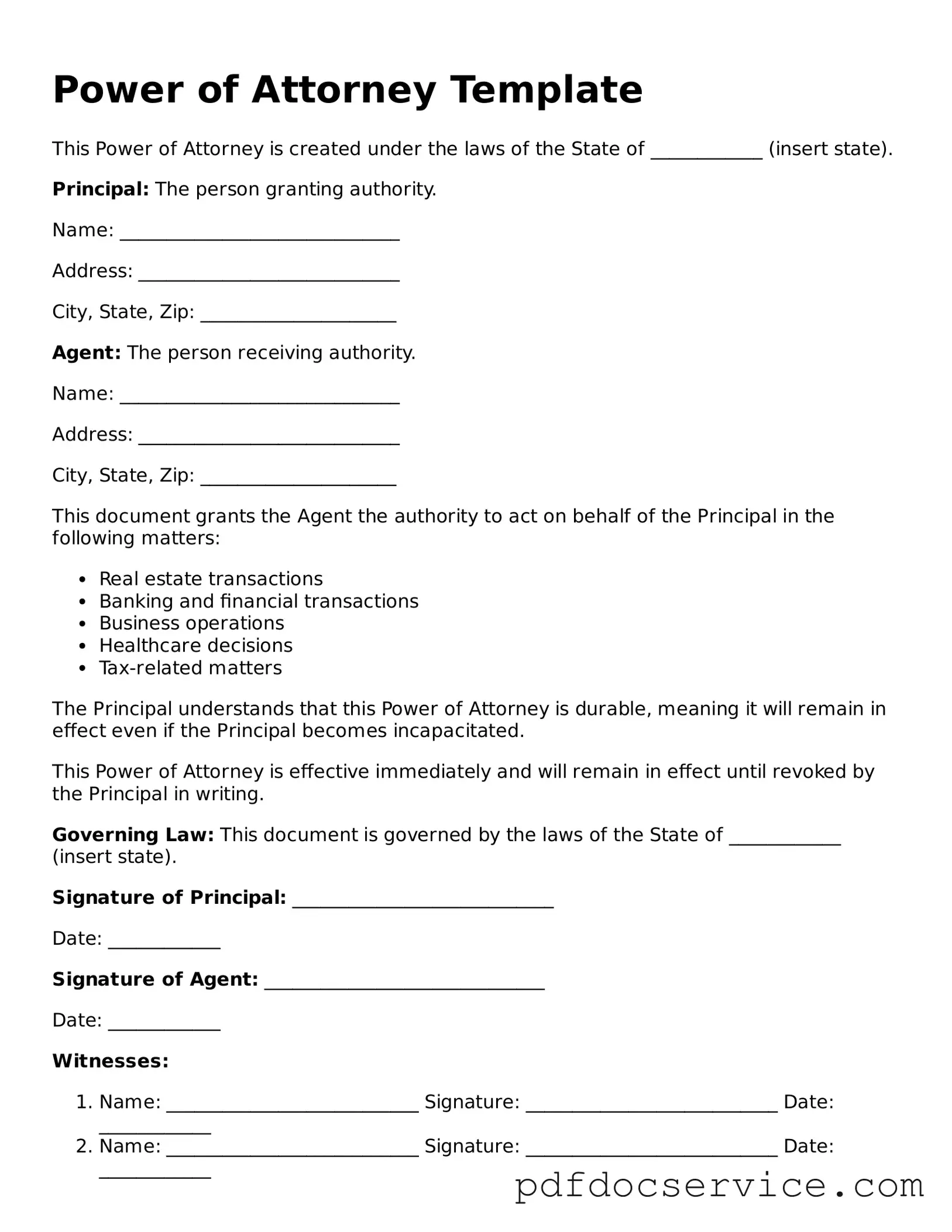

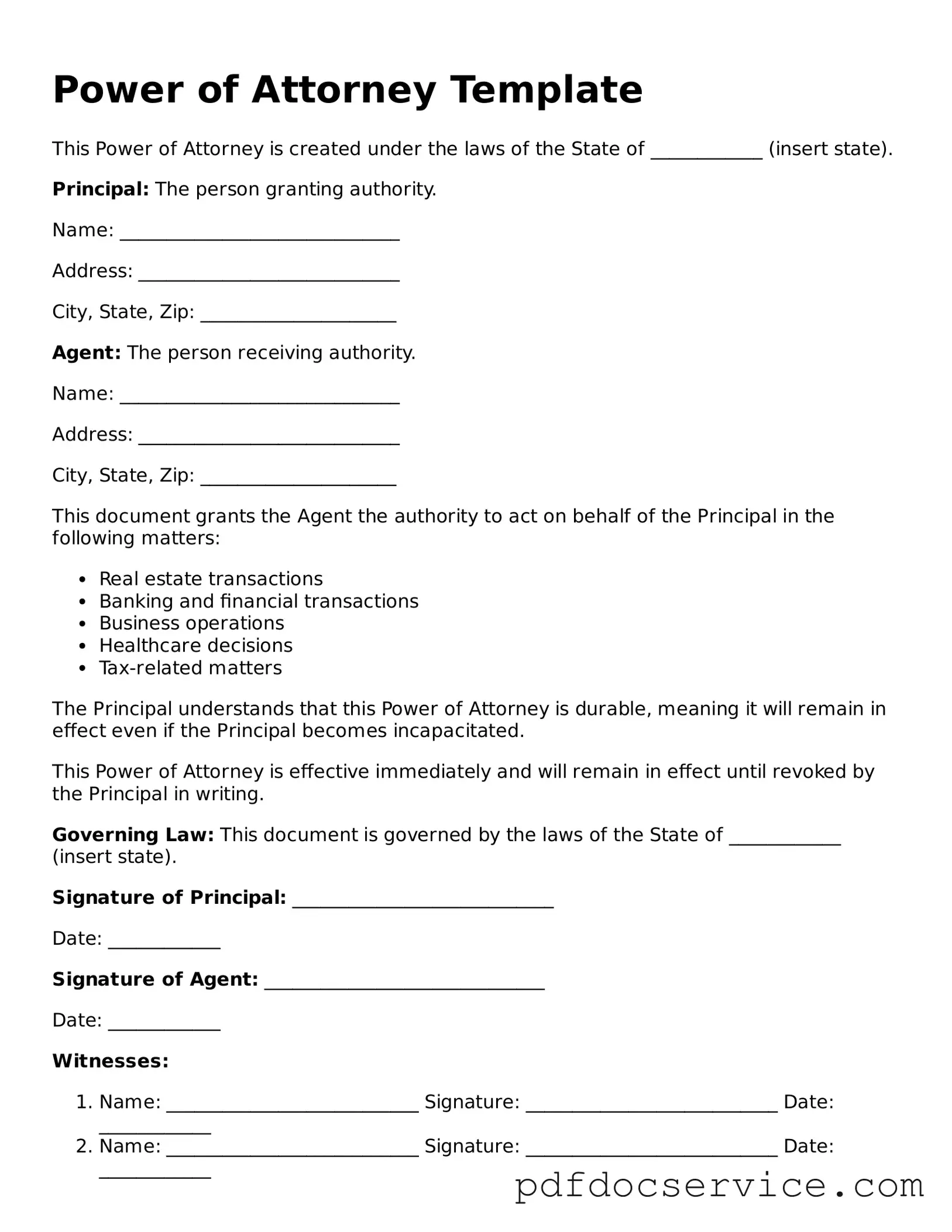

Blank Power of Attorney Form

A Power of Attorney form is a legal document that allows one person to grant another person the authority to act on their behalf in legal or financial matters. This form can be tailored to specific needs, whether for a limited time or for a particular purpose. Understanding its implications is essential for anyone considering this important decision.

Open Power of Attorney Editor

Blank Power of Attorney Form

Open Power of Attorney Editor

Open Power of Attorney Editor

or

Get Power of Attorney PDF

Finish the form now and be done

Finish Power of Attorney online using simple edit, save, and download steps.