What is a Promissory Note for a Car?

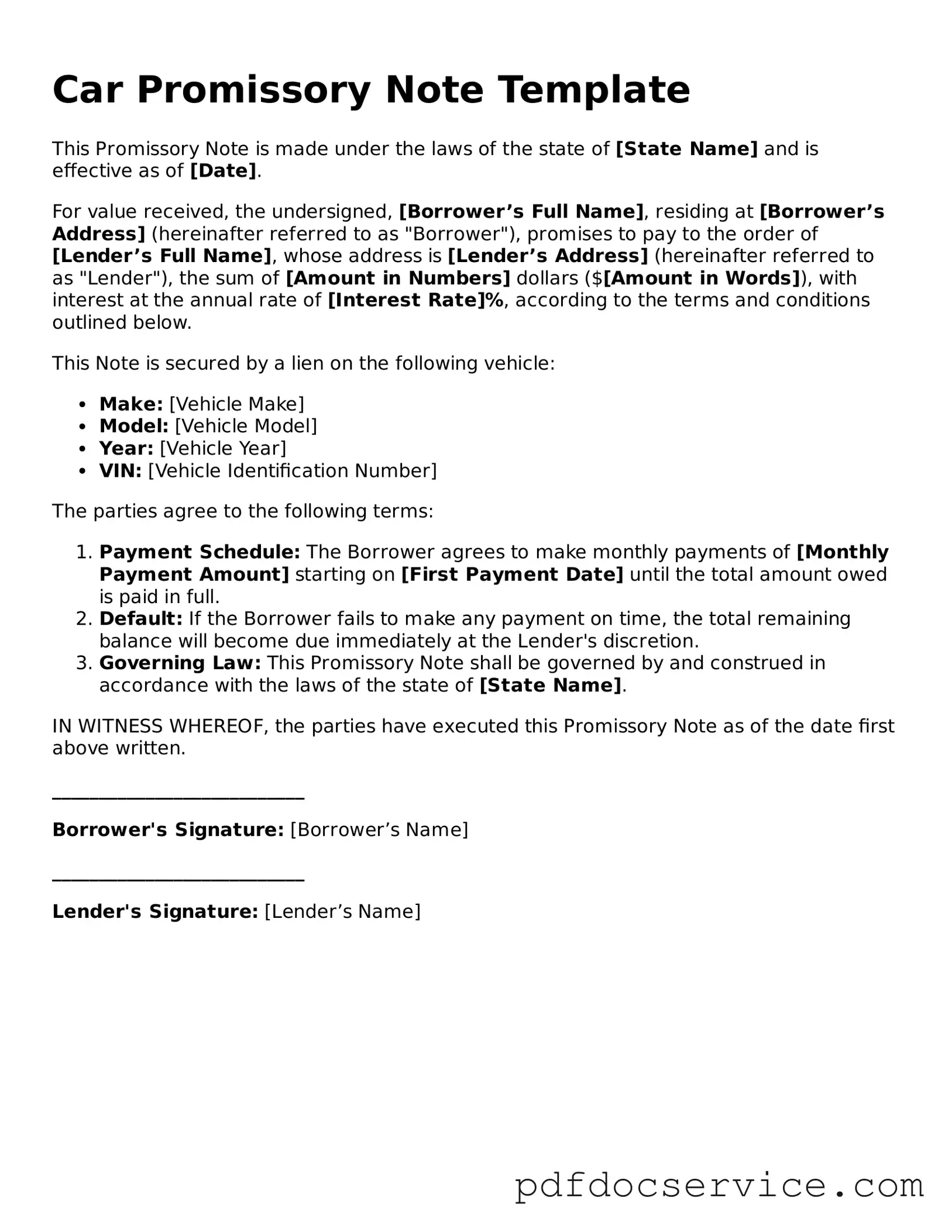

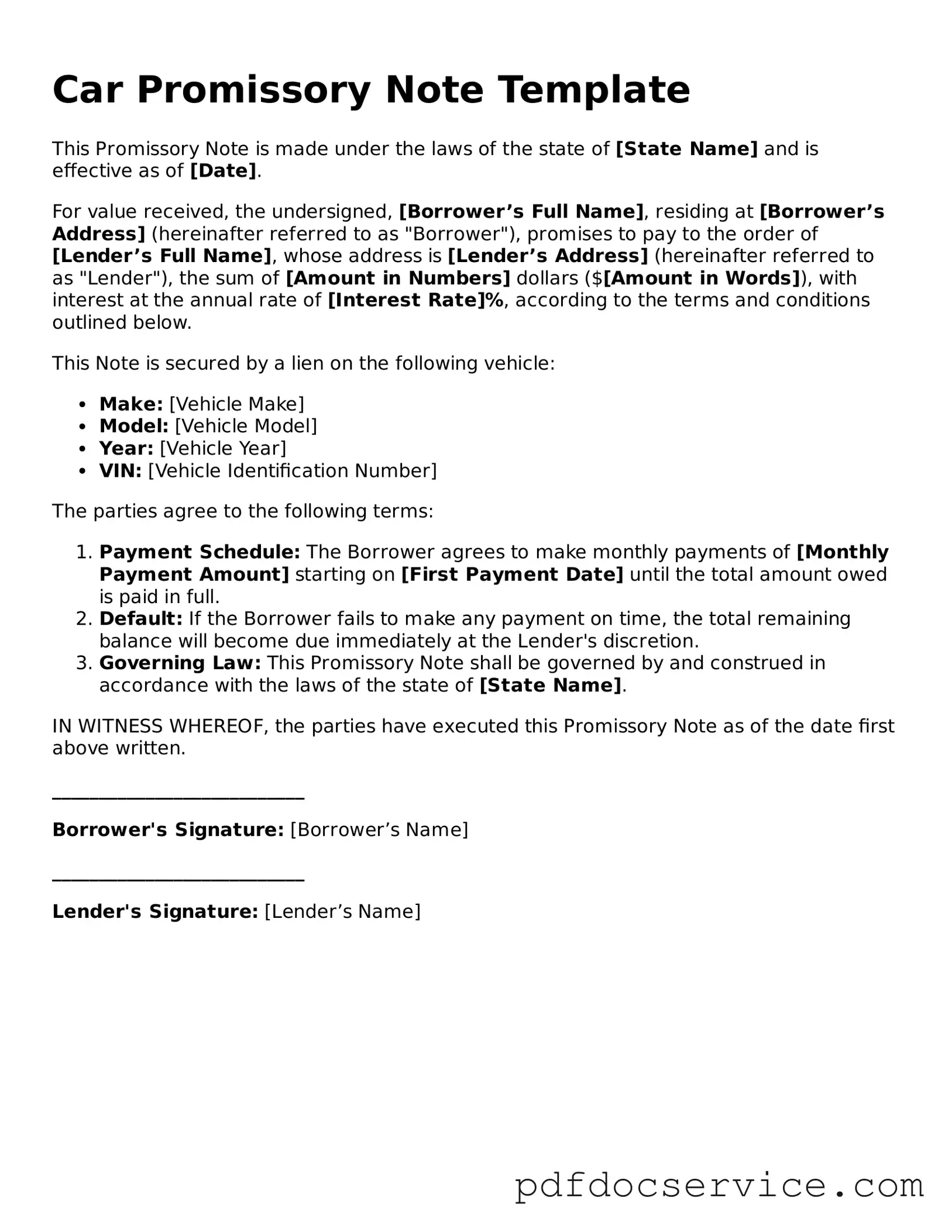

A Promissory Note for a Car is a legal document that outlines the terms of a loan used to purchase a vehicle. This note serves as a written promise from the borrower to repay the lender a specified amount of money, typically with interest, over a defined period. It includes details such as the loan amount, interest rate, payment schedule, and consequences of default.

Who needs a Promissory Note for a Car?

Anyone who borrows money to purchase a vehicle should have a Promissory Note. This document protects both the borrower and the lender by clearly stating the terms of the loan. It is particularly important when the loan is not secured through a traditional financial institution, such as a bank or credit union.

The following information is typically included in a Promissory Note for a Car:

-

Borrower’s name and contact information

-

Lender’s name and contact information

-

Loan amount

-

Interest rate

-

Payment schedule (due dates and amounts)

-

Consequences of late payments or default

-

Signatures of both parties

How is a Promissory Note different from a car loan agreement?

A Promissory Note is a specific document that focuses solely on the promise to repay the loan. In contrast, a car loan agreement may include additional terms related to the purchase, such as warranties, vehicle condition, and ownership transfer. While both documents are important, the Promissory Note is primarily concerned with the financial obligation.

What happens if I default on my Promissory Note?

If a borrower defaults on a Promissory Note, the lender has the right to take legal action to recover the owed amount. This may include pursuing a judgment against the borrower or repossessing the vehicle if it was used as collateral. Defaulting can also negatively impact the borrower’s credit score.

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified if both the borrower and lender agree to the changes. This may involve altering the payment schedule, interest rate, or other terms. It is advisable to document any modifications in writing and have both parties sign the updated agreement to avoid future disputes.

Is a Promissory Note legally binding?

Yes, a Promissory Note is a legally binding document as long as it meets certain requirements, such as being in writing, signed by both parties, and containing clear terms. If either party fails to uphold their end of the agreement, the other party may seek legal remedies.

Do I need a lawyer to create a Promissory Note for a Car?

While it is not legally required to have a lawyer draft a Promissory Note, consulting with one can be beneficial. A lawyer can ensure that the document complies with state laws and adequately protects your interests. Many templates are available online, but having legal guidance can help tailor the note to specific circumstances.

Where can I obtain a Promissory Note template?

Promissory Note templates can be found through various online legal resources, financial institutions, or local office supply stores. It is important to choose a template that is appropriate for your state and specific situation. Always review the template carefully to ensure it meets your needs.