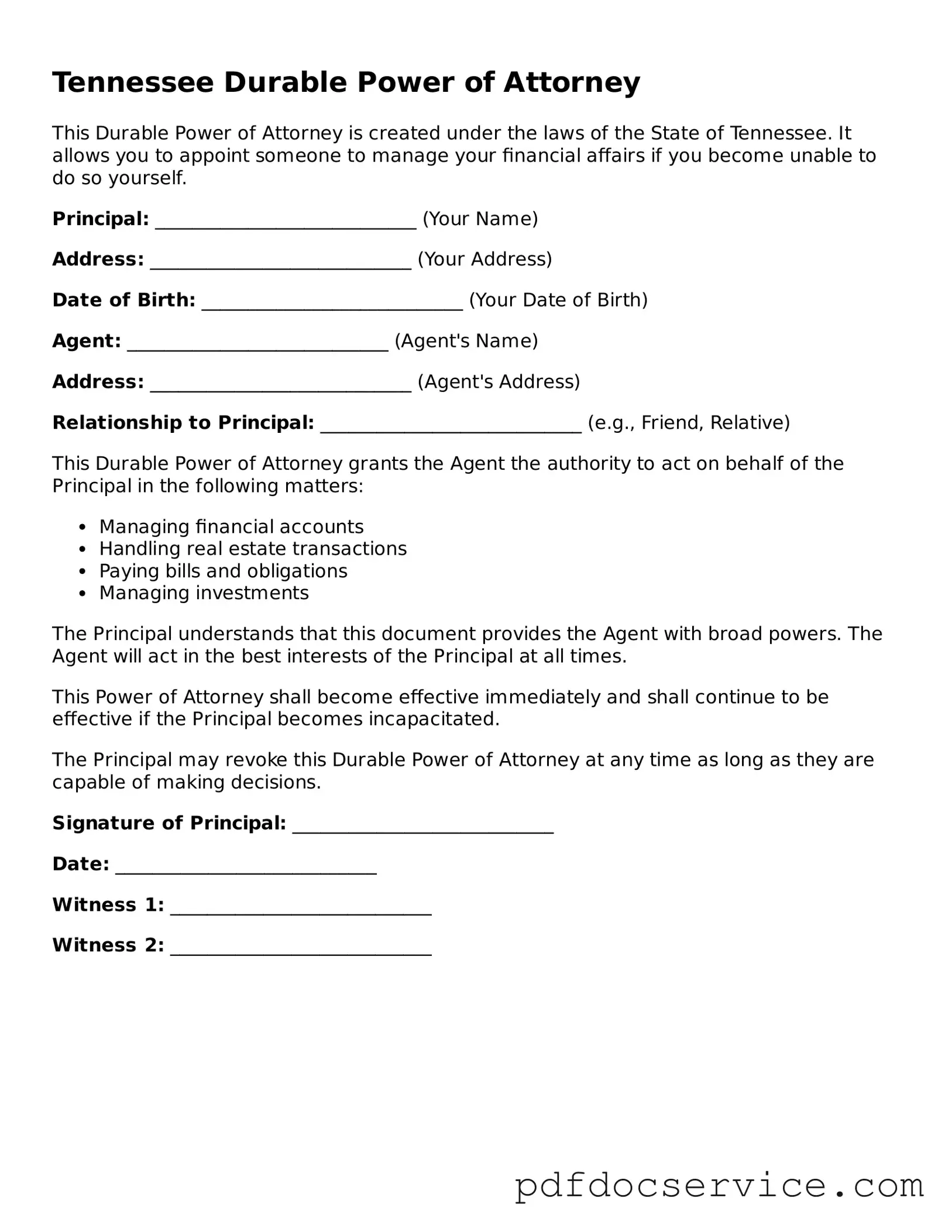

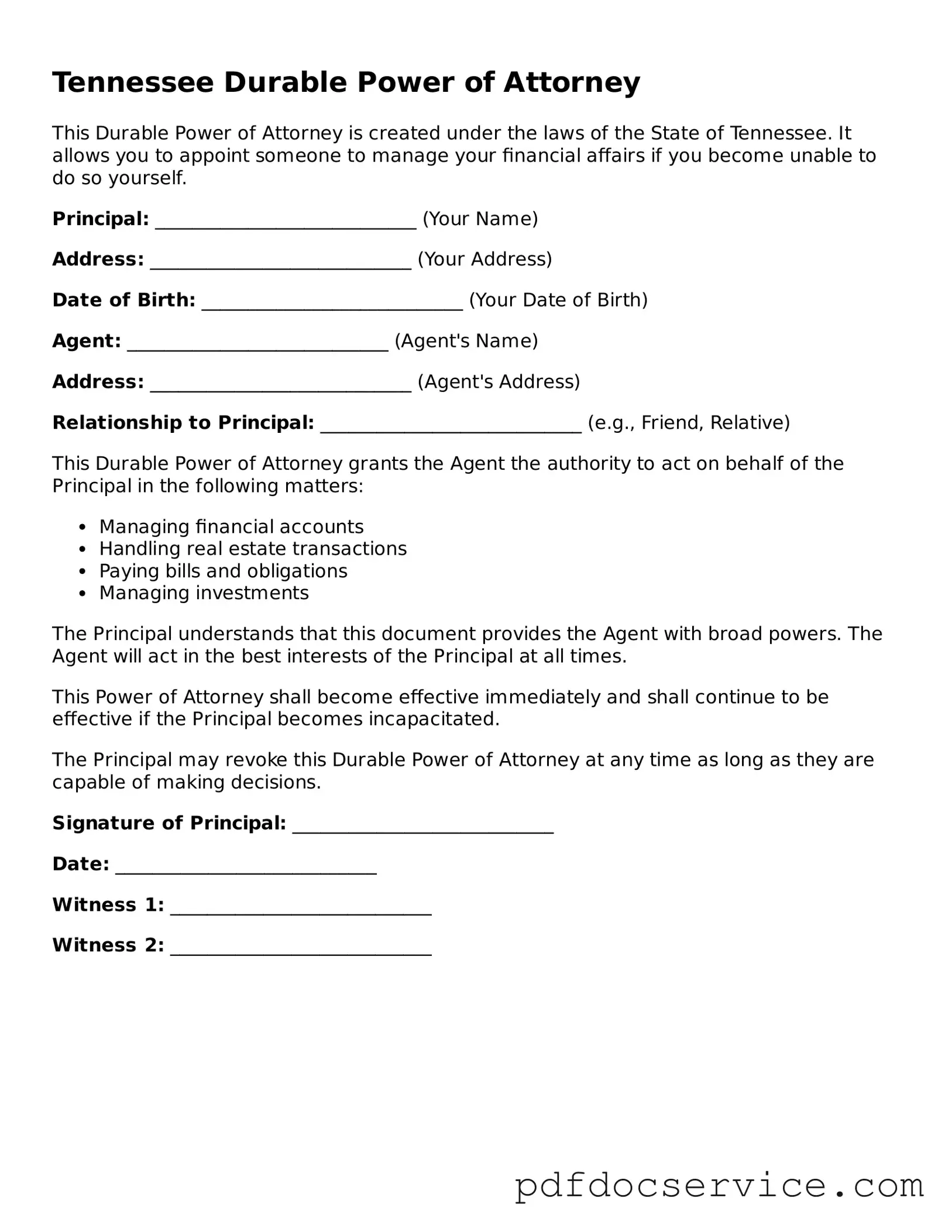

Printable Durable Power of Attorney Template for Tennessee

A Tennessee Durable Power of Attorney form is a legal document that allows an individual to designate another person to make decisions on their behalf, even if they become incapacitated. This form ensures that your financial and legal matters are managed according to your wishes when you are unable to do so. By using this document, you can provide peace of mind for yourself and your loved ones.

Open Durable Power of Attorney Editor

Printable Durable Power of Attorney Template for Tennessee

Open Durable Power of Attorney Editor

Open Durable Power of Attorney Editor

or

Get Durable Power of Attorney PDF

Finish the form now and be done

Finish Durable Power of Attorney online using simple edit, save, and download steps.