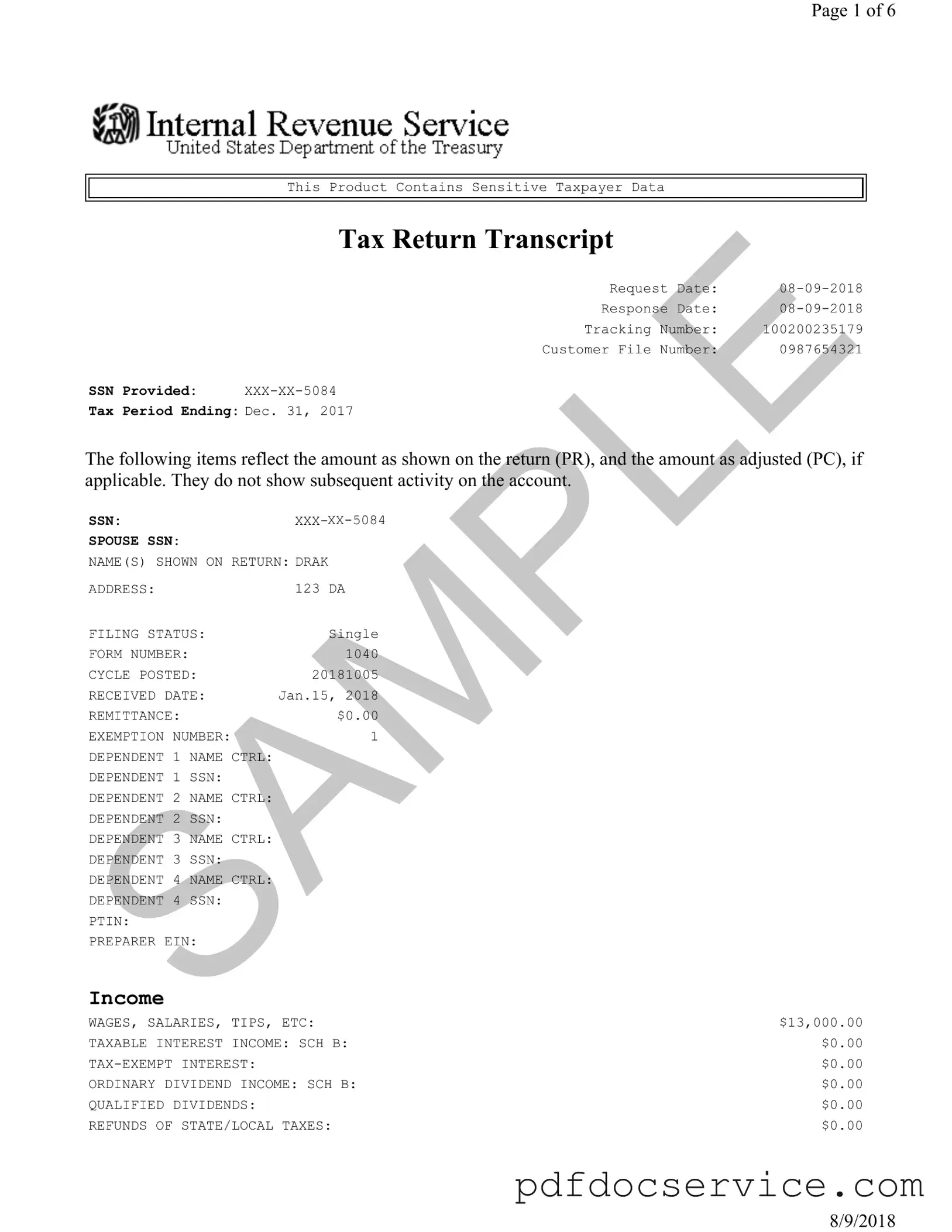

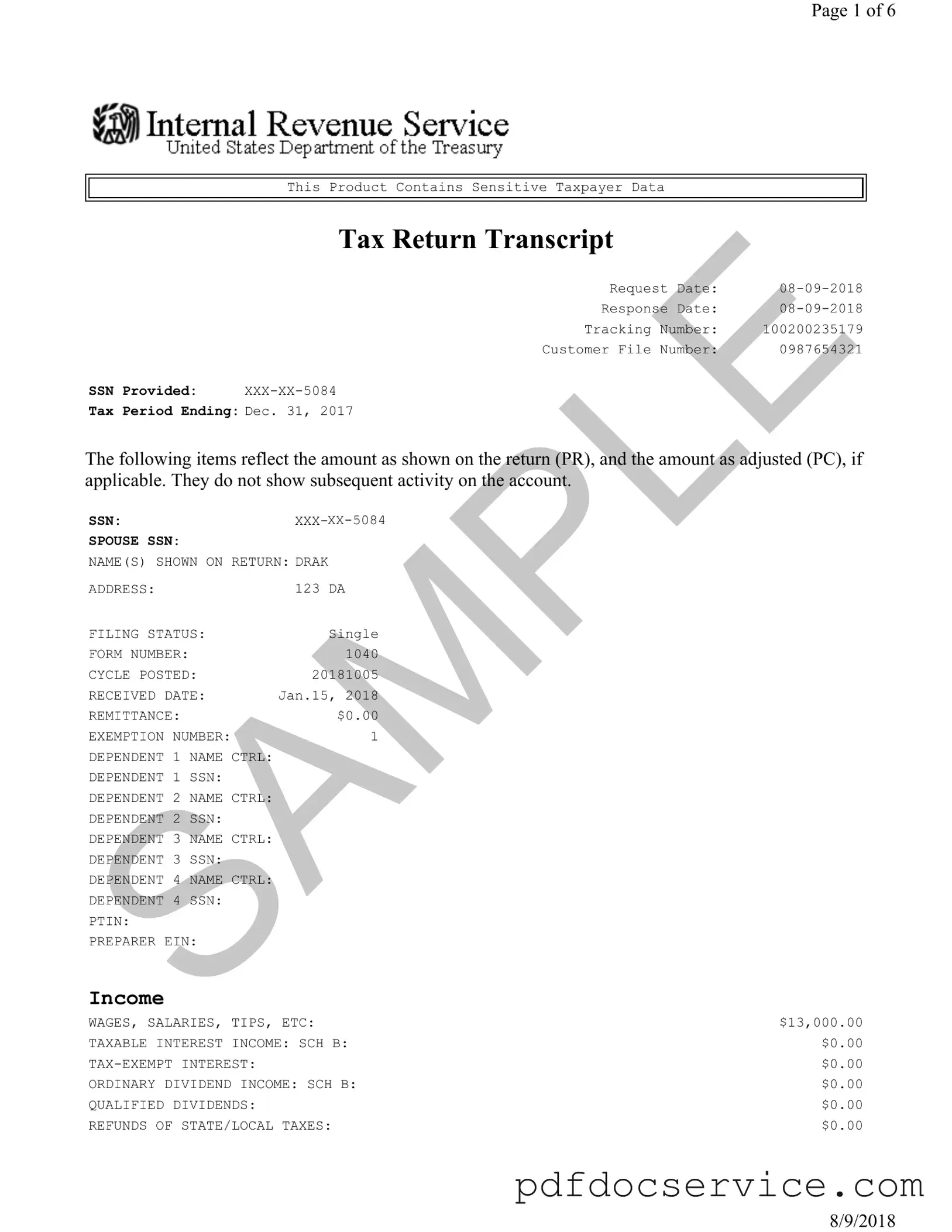

What is a Sample Tax Return Transcript?

A Sample Tax Return Transcript provides a summary of a taxpayer's income, deductions, and tax liabilities as reported on their tax return. It includes key information such as wages, taxable income, adjustments, and credits. This document is useful for various purposes, including loan applications and verifying income for financial aid.

How do I obtain a Sample Tax Return Transcript?

To obtain a Sample Tax Return Transcript, you can request it through the IRS website, by phone, or by mail. The IRS offers an online tool called "Get Transcript" where you can access your transcripts immediately. Alternatively, you can complete Form 4506-T and send it to the IRS to receive your transcript by mail. Ensure you have the necessary identification information ready, such as your Social Security number and the tax year for which you are requesting the transcript.

The Sample Tax Return Transcript includes a variety of information, such as:

-

Filing status

-

Income details, including wages, salaries, and other sources

-

Deductions and credits claimed

-

Adjusted gross income

-

Total tax liability

-

Payments made and any refunds due

This information reflects the amounts as shown on the return and any adjustments made by the IRS.

Is the Sample Tax Return Transcript the same as a tax return?

No, a Sample Tax Return Transcript is not the same as a complete tax return. While it summarizes the essential elements of your tax return, it does not include all the details or supporting documentation. For instance, it does not provide line-by-line details or additional schedules that may have been filed with your return.

Can I use the Sample Tax Return Transcript for loan applications?

Yes, many lenders accept the Sample Tax Return Transcript as a valid form of income verification. It provides a concise overview of your financial situation, which lenders often require when assessing your eligibility for loans or mortgages. However, it is always best to check with your lender to confirm their specific requirements.

How long does it take to receive a Sample Tax Return Transcript?

The time it takes to receive your Sample Tax Return Transcript can vary. If you request it online, you may receive it immediately. However, if you submit a request by mail, it can take several weeks for processing and delivery. Generally, you should allow up to 10 business days for online requests and up to 30 days for mailed requests.

What should I do if I find errors in my Sample Tax Return Transcript?

If you notice discrepancies or errors in your Sample Tax Return Transcript, it is crucial to address them promptly. You can contact the IRS to clarify any issues. If the error is on your original tax return, you may need to file an amended return using Form 1040-X to correct the information. Ensure you keep documentation supporting your claims to facilitate the correction process.

Is there a fee to obtain a Sample Tax Return Transcript?

No, there is no fee to obtain a Sample Tax Return Transcript. The IRS provides this service free of charge. Whether you request it online or through the mail, you will not incur any costs for obtaining your transcript.