What is a Quitclaim Deed in Tennessee?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another without guaranteeing that the property is free of claims or liens. In Tennessee, this type of deed is often used among family members or in situations where the parties know each other well.

How does a Quitclaim Deed differ from a Warranty Deed?

The main difference lies in the level of protection provided to the buyer. A Warranty Deed offers guarantees about the property’s title, ensuring that the seller has the right to sell and that there are no hidden claims against it. In contrast, a Quitclaim Deed transfers whatever interest the seller has without any warranties, meaning the buyer assumes the risk.

When should I use a Quitclaim Deed?

Consider using a Quitclaim Deed in the following situations:

-

Transferring property between family members.

-

Removing a spouse from the title after a divorce.

-

Transferring property into a trust.

-

Correcting a title issue or clarifying ownership.

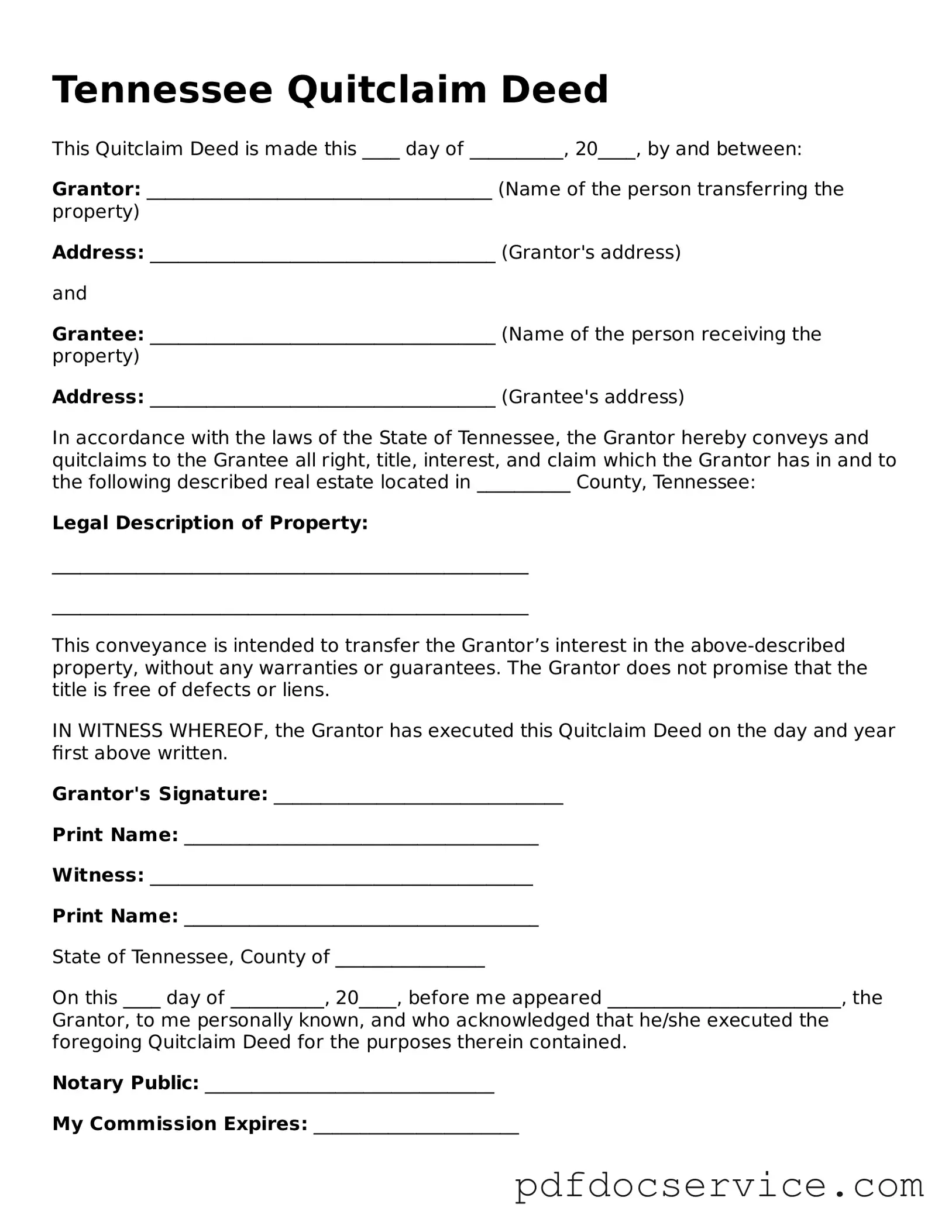

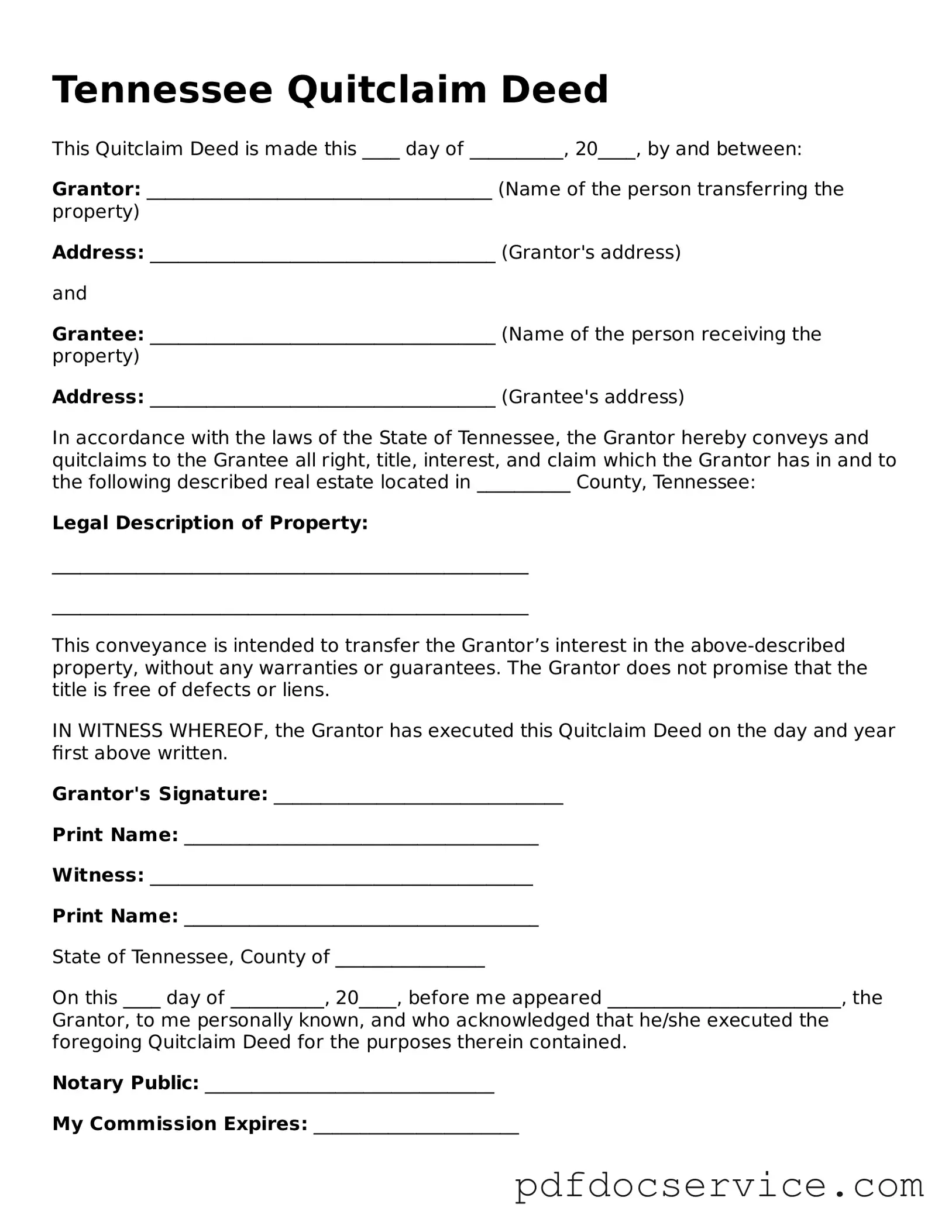

A Tennessee Quitclaim Deed should include the following information:

-

The names and addresses of the grantor (seller) and grantee (buyer).

-

A legal description of the property being transferred.

-

The date of the transfer.

-

The signature of the grantor.

-

Notarization of the document.

Is notarization required for a Quitclaim Deed in Tennessee?

Yes, notarization is required. The grantor must sign the Quitclaim Deed in the presence of a notary public. This step ensures the authenticity of the signatures and helps prevent fraud.

Do I need to file the Quitclaim Deed with the county?

Yes, after the Quitclaim Deed is signed and notarized, it must be filed with the county register of deeds in the county where the property is located. This filing makes the transfer of ownership a matter of public record.

Are there any fees associated with filing a Quitclaim Deed?

Yes, there are typically fees associated with filing a Quitclaim Deed. These fees can vary by county, so it is advisable to check with the local register of deeds for specific amounts. Additionally, there may be taxes or other costs related to the transfer of property.

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and filed, it cannot be revoked unilaterally. If the grantor wishes to regain ownership, they would need to execute another deed transferring the property back, which may require the consent of the current owner.

What happens if there are liens on the property?

With a Quitclaim Deed, the buyer takes on any existing liens or claims against the property. This means that if there are unpaid taxes, mortgages, or other debts associated with the property, the new owner may be responsible for addressing them. It's crucial to conduct a title search before proceeding with the transfer.

Can I use a Quitclaim Deed for commercial property?

Yes, a Quitclaim Deed can be used for commercial property in Tennessee. However, it is essential to understand the implications of using this type of deed, especially regarding potential liabilities and claims. Consulting with a legal professional is recommended when dealing with commercial real estate transactions.