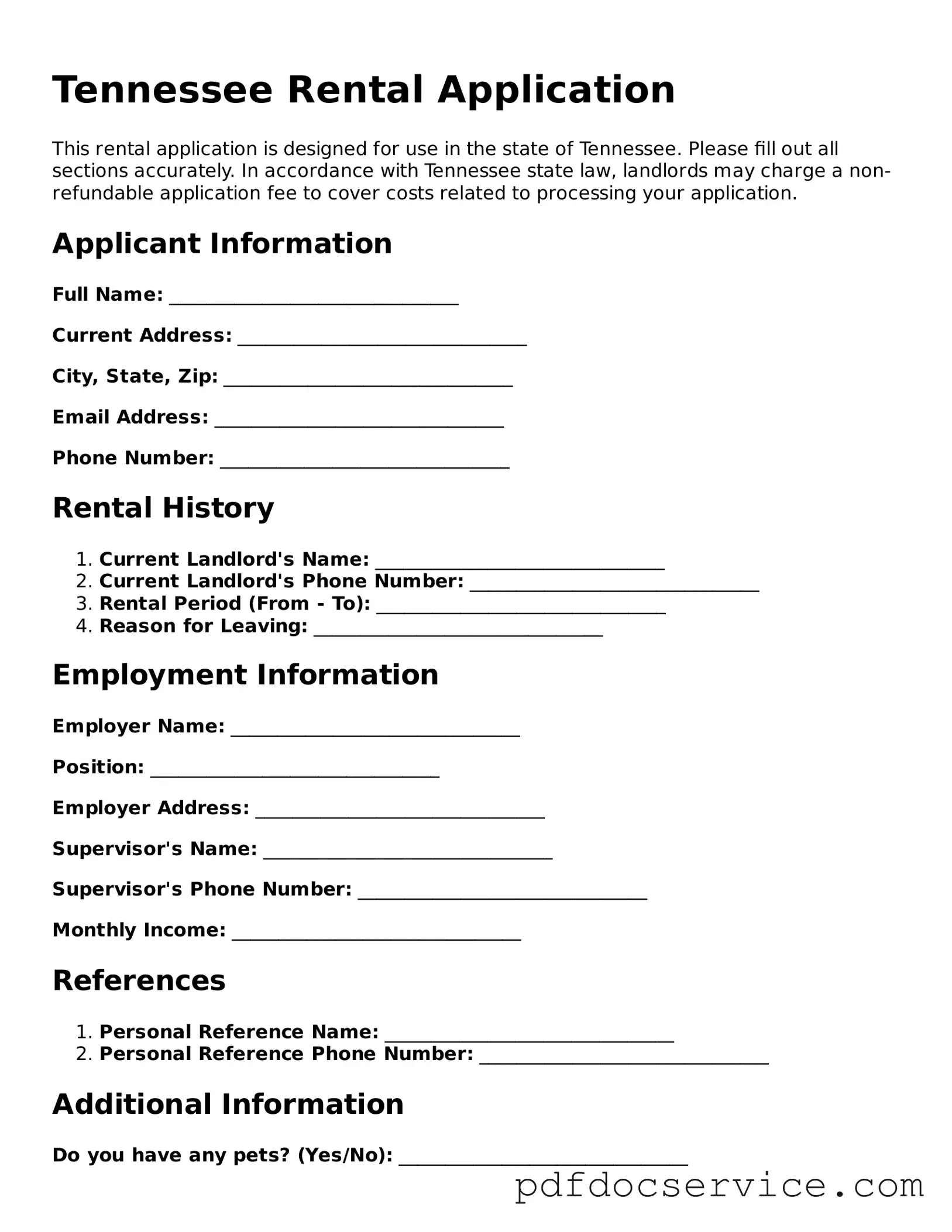

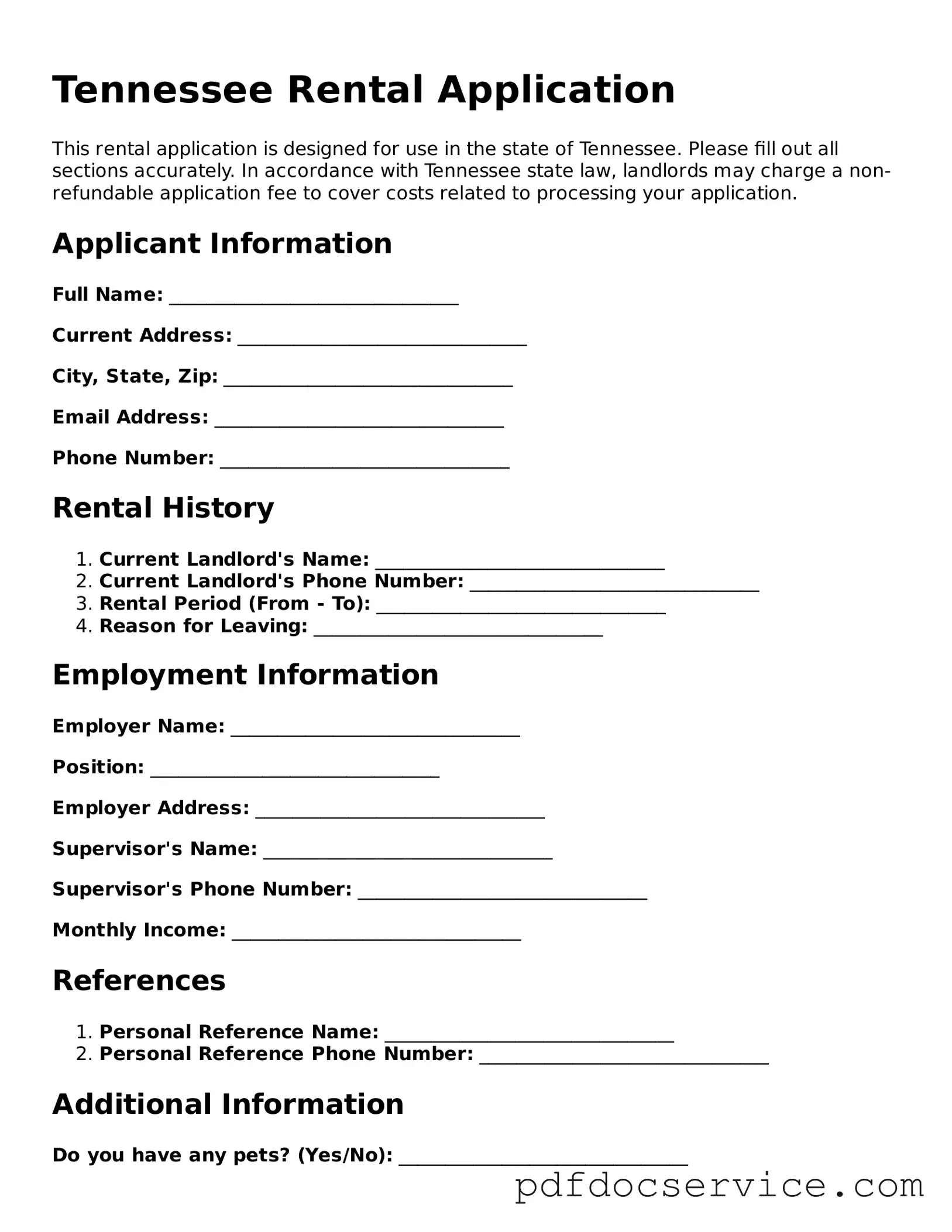

A Tennessee Rental Application form is a document that potential tenants fill out to apply for a rental property. This form helps landlords gather important information about applicants, such as their rental history, employment status, and creditworthiness. It serves as a tool for landlords to assess whether an applicant is a suitable tenant.

When completing a Tennessee Rental Application, you will typically need to provide the following information:

-

Personal details, including your name, address, and contact information

-

Employment information, such as your current employer and job title

-

Income details, including your monthly income and any additional sources of income

-

Rental history, which may include previous addresses and landlord contact information

-

References, often from employers or previous landlords

Is there a fee to submit a rental application?

Many landlords charge a fee to process rental applications. This fee can vary widely, typically ranging from $25 to $100. It covers the cost of background checks, credit checks, and other administrative expenses. Be sure to ask the landlord about any fees before submitting your application.

How long does it take to process the application?

The processing time for a rental application can vary. Generally, landlords aim to complete the process within a few days. However, it may take longer if the landlord needs to verify information or if there are multiple applications for the same property. It's a good idea to follow up with the landlord if you haven’t heard back within a week.

Can I apply for multiple rental properties at once?

Yes, you can apply for multiple rental properties simultaneously. However, keep in mind that each application may require a separate fee. It’s important to be honest in each application and ensure that the information provided is consistent across all forms.

What happens if my application is denied?

If your application is denied, the landlord is generally required to inform you of the decision. They may also provide a reason for the denial, especially if it relates to your credit history or rental history. You have the right to request a copy of your credit report if it was used in the decision-making process. If you believe the denial was unjust, you can discuss it with the landlord or consider applying for other properties.

Do I need to provide a co-signer?

If you have a limited credit history or insufficient income, a landlord may request that you provide a co-signer. A co-signer is someone who agrees to take responsibility for the lease if you cannot meet the terms. This person typically needs to have a good credit history and sufficient income. Discuss this option with the landlord if you think it might apply to your situation.