What is an ATV Bill of Sale in Tennessee?

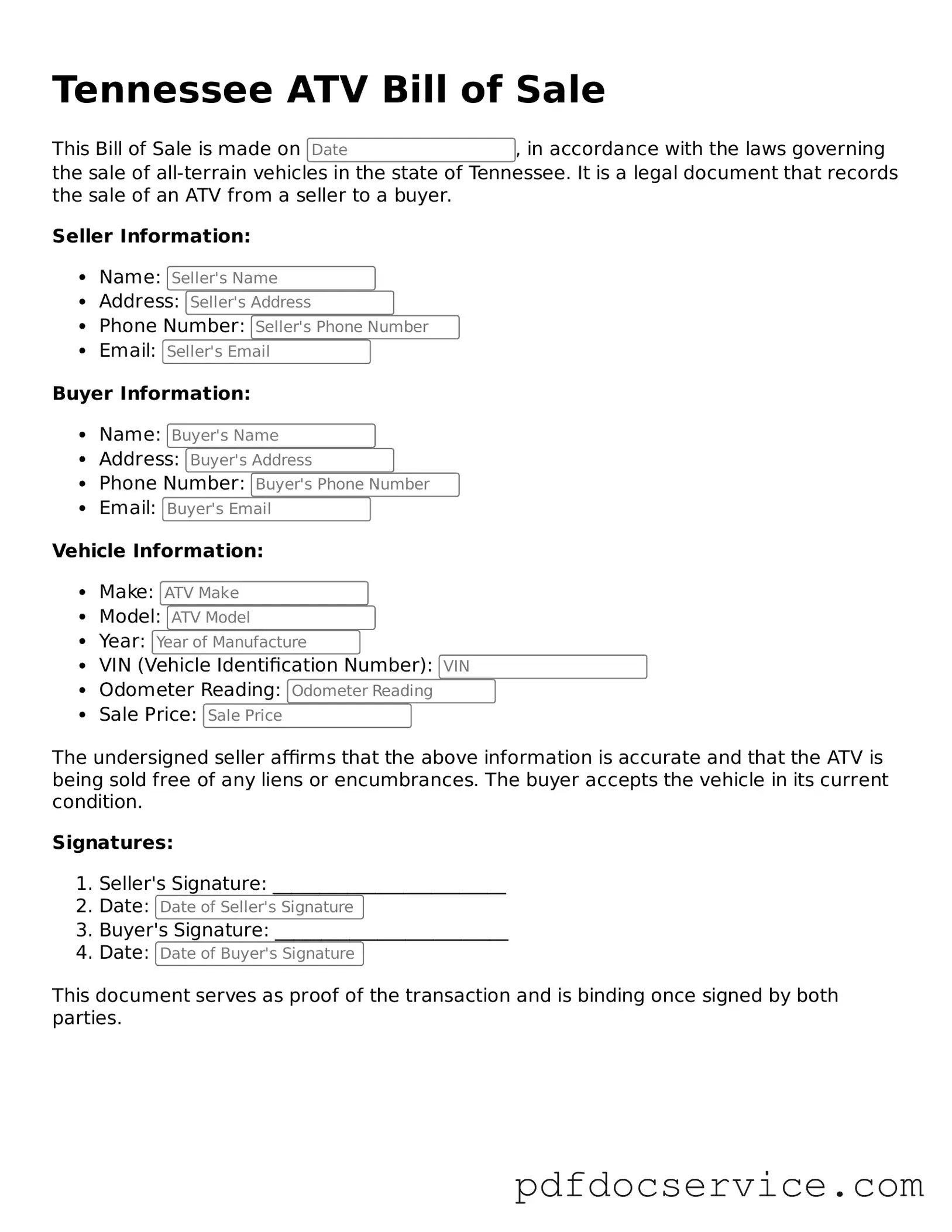

An ATV Bill of Sale is a legal document that serves as proof of the transfer of ownership of an all-terrain vehicle (ATV) from one party to another in Tennessee. This document typically includes essential information about the buyer, seller, and the ATV itself, such as the make, model, year, and Vehicle Identification Number (VIN).

Is a Bill of Sale required to sell an ATV in Tennessee?

While a Bill of Sale is not legally required to sell an ATV in Tennessee, it is highly recommended. This document provides a record of the transaction and protects both the buyer and seller in case of disputes or issues that may arise after the sale.

An effective ATV Bill of Sale should include the following details:

-

Full names and addresses of both the buyer and seller

-

Description of the ATV, including make, model, year, color, and VIN

-

Sale price of the ATV

-

Date of the transaction

-

Signatures of both parties

Can I create my own ATV Bill of Sale?

Yes, you can create your own ATV Bill of Sale. As long as it includes all the necessary information and is signed by both parties, it is valid. Many templates are available online, which can help ensure that you include all required details.

Do I need to have the Bill of Sale notarized?

In Tennessee, notarization of the Bill of Sale is not required. However, having the document notarized can add an extra layer of authenticity and may be beneficial in case of future disputes.

What should I do with the Bill of Sale after the transaction?

After the sale is complete, both the buyer and seller should keep a copy of the Bill of Sale for their records. The buyer will need it for registering the ATV in their name, while the seller may want it as proof of the sale.

How does the Bill of Sale affect registration of the ATV?

The Bill of Sale is an important document when registering the ATV in Tennessee. The buyer will need to present it to the Department of Revenue to prove ownership and to obtain a title for the vehicle. Without this document, registering the ATV may be more complicated.

What if the ATV is financed or has a lien on it?

If the ATV is financed or has a lien, the seller must ensure that the lien is satisfied before transferring ownership. The Bill of Sale should reflect that the lien has been cleared, or the seller should provide documentation from the lender confirming that the loan has been paid off.

Are there any fees associated with the Bill of Sale?

There are typically no fees directly associated with creating a Bill of Sale itself. However, when registering the ATV with the state, there may be registration fees, title fees, and taxes that the buyer will need to pay.

What should I do if there are discrepancies on the Bill of Sale?

If there are discrepancies on the Bill of Sale, it is crucial to address them before completing the transaction. Both parties should review the document carefully and make any necessary corrections. If the discrepancies are significant, it may be best to create a new Bill of Sale to avoid confusion in the future.