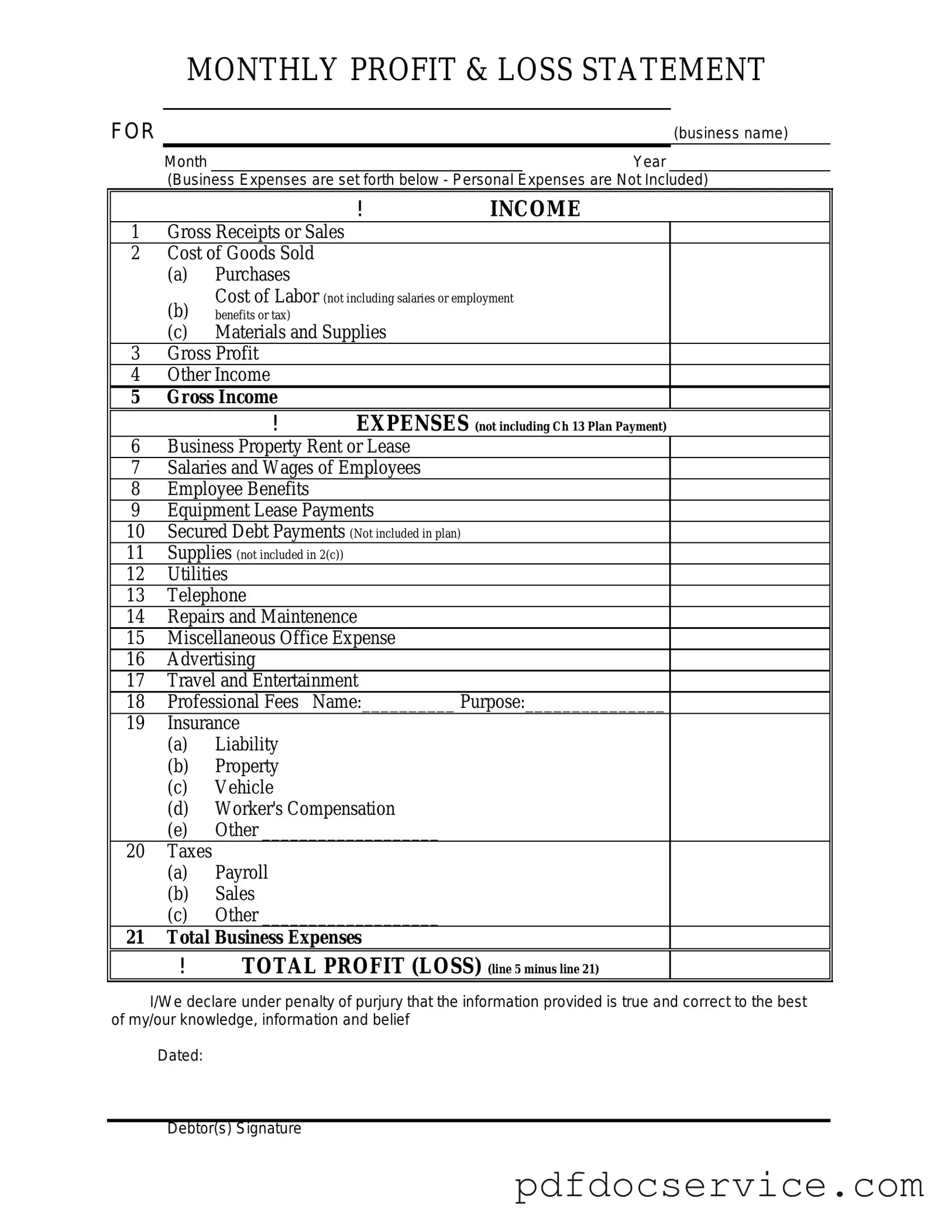

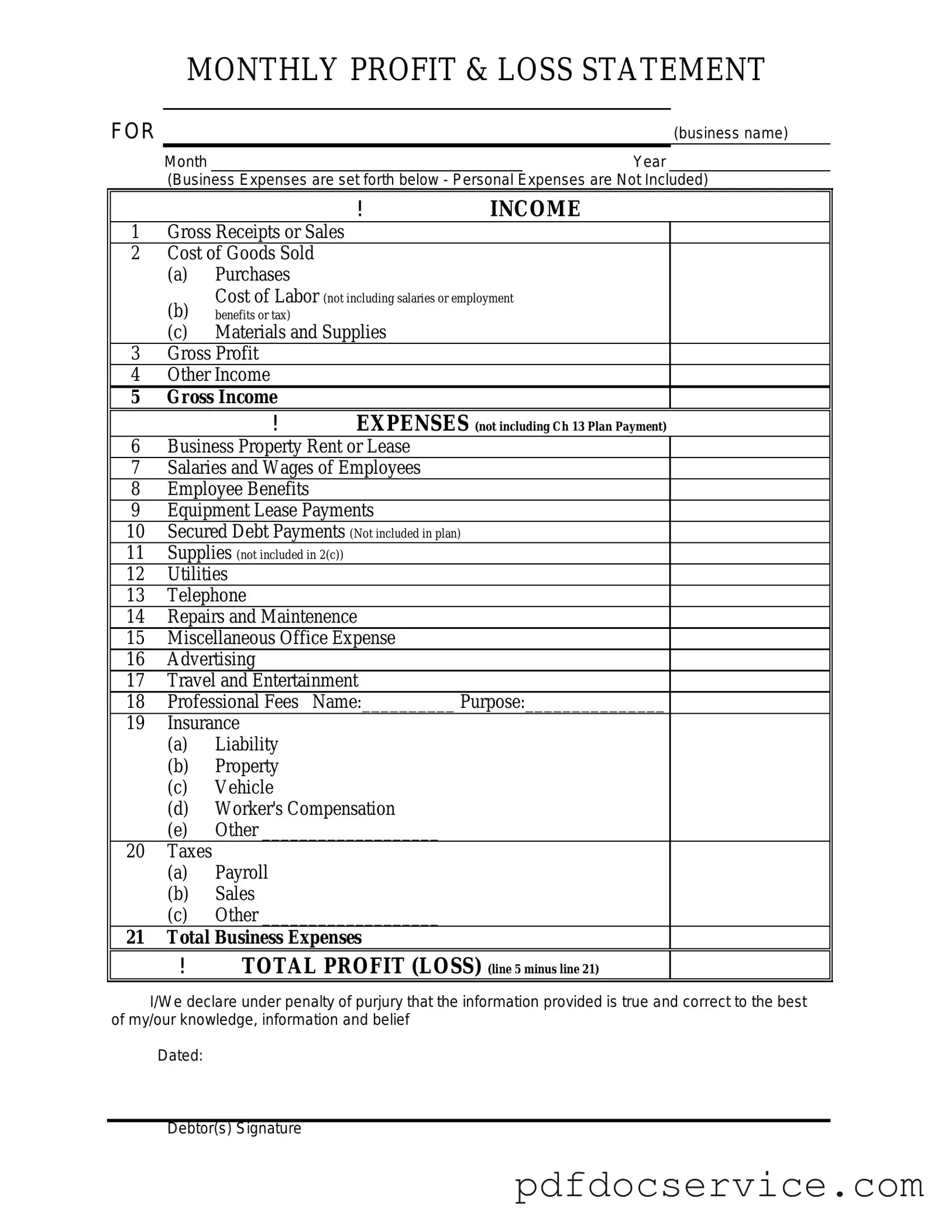

Fill Your Profit And Loss Form

The Profit and Loss form, often referred to as an income statement, summarizes a business's revenues and expenses over a specific period. This essential financial document provides insights into the company's profitability and operational efficiency. Understanding its components can help business owners make informed financial decisions.

Open Profit And Loss Editor

Fill Your Profit And Loss Form

Open Profit And Loss Editor

Open Profit And Loss Editor

or

Get Profit And Loss PDF

Finish the form now and be done

Finish Profit And Loss online using simple edit, save, and download steps.