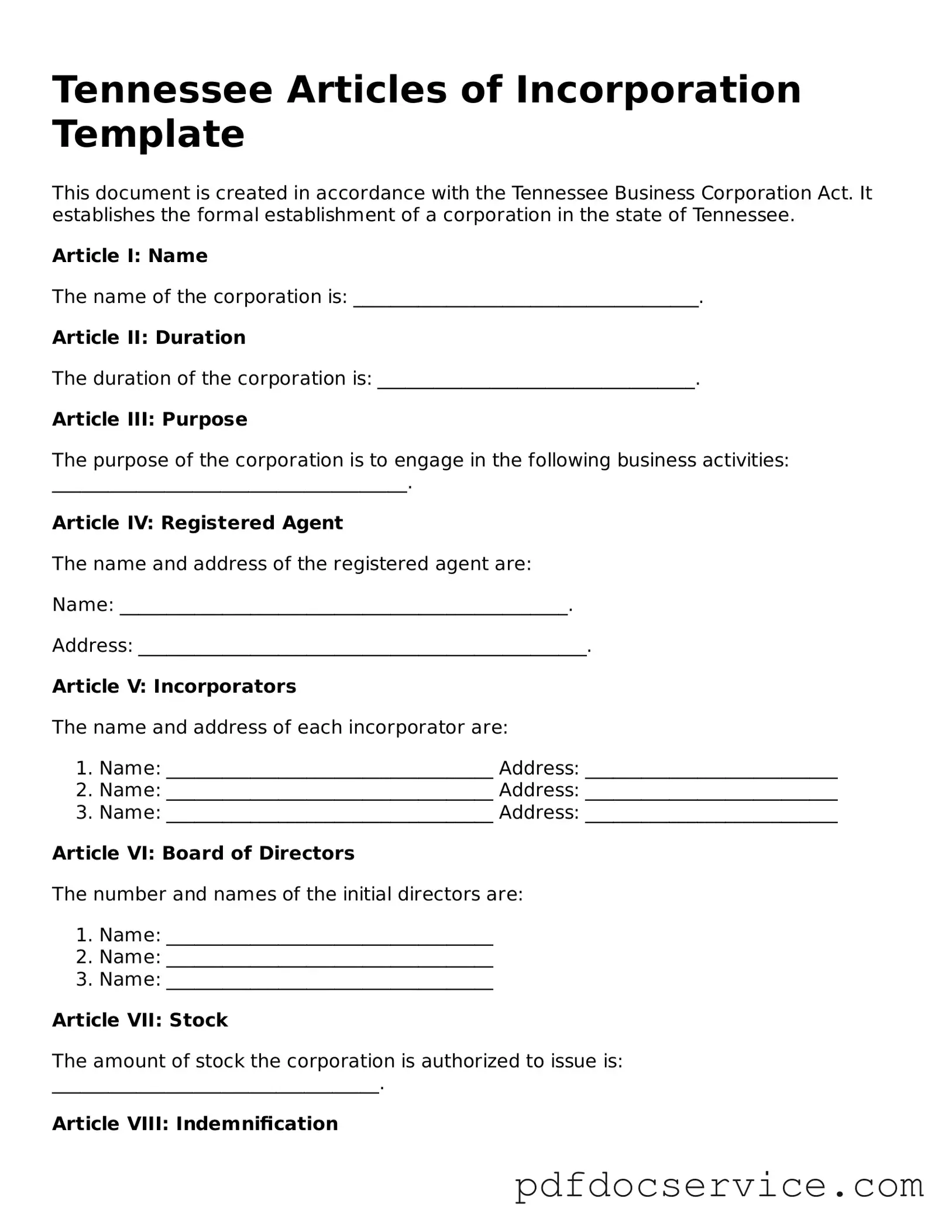

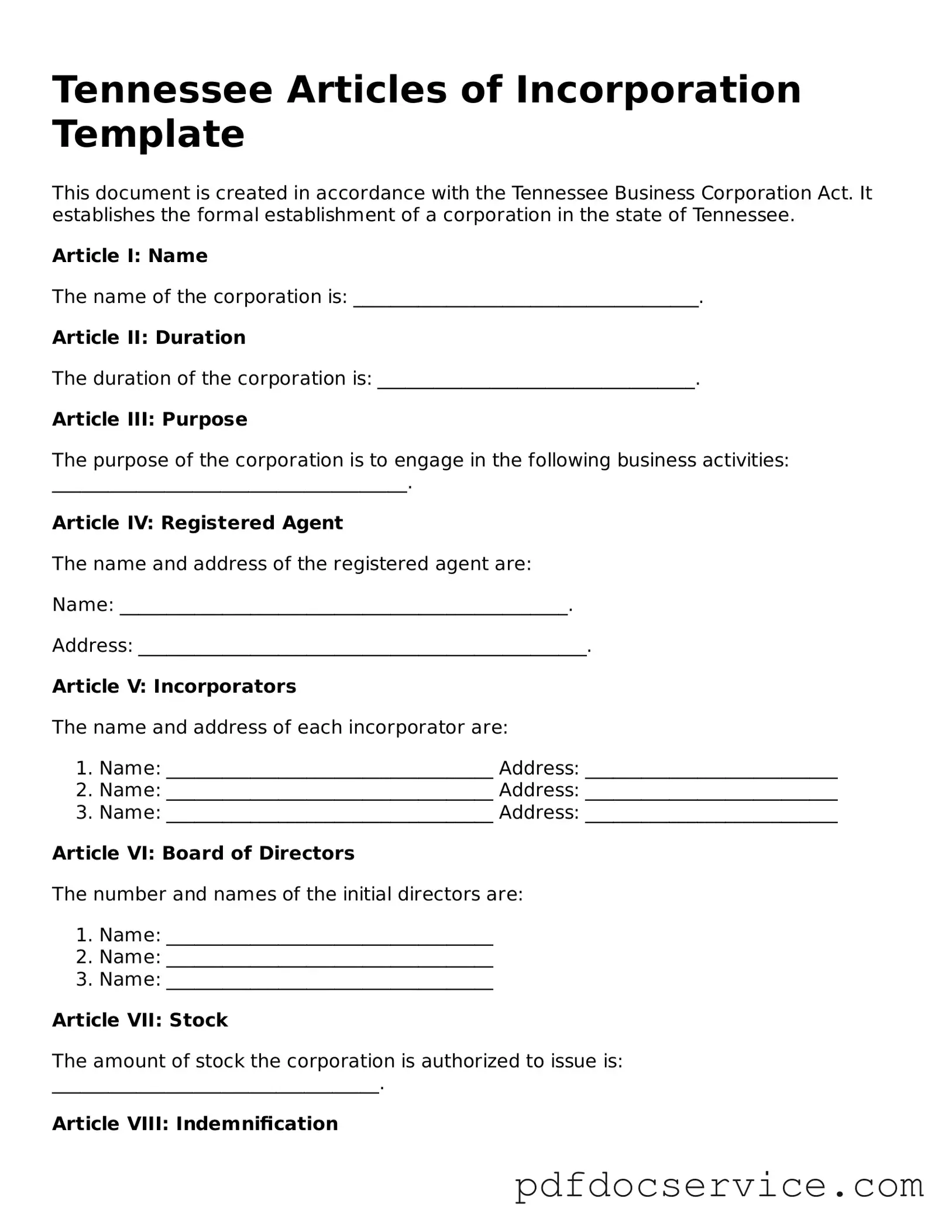

What are the Articles of Incorporation in Tennessee?

The Articles of Incorporation is a legal document that establishes a corporation in the state of Tennessee. It outlines essential information about the corporation, such as its name, purpose, and registered agent. Filing this document is a crucial step in forming a corporation and provides legal recognition to the business entity.

What information is required to complete the Articles of Incorporation?

To complete the Articles of Incorporation, you will need to provide the following information:

-

The name of the corporation.

-

The purpose of the corporation.

-

The address of the corporation's principal office.

-

The name and address of the registered agent.

-

The number of shares the corporation is authorized to issue.

-

The names and addresses of the incorporators.

Make sure that the name you choose complies with Tennessee naming requirements and is distinguishable from existing entities.

How do I file the Articles of Incorporation?

Filing the Articles of Incorporation can be done online or by mail. If you choose to file online, visit the Tennessee Secretary of State's website. You will need to create an account and follow the prompts to submit your form. If you prefer to file by mail, print the completed form, sign it, and send it to the appropriate address along with the filing fee.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Tennessee varies based on the type of corporation you are forming. Generally, the fee is around $100. It's important to check the latest fee schedule on the Tennessee Secretary of State's website to confirm the current amount.

How long does it take for the Articles of Incorporation to be processed?

The processing time for the Articles of Incorporation can vary. Typically, online submissions are processed faster, often within a few business days. Mail submissions may take longer, sometimes up to two weeks or more. If you need expedited processing, inquire about available options when you file.

What happens after my Articles of Incorporation are approved?

Once your Articles of Incorporation are approved, you will receive a certificate of incorporation from the state. This document serves as proof that your corporation is officially recognized. After approval, you should also consider obtaining an Employer Identification Number (EIN) from the IRS and setting up any necessary business licenses or permits.

Can I amend my Articles of Incorporation later?

Yes, you can amend your Articles of Incorporation if necessary. Common reasons for amendments include changes to the corporation's name, purpose, or structure. To amend, you must file the appropriate amendment form with the Tennessee Secretary of State and pay any required fees. Keep in mind that certain changes may require approval from the corporation's board or shareholders.