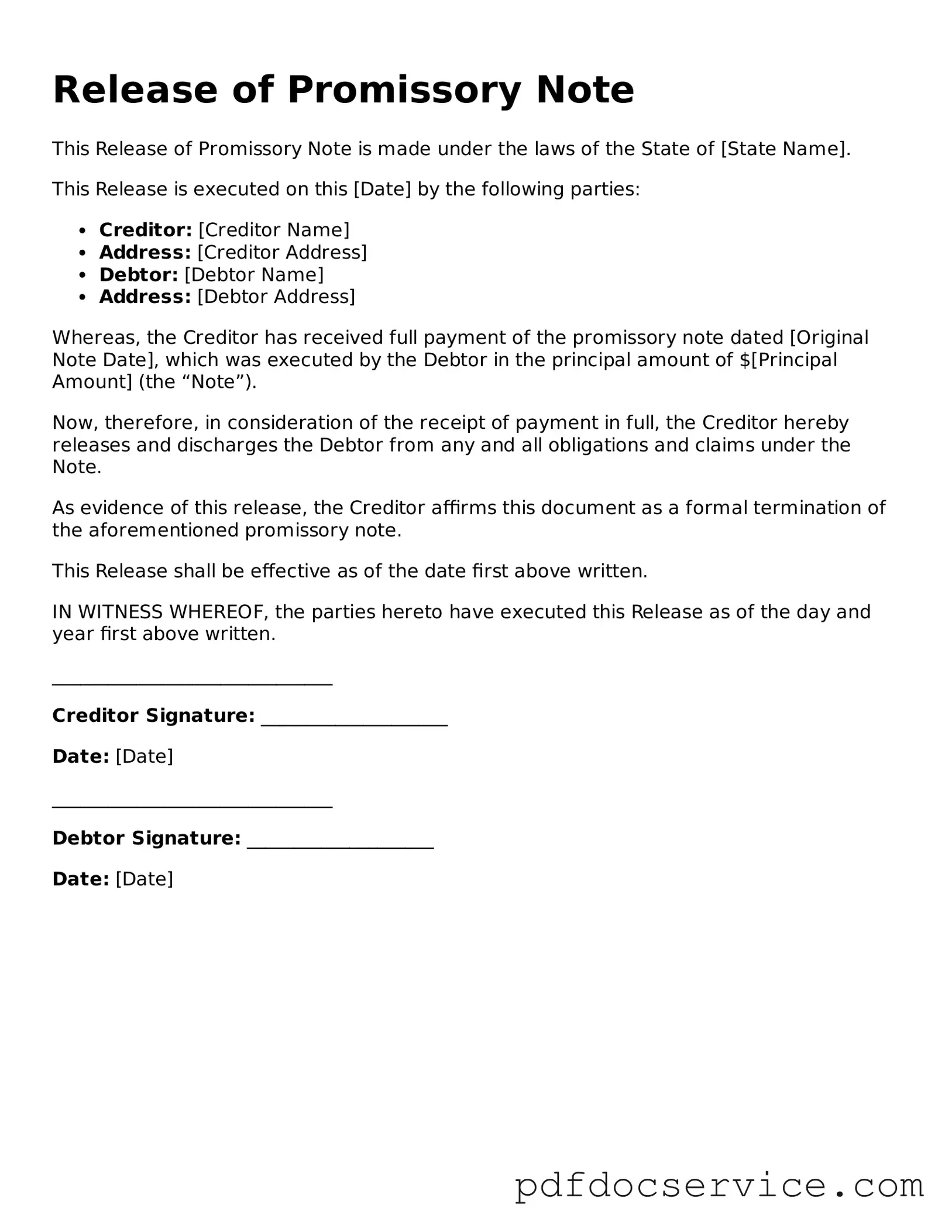

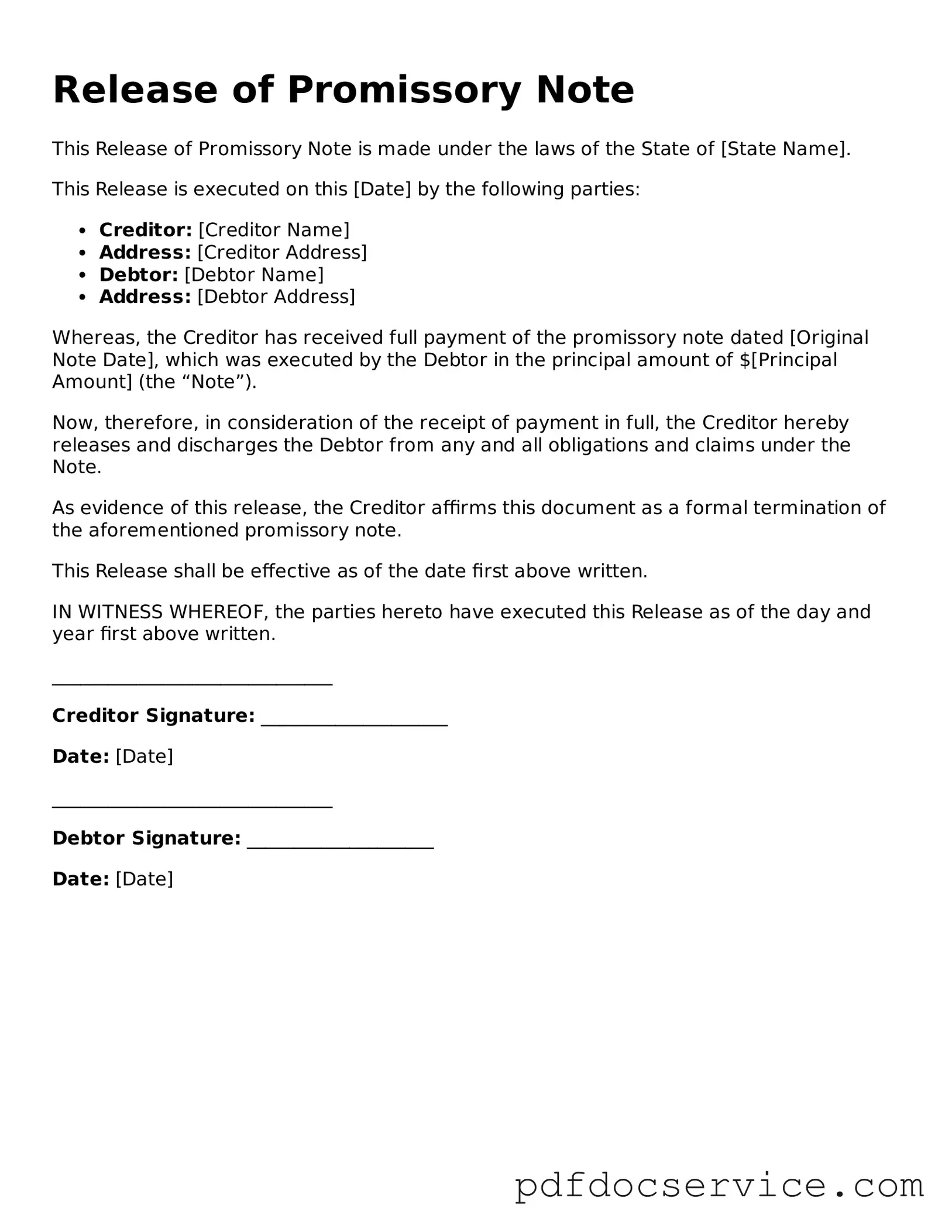

Blank Release of Promissory Note Form

A Release of Promissory Note form is a legal document used to formally acknowledge the satisfaction of a debt and to release the borrower from further obligations. This form serves as evidence that the lender has received full payment and no longer holds any claims against the borrower regarding the specified note. Understanding this form is essential for both parties to ensure clarity and closure in their financial agreement.

Open Release of Promissory Note Editor

Blank Release of Promissory Note Form

Open Release of Promissory Note Editor

Open Release of Promissory Note Editor

or

Get Release of Promissory Note PDF

Finish the form now and be done

Finish Release of Promissory Note online using simple edit, save, and download steps.