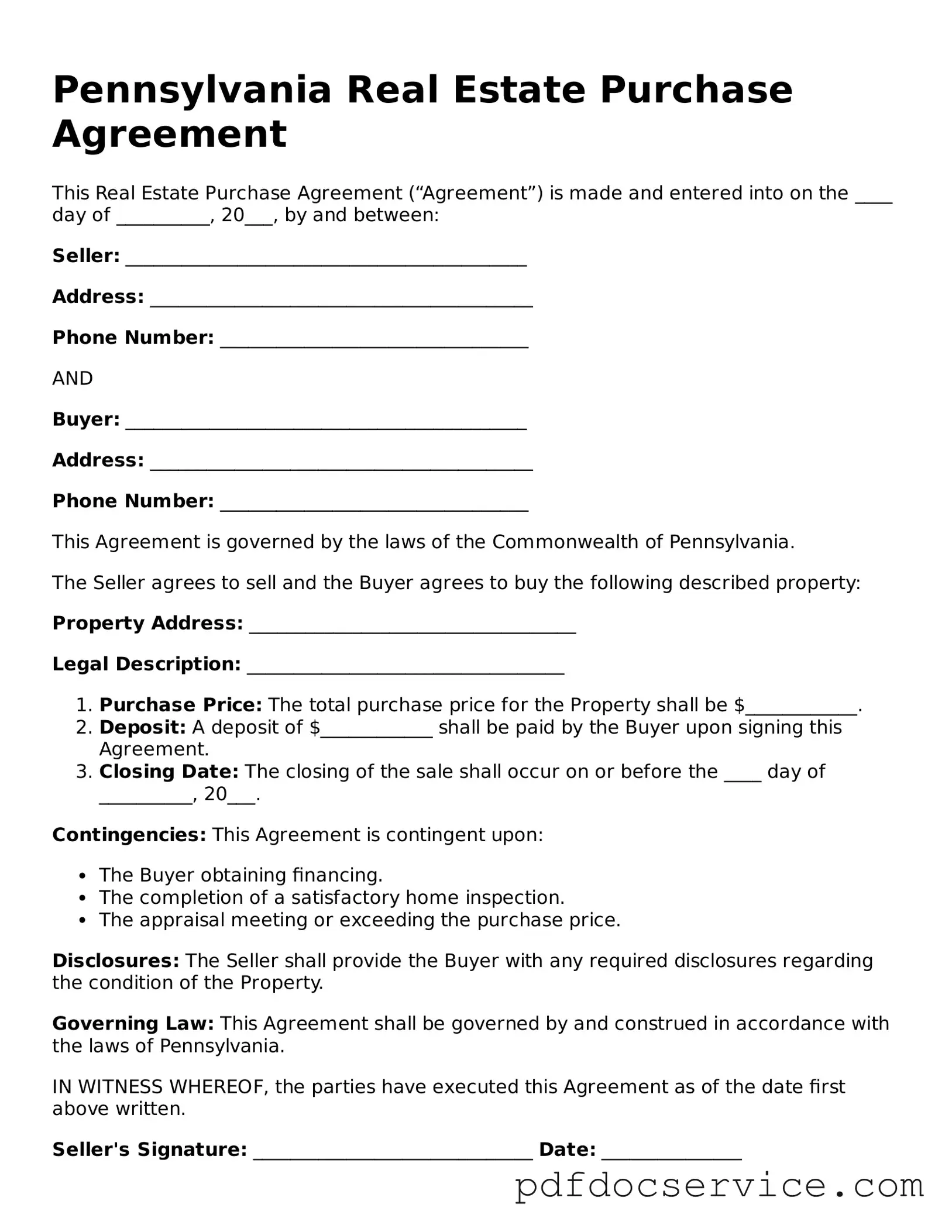

The Pennsylvania Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions under which a buyer agrees to purchase property from a seller. This agreement serves as a roadmap for the transaction, detailing aspects such as the purchase price, financing terms, and contingencies that must be satisfied before the sale can be completed.

What key components should I expect in this agreement?

A typical Pennsylvania Real Estate Purchase Agreement includes several essential components, such as:

-

Purchase Price:

The total amount the buyer agrees to pay for the property.

-

Earnest Money:

A deposit made by the buyer to demonstrate serious intent to purchase.

-

Closing Date:

The date when the transaction will be finalized and ownership transferred.

-

Contingencies:

Conditions that must be met for the agreement to remain valid, such as home inspections or financing approval.

-

Property Description:

A detailed description of the property being sold, including its address and any included fixtures.

Why is it important to have an attorney review the agreement?

Having an attorney review the Pennsylvania Real Estate Purchase Agreement can provide peace of mind. An attorney can help identify any potential issues or concerns that may arise during the transaction. They can also ensure that your rights are protected and that the terms are fair and reasonable. This is especially important for first-time buyers or sellers who may not be familiar with real estate transactions.

What happens if a buyer wants to back out after signing?

If a buyer wishes to back out of the agreement after signing, the consequences depend on the specific terms laid out in the contract. If the buyer has contingencies in place—such as failing a home inspection or not securing financing—they may be able to withdraw without penalty. However, if no contingencies exist, the seller may retain the earnest money deposit or pursue legal action for breach of contract. Therefore, understanding the terms of the agreement is crucial.

Are there any disclosures required in Pennsylvania?

Yes, Pennsylvania law requires sellers to provide certain disclosures to buyers. This includes a Property Disclosure Statement, which outlines known defects or issues with the property. Sellers must disclose information about the condition of the property, including any past repairs, pest infestations, or environmental hazards. Transparency helps buyers make informed decisions and fosters trust in the transaction.

Can the agreement be modified after it is signed?

Yes, modifications to the Pennsylvania Real Estate Purchase Agreement can be made after it is signed, but both parties must agree to the changes. This typically involves drafting an addendum that outlines the specific modifications. Both the buyer and seller should sign this addendum to ensure that it is legally binding. Clear communication is essential to avoid misunderstandings during this process.

What are common pitfalls to avoid when using this agreement?

When navigating the Pennsylvania Real Estate Purchase Agreement, several common pitfalls can be avoided:

-

Not reading the fine print:

Always read the entire agreement carefully, including any contingencies and clauses.

-

Neglecting to include contingencies:

Without appropriate contingencies, you may be at risk of losing your earnest money.

-

Failing to conduct due diligence:

Research the property thoroughly, including inspections and neighborhood assessments.

-

Ignoring deadlines:

Pay attention to timelines for contingencies and closing dates to avoid complications.