Fill Your Stock Transfer Ledger Form

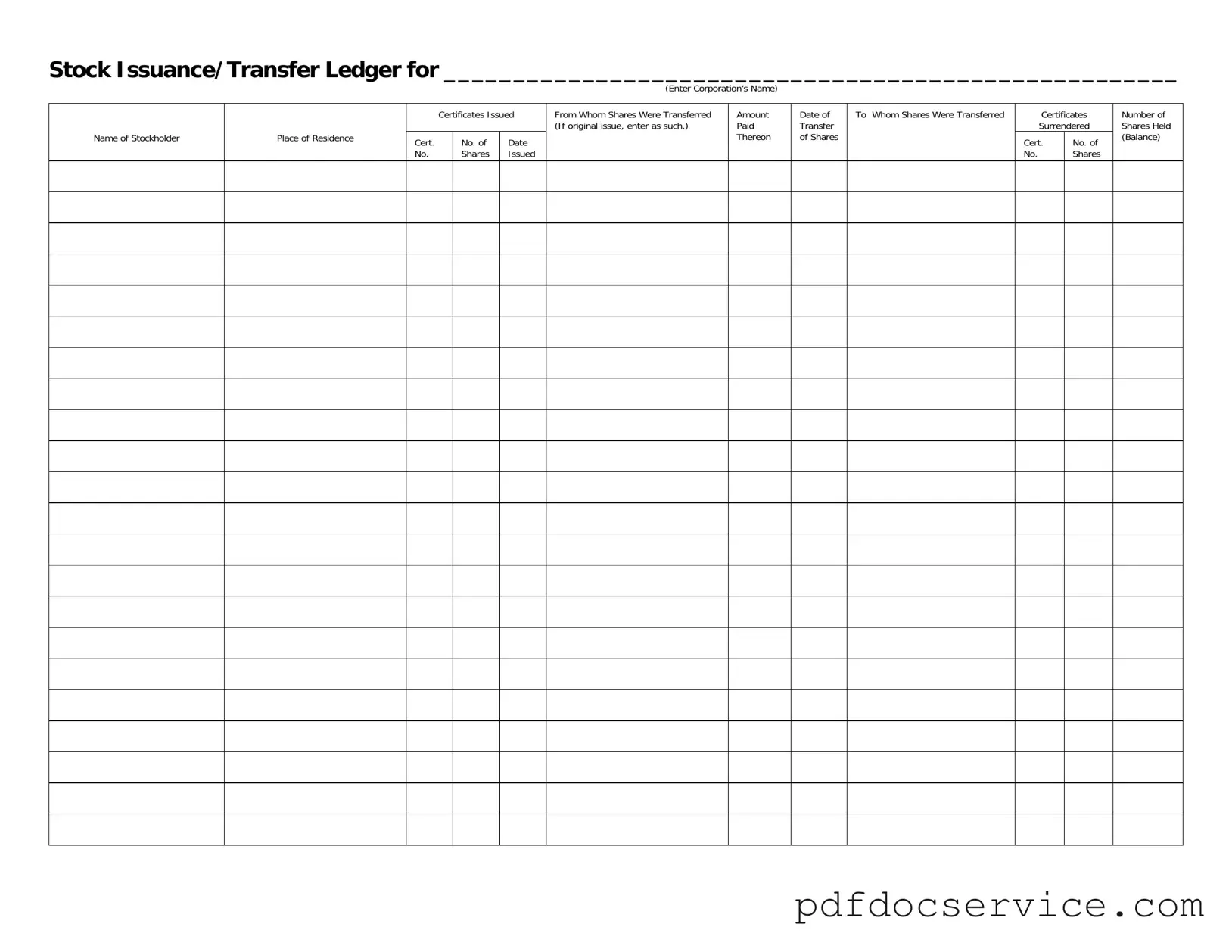

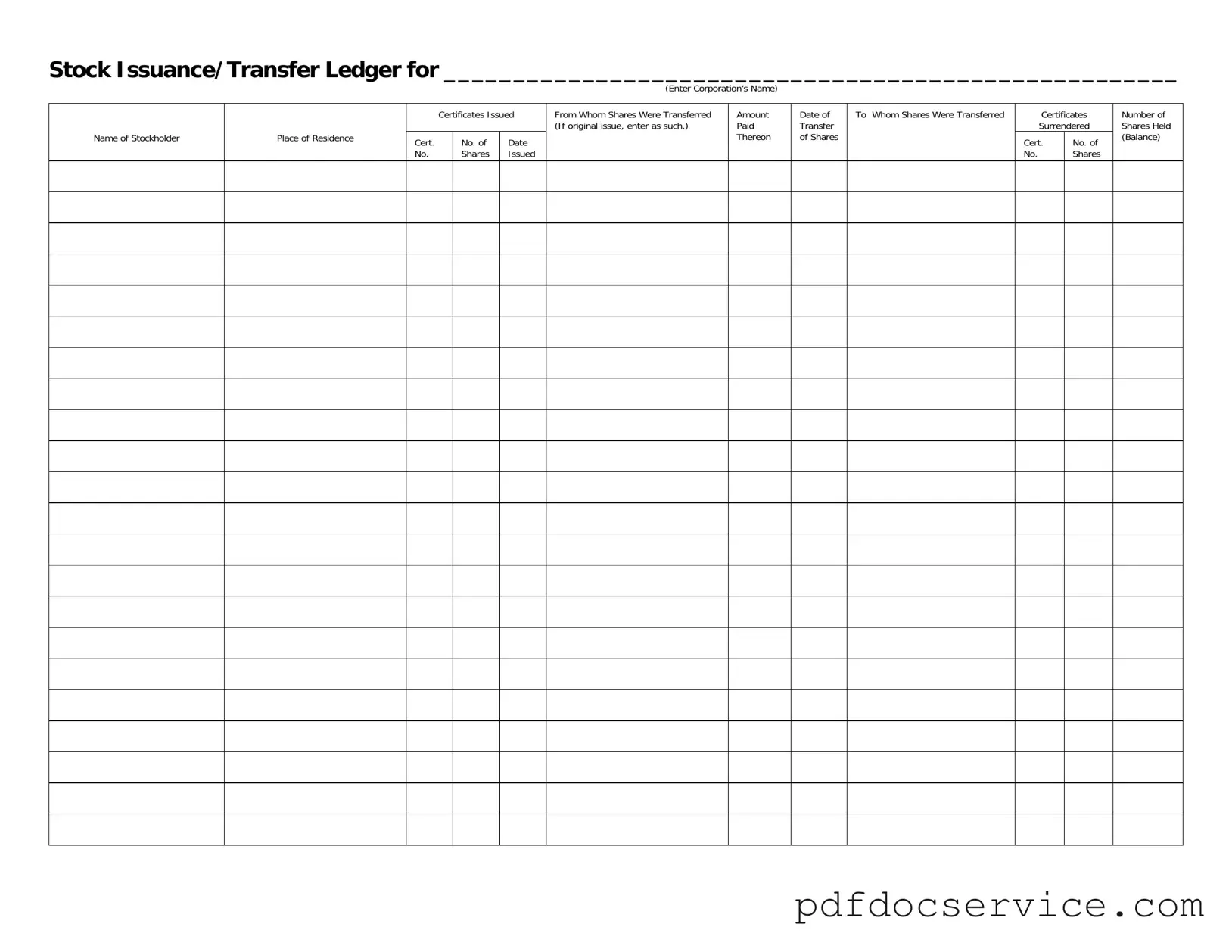

The Stock Transfer Ledger form is a crucial document used by corporations to record the issuance and transfer of stock among shareholders. This form helps maintain accurate records of stock ownership, detailing essential information such as the stockholder's name, the number of shares issued, and the dates of transactions. By keeping this ledger up to date, corporations ensure compliance with regulations and provide transparency in their stock management practices.

Open Stock Transfer Ledger Editor

Fill Your Stock Transfer Ledger Form

Open Stock Transfer Ledger Editor

Open Stock Transfer Ledger Editor

or

Get Stock Transfer Ledger PDF

Finish the form now and be done

Finish Stock Transfer Ledger online using simple edit, save, and download steps.