What is a Transfer-on-Death Deed in Pennsylvania?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows property owners in Pennsylvania to designate a beneficiary who will receive the property upon the owner’s death. This deed enables the transfer of property without going through the probate process, which can save time and reduce costs for the beneficiaries. The property owner retains full control over the property during their lifetime, including the right to sell or mortgage it.

How do I create a Transfer-on-Death Deed?

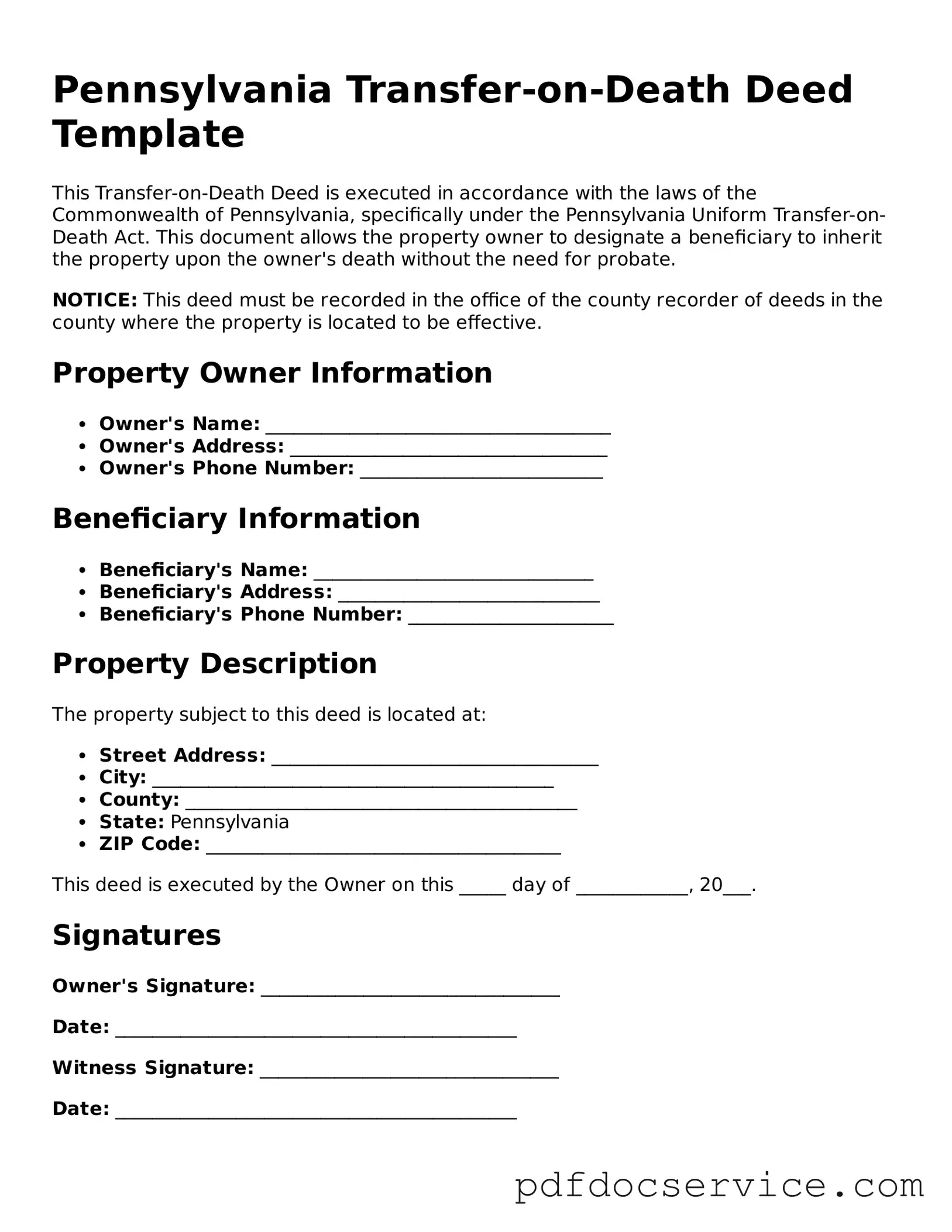

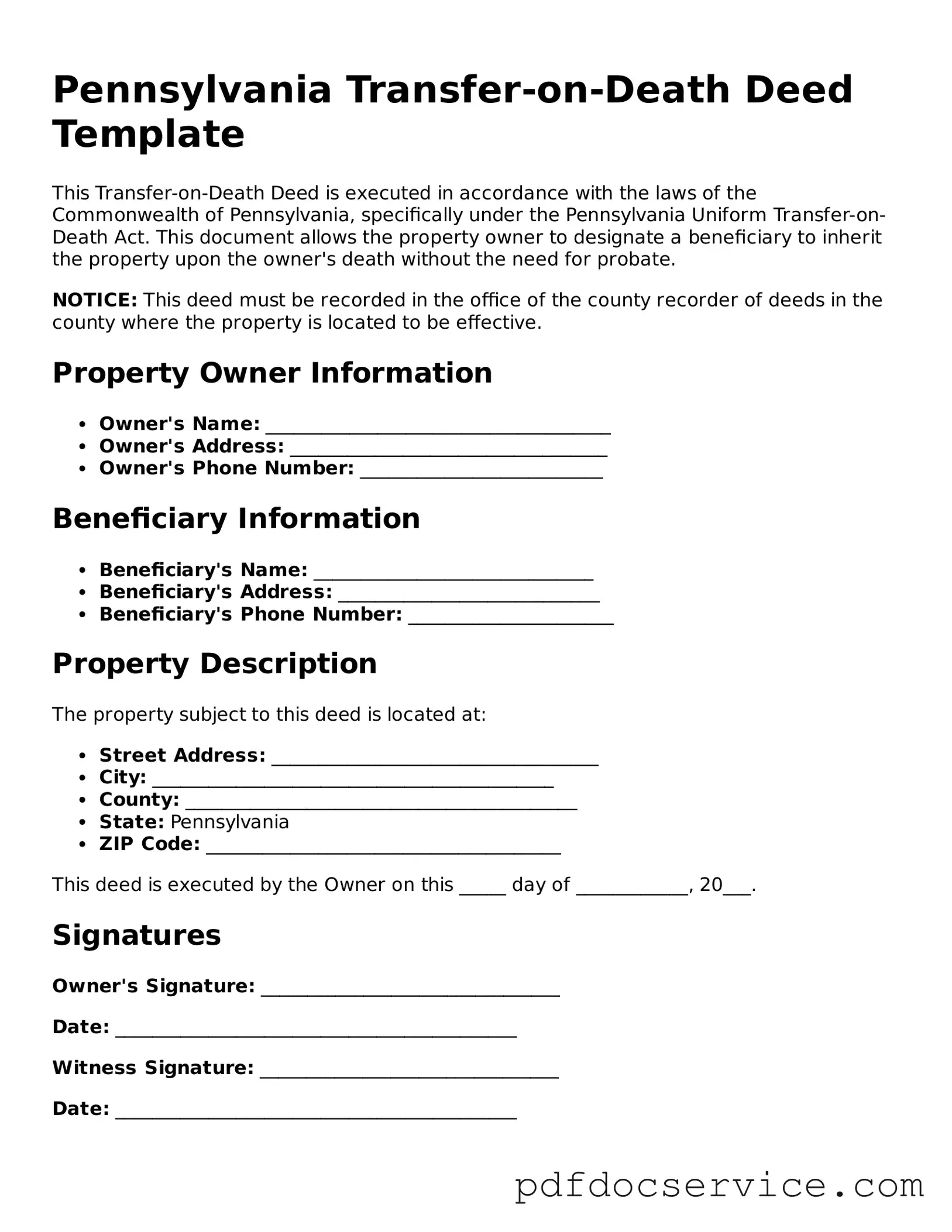

To create a Transfer-on-Death Deed in Pennsylvania, follow these steps:

-

Obtain the official form for the TOD Deed, which is available through the Pennsylvania Department of State or local county office.

-

Fill out the form with accurate information, including your name, the property description, and the name of the beneficiary.

-

Sign the deed in front of a notary public to ensure it is legally valid.

-

Record the signed deed with the county recorder of deeds in the county where the property is located. This step is crucial to make the deed effective.

Make sure to keep a copy of the recorded deed for your records.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time during your lifetime. To do this, you must execute a new TOD Deed that either names a different beneficiary or explicitly states that the previous deed is revoked. It is important to record the new deed with the county recorder of deeds to ensure that your changes are legally recognized. If you choose to revoke the deed, it’s advisable to inform the previous beneficiary of the change.

What happens if the beneficiary dies before me?

If the designated beneficiary passes away before you, the property will not automatically transfer to them. Instead, the property will become part of your estate and will be distributed according to your will or Pennsylvania intestacy laws if you do not have a will. To avoid complications, consider naming an alternate beneficiary in your TOD Deed. This ensures that there is a clear plan for the transfer of property, even if the primary beneficiary is no longer available.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when creating a Transfer-on-Death Deed. The property remains part of your estate until your death, meaning you will continue to be responsible for property taxes and any other obligations. However, once the property transfers to the beneficiary, they may be subject to inheritance tax. Pennsylvania has specific inheritance tax rates based on the relationship of the beneficiary to the deceased. It is wise to consult with a tax professional to understand any potential tax liabilities and plan accordingly.