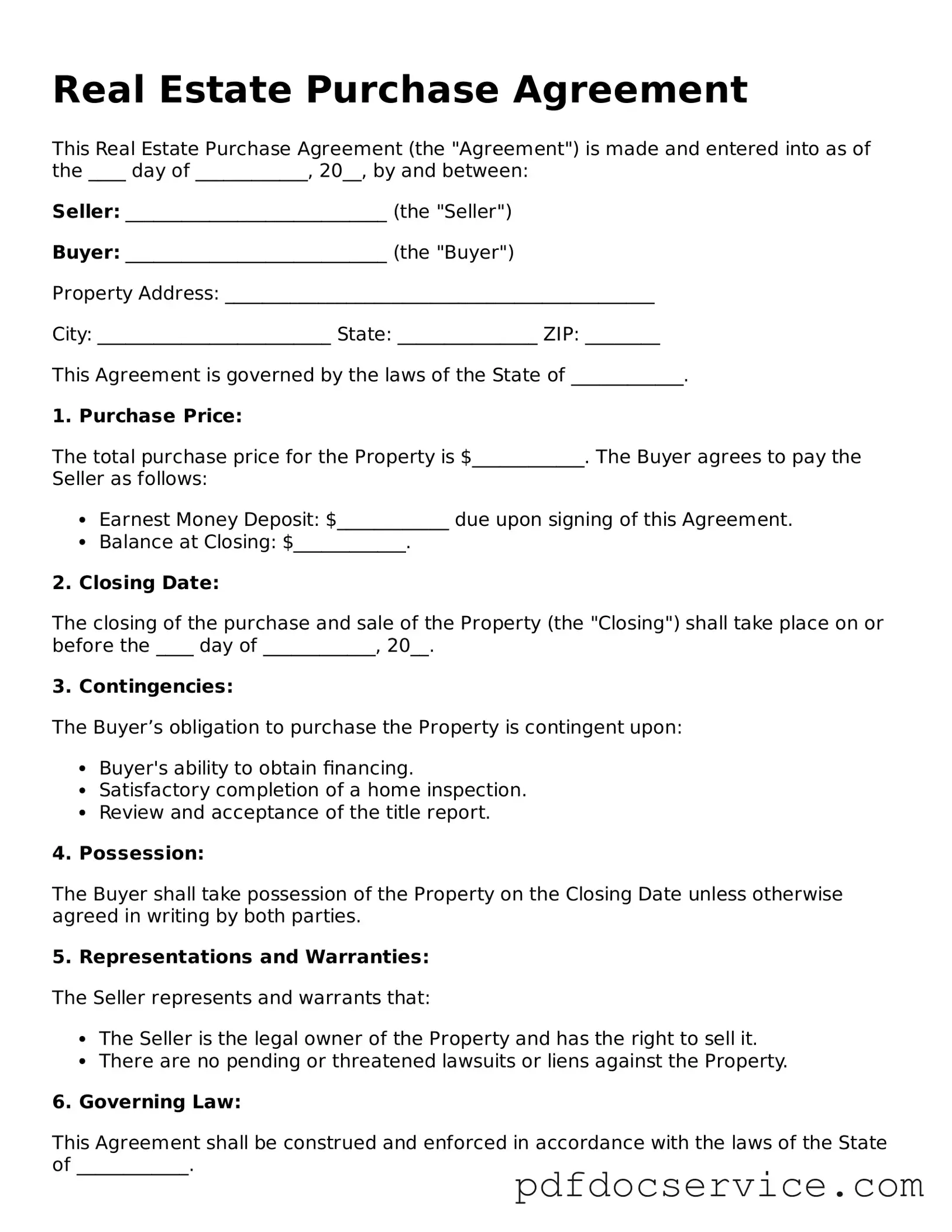

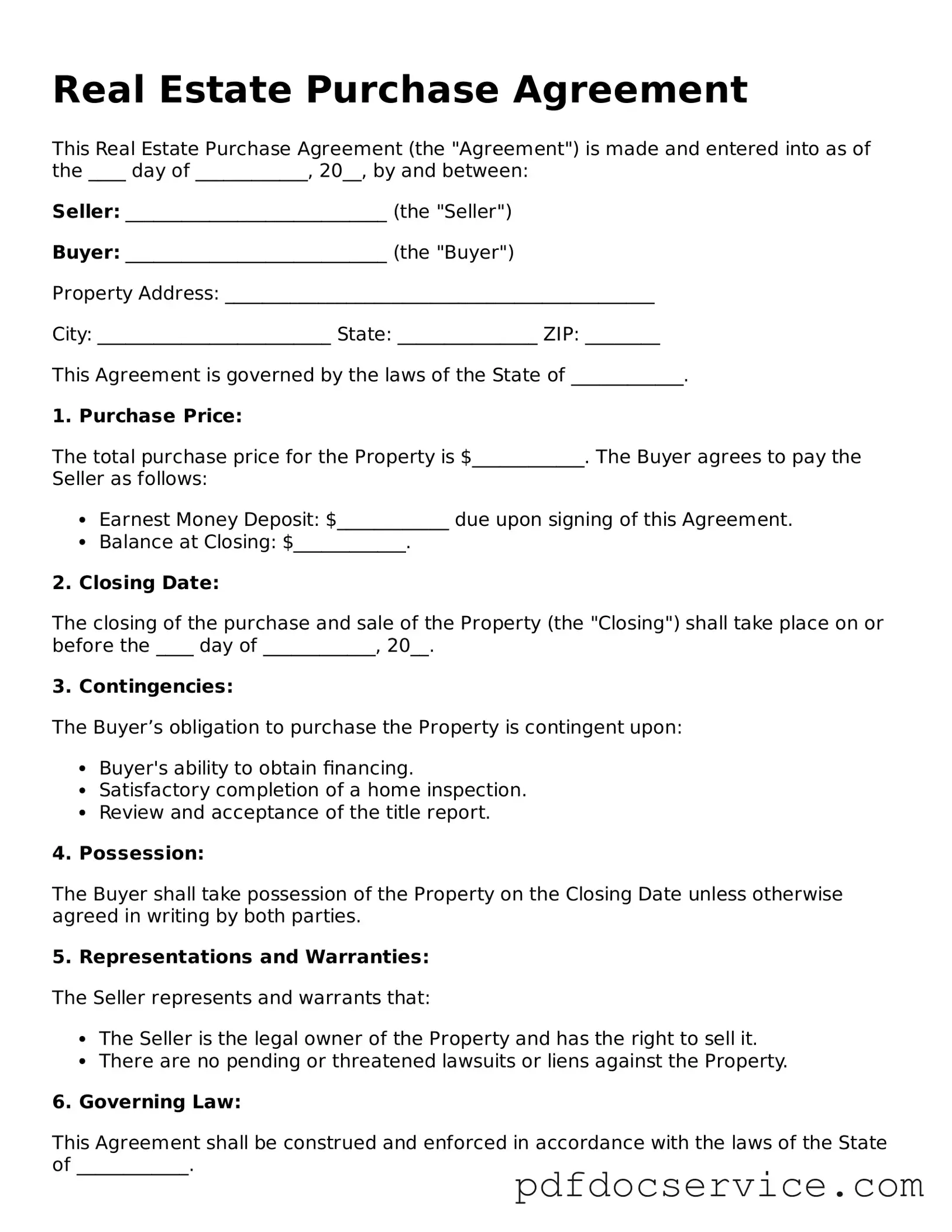

Blank Real Estate Purchase Agreement Form

A Real Estate Purchase Agreement is a legally binding contract that outlines the terms and conditions under which a buyer agrees to purchase property from a seller. This essential document serves as a roadmap for the transaction, detailing the responsibilities of both parties and ensuring clarity in the sale process. Understanding its components is crucial for anyone involved in real estate transactions, as it protects the interests of all parties involved.

Open Real Estate Purchase Agreement Editor

Blank Real Estate Purchase Agreement Form

Open Real Estate Purchase Agreement Editor

Open Real Estate Purchase Agreement Editor

or

Get Real Estate Purchase Agreement PDF

Finish the form now and be done

Finish Real Estate Purchase Agreement online using simple edit, save, and download steps.