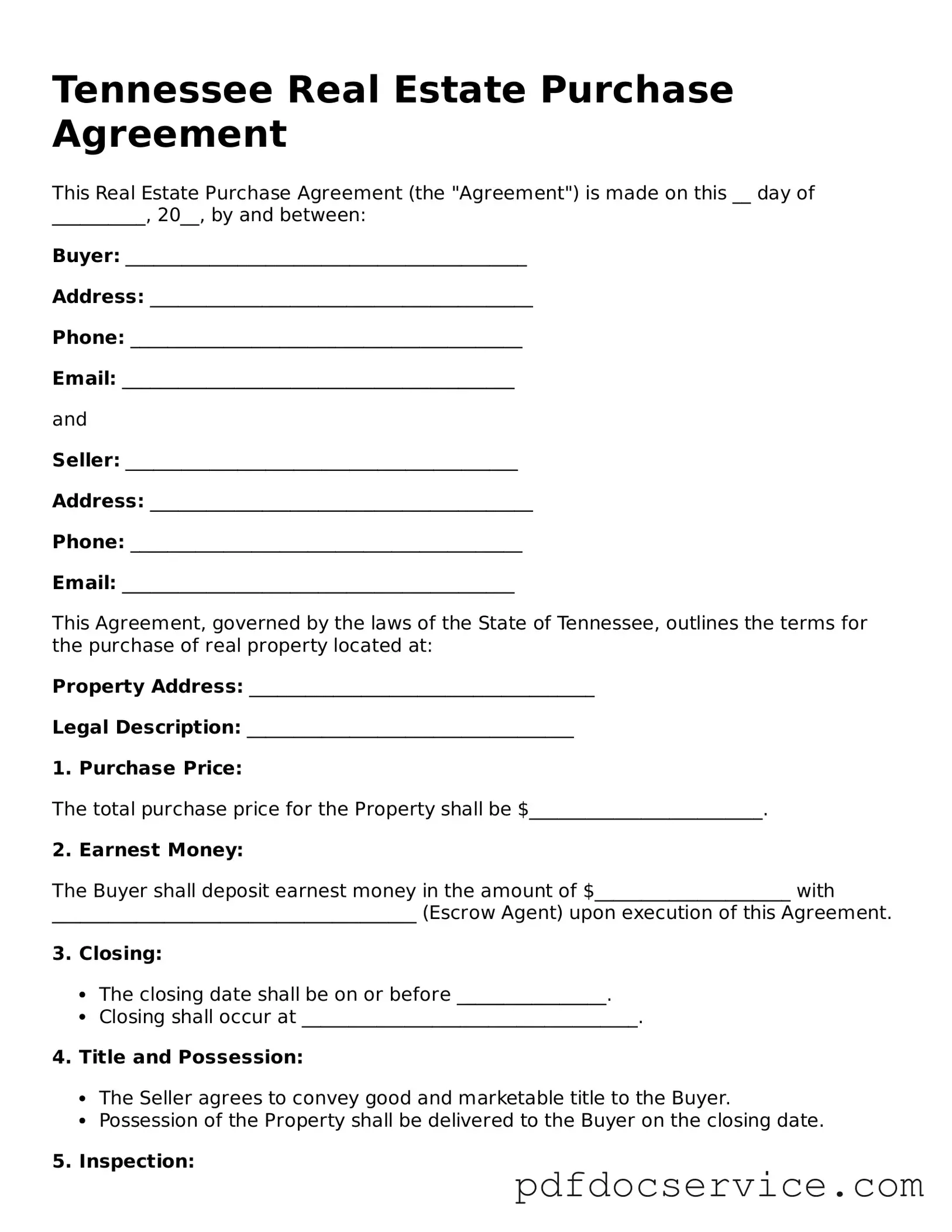

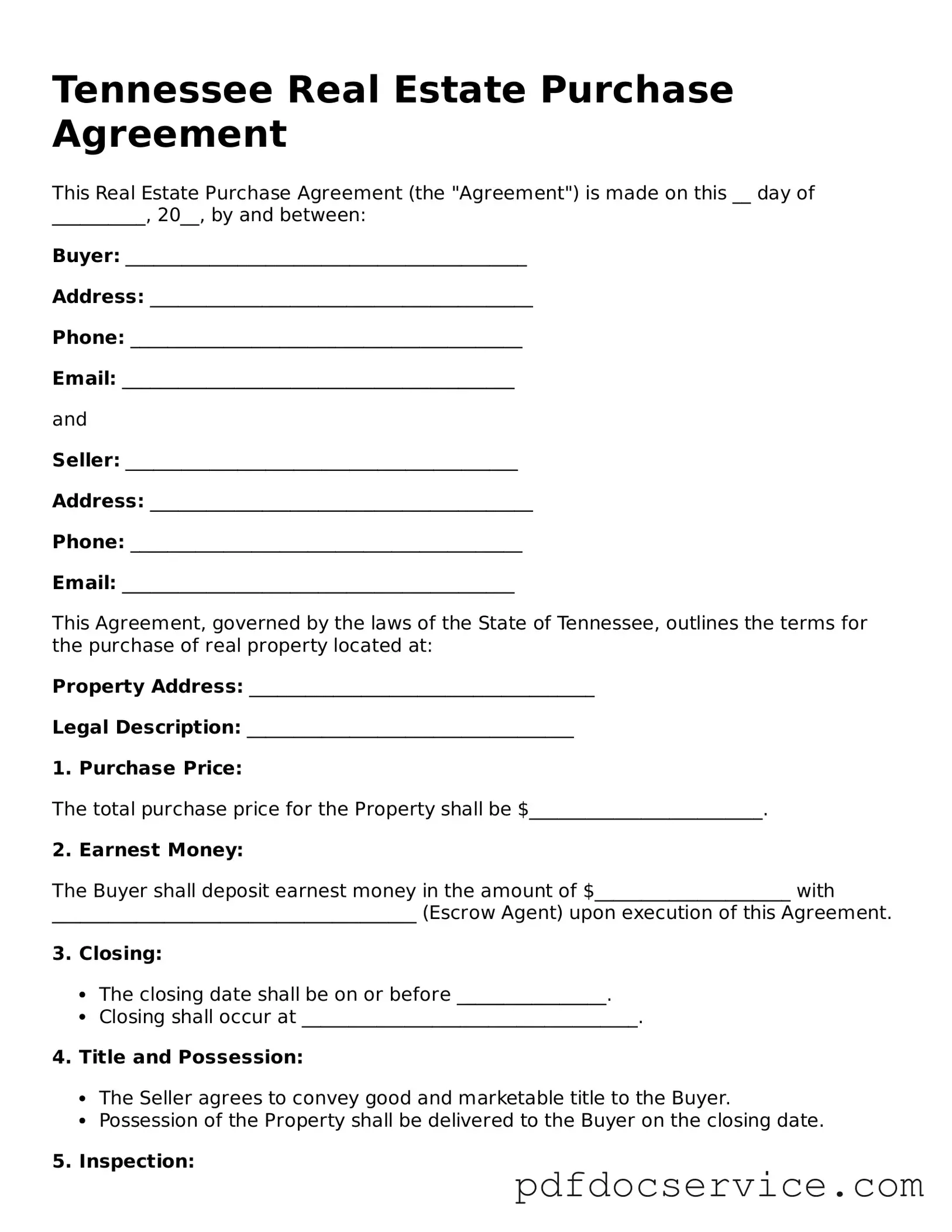

The Tennessee Real Estate Purchase Agreement form is a legal document used in real estate transactions within the state of Tennessee. It outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement serves as a binding contract once both parties have signed it, providing clarity and protection for both the buyer and seller throughout the transaction process.

What are the key components of the agreement?

The agreement typically includes several important components, such as:

-

Property Description:

A detailed description of the property being sold, including its address and legal description.

-

Purchase Price:

The agreed-upon price for the property, along with any earnest money deposit required.

-

Closing Date:

The date on which the transaction will be finalized and ownership transferred.

-

Contingencies:

Conditions that must be met for the sale to proceed, such as financing or home inspection requirements.

-

Disclosures:

Any known issues with the property that the seller is required to disclose to the buyer.

This form is primarily used by individuals or entities involved in buying or selling residential real estate in Tennessee. Real estate agents often facilitate the process, but buyers and sellers can also use the form directly. It is essential for anyone entering into a real estate transaction to have a clear understanding of the terms involved.

Yes, once both the buyer and seller sign the Tennessee Real Estate Purchase Agreement, it becomes a legally binding contract. This means that both parties are obligated to fulfill the terms outlined in the agreement. Failure to comply can result in legal consequences, including potential lawsuits or financial penalties.

Can the agreement be modified after signing?

Modifications to the agreement can be made, but both parties must agree to any changes. It is advisable to document any amendments in writing and have both parties sign the revised agreement. Verbal agreements or changes may not hold up in court, so maintaining a clear, written record is crucial.

What happens if the buyer or seller backs out?

If either party wishes to back out of the agreement after it has been signed, they may face legal repercussions. The specific consequences depend on the terms of the agreement and the circumstances surrounding the withdrawal. If a buyer backs out without a valid reason, they may lose their earnest money deposit. Sellers may also face legal action if they refuse to sell without justification.

The Tennessee Real Estate Purchase Agreement form can be obtained from various sources, including:

-

Real estate agents and brokers, who often have access to standardized forms.

-

Online legal document services that provide templates for purchase agreements.

-

Local real estate associations or boards, which may offer the form to their members.

It is advisable to ensure that the version used complies with current Tennessee laws and regulations.